Answered step by step

Verified Expert Solution

Question

1 Approved Answer

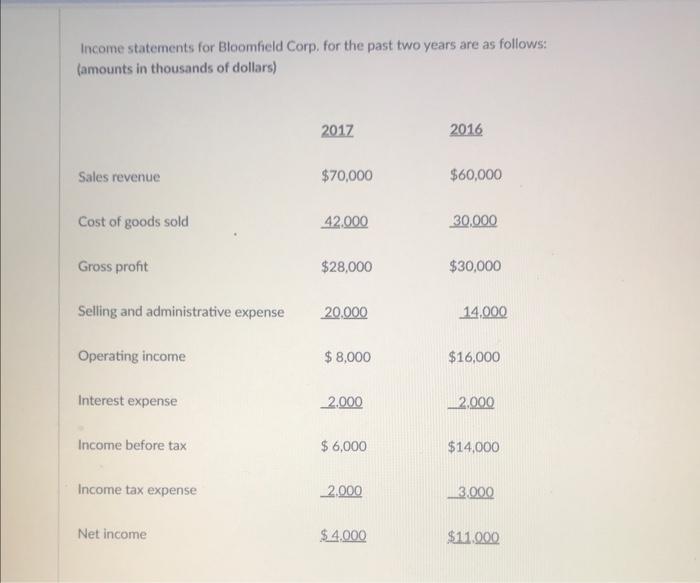

Income statements for Bloomfield Corp. for the past two years are as follows: (amounts in thousands of dollars) 2017 2016 Sales revenue $70,000 $60,000

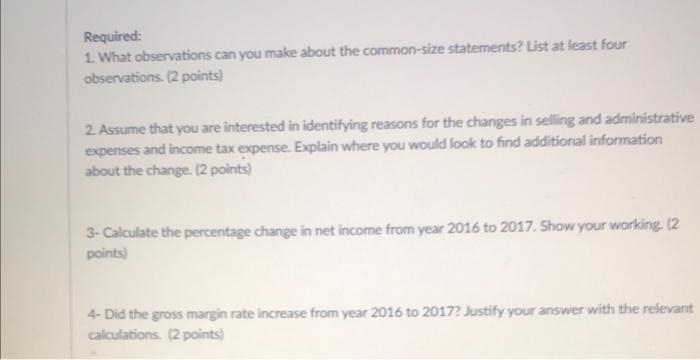

Income statements for Bloomfield Corp. for the past two years are as follows: (amounts in thousands of dollars) 2017 2016 Sales revenue $70,000 $60,000 Cost of goods sold 42.000 30,000 Gross profit $28,000 $30,000 Selling and administrative expense 20.000 14,000 Operating income $8,000 $16,000 Interest expense 2,000 2.000 Income before tax $ 6,000 $14,000 Income tax expense 2.000 3.000 Net income $4.000 $11.000 Required: 1. What observations can you make about the common-size statements? List at least four observations. (2 points) 2. Assume that you are interested in identifying reasons for the changes in selling and administrative expenses and income tax expense. Explain where you would look to find additional information about the change. (2 points) 3-Calculate the percentage change in net income from year 2016 to 2017. Show your working. (2 points) 4- Did the gross margin rate increase from year 2016 to 2017? Justify your answer with the relevant calculations. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started