Answered step by step

Verified Expert Solution

Question

1 Approved Answer

income tax planning answer I 1. (40 points) Your new clients, Jim and Nancy Billings (both under age 65 and not blind), have two dependent

income tax planning

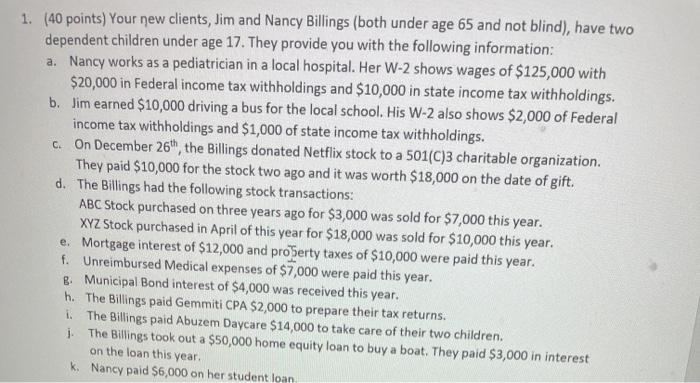

1. (40 points) Your new clients, Jim and Nancy Billings (both under age 65 and not blind), have two dependent children under age 17. They provide you with the following information: a. Nancy works as a pediatrician in a local hospital. Her W-2 shows wages of $125,000 with $20,000 in Federal income tax withholdings and $10,000 in state income tax with holdings. b. Jim earned $10,000 driving a bus for the local school. His W-2 also shows $2,000 of Federal income tax withholdings and $1,000 of state income tax withholdings. c. On December 26th, the Billings donated Netflix stock to a 501(C)3 charitable organization. They paid $10,000 for the stock two ago and it was worth $18,000 on the date of gift. d. The Billings had the following stock transactions: ABC Stock purchased on three years ago for $3,000 was sold for $7,000 this year. XYZ Stock purchased in April of this year for $18,000 was sold for $10,000 this year. e. Mortgage interest of $12,000 and proberty taxes of $10,000 were paid this year. f. Unreimbursed Medical expenses of $7,000 were paid this year. 8. Municipal Bond interest of $4,000 was received this year. h. The Billings paid Gemmiti CPA $2,000 to prepare their tax returns. i The Billings paid Abuzem Daycare $14,000 to take care of their two children. i The Billings took out a $50,000 home equity loan to buy a boat. They paid $3,000 in interest on the loan this year. k. Nancy paid $6,000 on her student loan answer I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started