Answered step by step

Verified Expert Solution

Question

1 Approved Answer

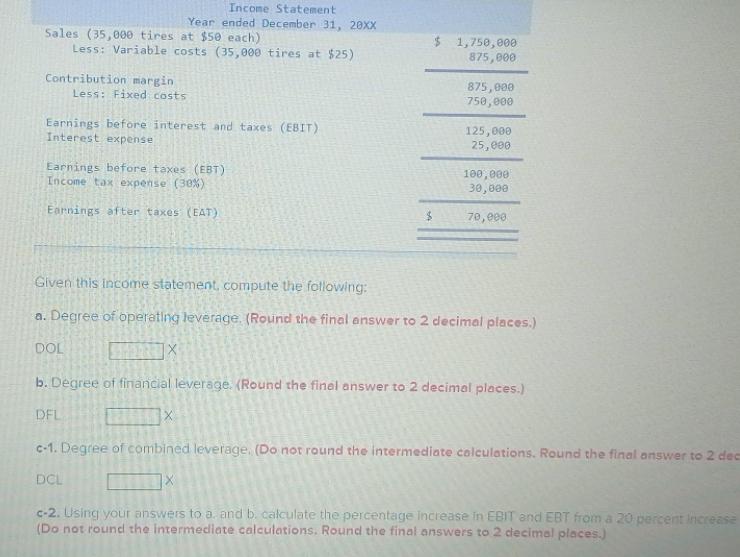

Income Statement Year ended December 3i, 20XX Sales (35,000 tires at $50 each) Less: Variable costs (35,000 tires at $25) 1,750,000 875,000 Contribution margin

Income Statement Year ended December 3i, 20XX Sales (35,000 tires at $50 each) Less: Variable costs (35,000 tires at $25) 1,750,000 875,000 Contribution margin Less: Fixed costs 875,e00 750,000 Earnings before interest and taxes (EBIT) Interest expense 125,000 25, e00 Earnings before taxes (EBT) Income tax expense (30%) 100, 000 30,800 Earnings after taxes (EAT) 70,e00 Given this Income statement, compute the fotlowing: a. Degree of operating leverage. (Round the final enswer to 2 decimal places.) DOL b. Degree of financial leverage. (Round the finel answer to 2 decimal places.) DFL c-1. Degree of combined leverage. (Do not round the intermediate colculations. Round the final answer to 2 dec DCL c-2. Using your answers to a. and b. calculate the percentage increase In EBIT and EBT from a 20 percent Increase (Do not round the intermediate calculations. Round the final answers to 2 clecimal places.)

Step by Step Solution

★★★★★

3.64 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Ans a Degree of operating leverage Sales units sale price variable cost Sales units sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started