Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income tax question ( The answer is not C by the way) John and Marsha are both 30 years old. . They are not married

Income tax question

( The answer is not C by the way)

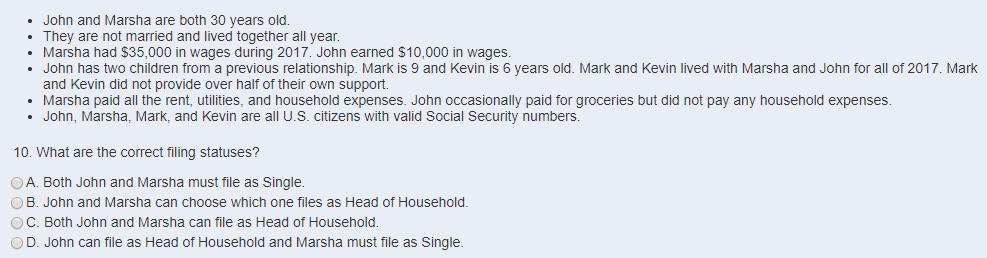

John and Marsha are both 30 years old. . They are not married and lived together all year Marsha had $35,000 in wages during 2017. John earned $10,000 in wages John has two children from a previous relationship. Mark is 9 and Kevin is 6 years old. Mark and Kevin lived with Marsha and John for all of 2017. Mark and Kevin did not provide over half of their own support. Marsha paid all the rent, utilities, and household expenses. John occasionally paid for groceries but did not pay any household expenses. John, Marsha, Mark, and Kevin are all U.S. citizens with valid Social Security numbers. 10. What are the correct filing statuses? OA. Both John and Marsha must file as Single. B. John and Marsha can choose which one files as Head of Household. OC. Both John and Marsha can file as Head of Household D. John can file as Head of Household and Marsha must file as SingleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started