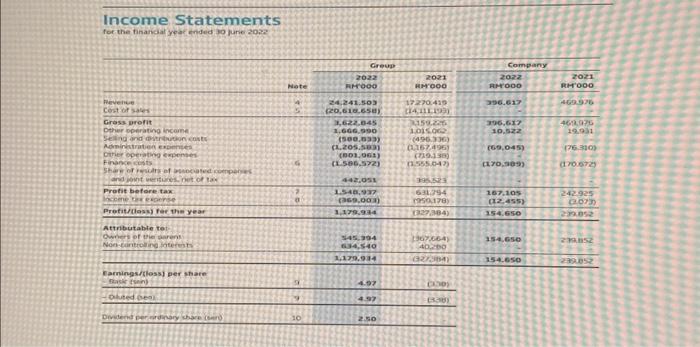

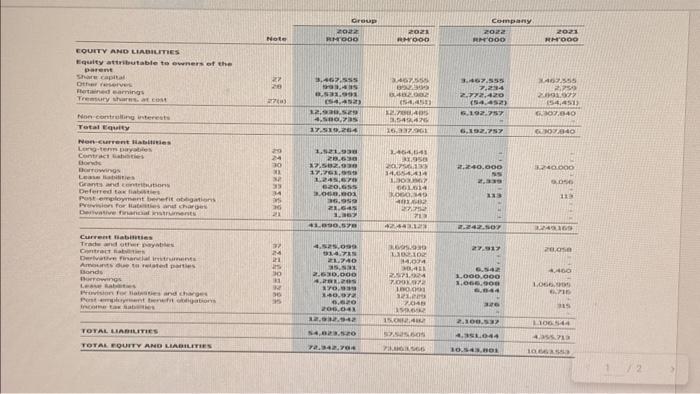

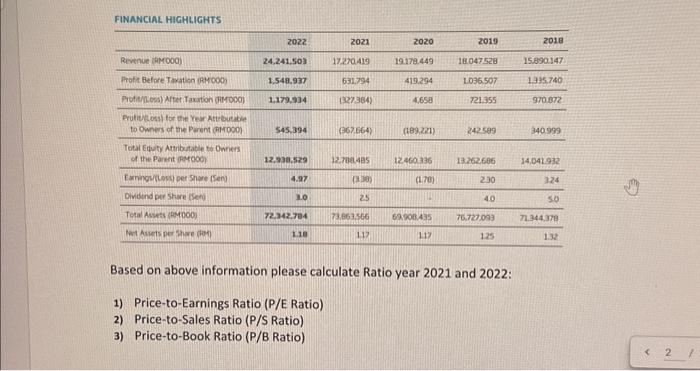

Income Statements \begin{tabular}{|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{ Blote } & \multicolumn{2}{|c|}{ creup. } & \multicolumn{2}{|c|}{ Company: } \\ \hline & & \begin{tabular}{r} godz \\ minoos \end{tabular} & \begin{tabular}{r} 2021 \\ muroos \end{tabular} & \begin{tabular}{r} z022 \\ merooo \end{tabular} & \begin{tabular}{r} 202x \\ nitroos \\ \end{tabular} \\ \hline & \begin{tabular}{c} 27 \\ 20 \\ 27(a) \\ \end{tabular} & & & \begin{tabular}{r} 3.467,535 \\ 7,284 \\ 2,772,420 \\ (5.4,452) \end{tabular} & \\ \hline Non-eontruiling interests & & \begin{tabular}{r} 1.2,0a0,5er \\ 4,500,7s \end{tabular} & & 6,102,757 & \begin{tabular}{r} 6.007,040 \\ \\ \end{tabular} \\ \hline Total Equity & & & 16aragot & 6,192,757 & arorato \\ \hline & & & & & \\ \hline & & 4..090.578 & 42.4+3.127 & 2.242 .507 & \\ \hline & & & & \begin{tabular}{r} 27,017 \\ 0,542 \\ 1,000,000 \\ 1,006,000 \\ 6,044 \\ 3,40 \end{tabular} & \\ \hline & & & 15coup.ten & 2,300,537 & 1.00544 \\ \hline roral uabiumes & & & sosasisos & 4,751,044 & \\ \hline rotak rourry ano Laburries & & ra, 3+2,70i & ransises. & 10:sas.wex. & \\ \hline \end{tabular} FINANCIAL HIGHLIGHTS Based on above information please calculate Ratio year 2021 and 2022: 1) Price-to-Earnings Ratio ( P/E Ratio) 2) Price-to-Sales Ratio ( P/S Ratio) 3) Price-to-Book Ratio (P/B Ratio) Income Statements \begin{tabular}{|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{ Blote } & \multicolumn{2}{|c|}{ creup. } & \multicolumn{2}{|c|}{ Company: } \\ \hline & & \begin{tabular}{r} godz \\ minoos \end{tabular} & \begin{tabular}{r} 2021 \\ muroos \end{tabular} & \begin{tabular}{r} z022 \\ merooo \end{tabular} & \begin{tabular}{r} 202x \\ nitroos \\ \end{tabular} \\ \hline & \begin{tabular}{c} 27 \\ 20 \\ 27(a) \\ \end{tabular} & & & \begin{tabular}{r} 3.467,535 \\ 7,284 \\ 2,772,420 \\ (5.4,452) \end{tabular} & \\ \hline Non-eontruiling interests & & \begin{tabular}{r} 1.2,0a0,5er \\ 4,500,7s \end{tabular} & & 6,102,757 & \begin{tabular}{r} 6.007,040 \\ \\ \end{tabular} \\ \hline Total Equity & & & 16aragot & 6,192,757 & arorato \\ \hline & & & & & \\ \hline & & 4..090.578 & 42.4+3.127 & 2.242 .507 & \\ \hline & & & & \begin{tabular}{r} 27,017 \\ 0,542 \\ 1,000,000 \\ 1,006,000 \\ 6,044 \\ 3,40 \end{tabular} & \\ \hline & & & 15coup.ten & 2,300,537 & 1.00544 \\ \hline roral uabiumes & & & sosasisos & 4,751,044 & \\ \hline rotak rourry ano Laburries & & ra, 3+2,70i & ransises. & 10:sas.wex. & \\ \hline \end{tabular} FINANCIAL HIGHLIGHTS Based on above information please calculate Ratio year 2021 and 2022: 1) Price-to-Earnings Ratio ( P/E Ratio) 2) Price-to-Sales Ratio ( P/S Ratio) 3) Price-to-Book Ratio (P/B Ratio)