Answered step by step

Verified Expert Solution

Question

1 Approved Answer

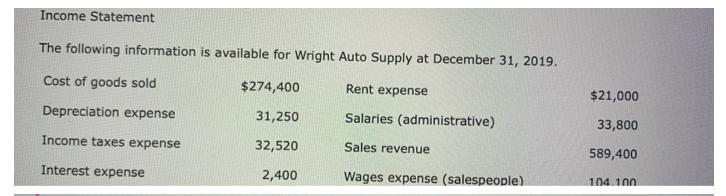

Income Statement The following information is available for Wright Auto Supply at December 31, 2019. Cost of goods sold $274,400 Depreciation expense 31,250 Income

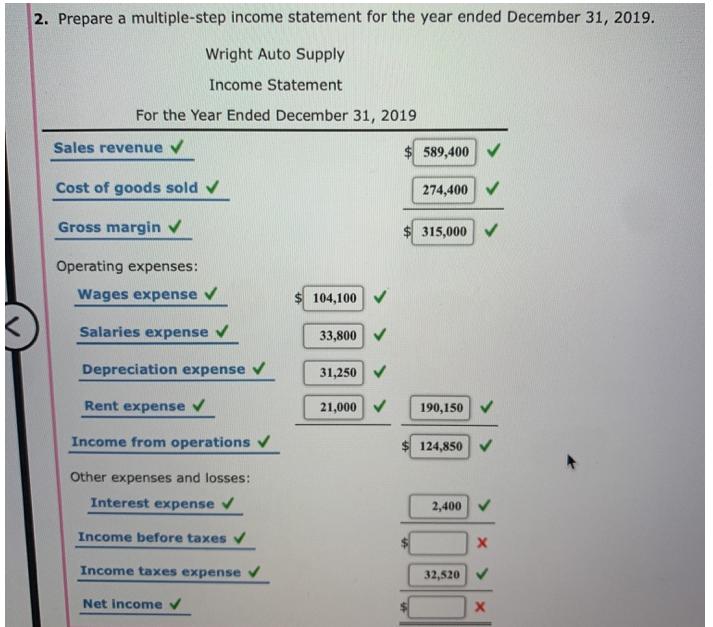

Income Statement The following information is available for Wright Auto Supply at December 31, 2019. Cost of goods sold $274,400 Depreciation expense 31,250 Income taxes expense 32,520 Interest expense 2,400 Rent expense Salaries (administrative) Sales revenue Wages expense (salespeople). $21,000 33,800 589,400 104.100 2. Prepare a multiple-step income statement for the year ended December 31, 2019. Wright Auto Supply Income Statement For the Year Ended December 31, 2019 Sales revenue Cost of goods sold Gross margin Operating expenses: Wages expense Salaries expense Depreciation expense Rent expense Income from operations Other expenses and losses: Interest expense Income before taxes Income taxes expense Net income 104,100 33,800 31,250 21,000 589,400 274,400 315,000 190,150 124,850 2,400 32,520 X X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started