Answered step by step

Verified Expert Solution

Question

1 Approved Answer

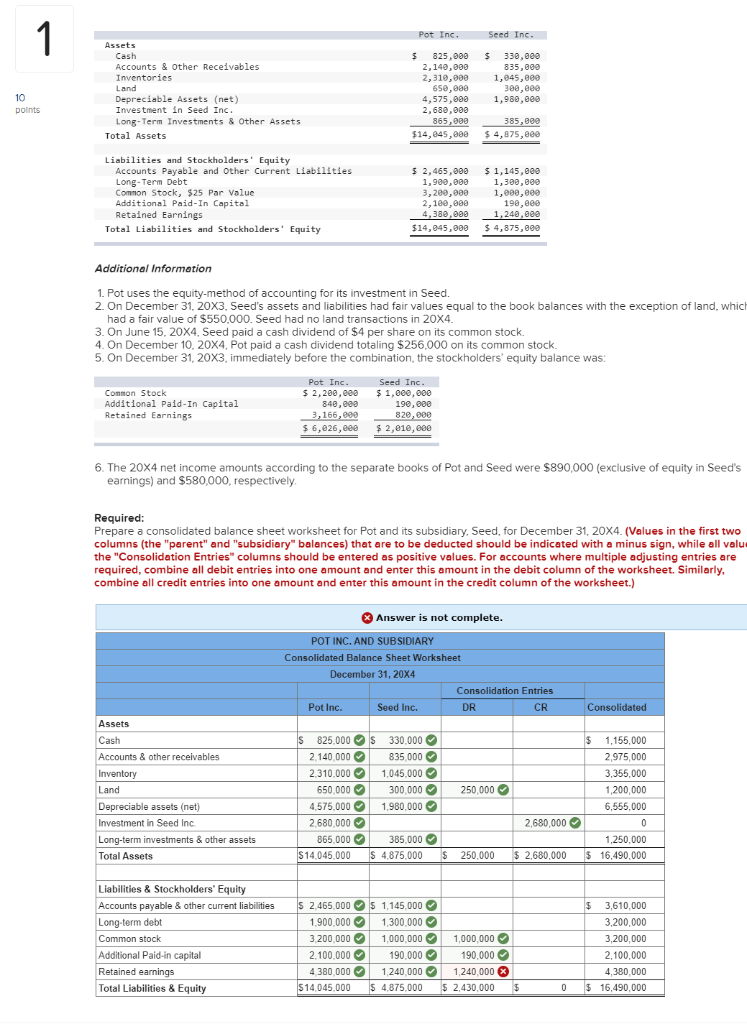

Incomplete answer? Retained earning is not correct. Please help! will like :) thank you! Incomplete answer? Retained earning is not correct. Please help! will like

Incomplete answer? Retained earning is not correct. Please help! will like :) thank you!

Incomplete answer? Retained earning is not correct. Please help! will like :) thank you!

1 10 points Assets Cash Accounts & Other Receivables Inventories Land Depreciable Assets (net) Investment in Seed Inc. Long-Term Investments & Other Assets Total Assets Liabilities and Stockholders' Equity Accounts Payable and Other Current Liabilities Long-Term Debt Common Stock, $25 Par Value Additional Paid-In Capital Retained Earnings Total Liabilities and Stockholders' Equity Additional Information Common Stock Additional Paid-In Capital Retained Earnings Assets Cash Accounts & other receivables Inventory Land Pot Inc. $ 2,200,000 Depreciable assets (net) Investment in Seed Inc. Long-term investments & other assets Total Assets 840,000 3,166,000 $ 6,026,000 Liabilities & Stockholders' Equity Accounts payable & other current liabilities Long-term debt Common stock Additional Paid-in capital Retained earnings Total Liabilities & Equity 1. Pot uses the equity-method of accounting for its investment in Seed. 2. On December 31, 20X3, Seed's assets and liabilities had fair values equal to the book balances with the exception of land, which had a fair value of $550,000. Seed had no land transactions in 20X4. 3. On June 15, 20X4, Seed paid a cash dividend of $4 per share on its common stock 4. On December 10, 20X4, Pot paid a cash dividend totaling $256,000 on its common stock. 5. On December 31, 20X3, immediately before the combination, the stockholders' equity balance was: Pot Inc. 825,000 2,140,000 2,310,000 650,000 4,575,000 2,680,000 865,000 $14,045,000 Pot Inc. $ 2,680,000 865,000 $14.045,000 6. The 20x4 net income amounts according to the separate books of Pot and Seed were $890,000 (exclusive of equity in Seed's earnings) and $580,000, respectively. $ 2,465,000 1,900,000 3,200,000 2,100,000 190,000 4,380,000 1,240,000 $14,045,000 $ 4,875,000 Seed Inc. $ 1,000,000 Required: Prepare a consolidated balance sheet worksheet for Pot and its subsidiary, Seed, for December 31, 20X4. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all valu the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) 190,000 820,000 $ 2,010,000 $14,045,000 POT INC. AND SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X4 S 825,000 $ 330,000 2,140,000 2,310,000 650,000 4,575,000 Seed Inc. Answer is not complete. 835,000 1,045,000 Seed Inc. $ 330,000 835,000 1,045,000 300,000 1,980,000 300,000 1,980,000 385,000 $ 4,875,000 2,100,000 190,000 4,380,000 1,240,000 $ 1,145,000 1,300,000 1,000,000 $ 4,875,000 DR ME Consolidation Entries CR 385,000 $ 4.875.000 $ 250,000 $ 2,465,000 $ 1,145,000 1,900,000 1,300,000 3,200,000 1,000,000 1,000,000 190,000 1,240,000 x $ 2,430,000 $ 250,000 2,680,000 $ 2,680,000 Consolidated $ 1,155,000 2,975,000 3,355,000 1,200,000 6,555,000 $ 0 1,250,000 $ 16,490,000 3,610,000 3,200,000 3,200,000 2,100,000 4,380,000 0 $ 16,490,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started