Question

Incorporate the following assumptions when answering the questions. The fund has a 10-year life, with committed capital (the total amount of funds that the investors

Incorporate the following assumptions when answering the questions.

The fund has a 10-year life, with committed capital (the total amount of funds that the investors have promised to provide) of $20 billion.

The funds are received in five equal installments, at the beginning of the first five years of the fund.

The management fee is 1.5% of committed capital (including those funds that are promised but have not yet been provided by the investors), payable in advance at the beginning of the year.

The funds invested assets grow at a steady 20% rate each year.

Starting at the end of Year 5, 20% of the investment portfolio is liquidated, and the

proceeds are available for distribution to LPs and GPs.

Assume a discount rate of 15% is appropriate for the risk of the fund cash flows.

At the end of Year 10, all remaining assets are liquidated.

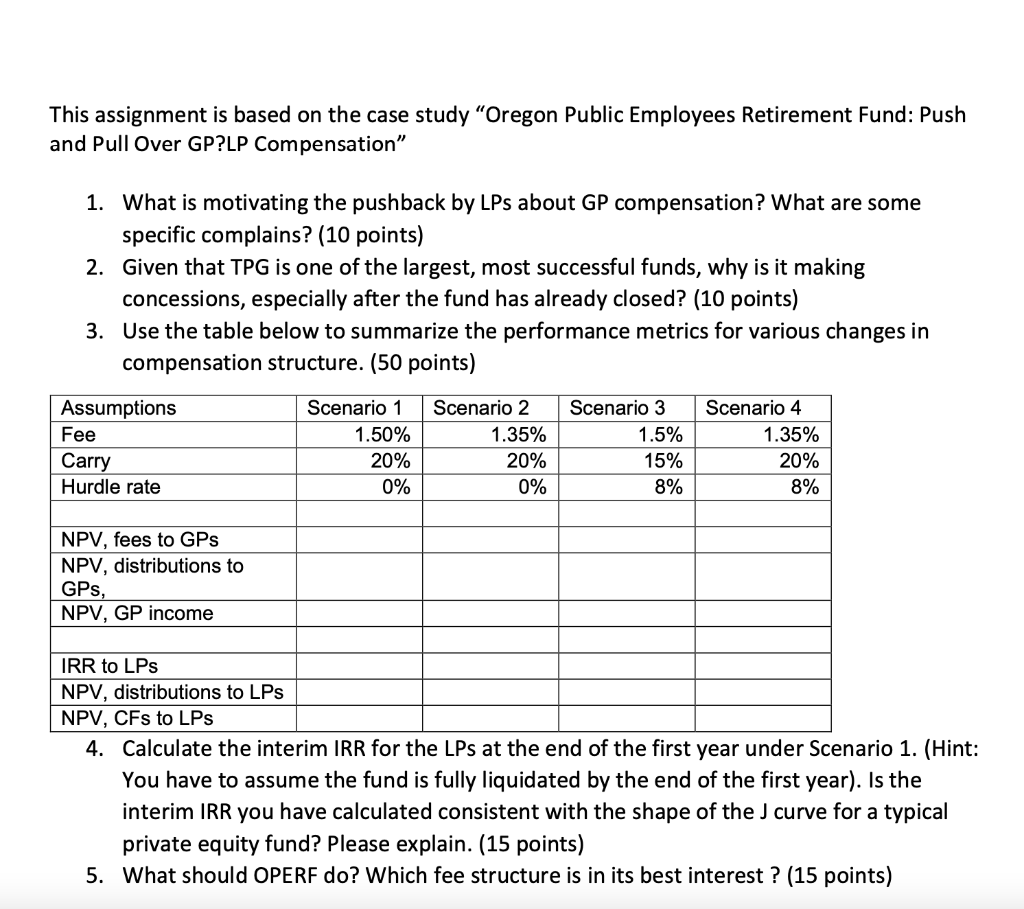

This assignment is based on the case study "Oregon Public Employees Retirement Fund: Push and Pull Over GP?LP Compensation" 1. What is motivating the pushback by LPs about GP compensation? What are some specific complains? (10 points) 2. Given that TPG is one of the largest, most successful funds, why is it making concessions, especially after the fund has already closed? (10 points) 3. Use the table below to summarize the performance metrics for various changes in compensation structure. (50 points) 4. Calculate the interim IRR for the LPs at the end of the first year under Scenario 1. (Hint: You have to assume the fund is fully liquidated by the end of the first year). Is the interim IRR you have calculated consistent with the shape of the J curve for a typical private equity fund? Please explain. (15 points) This assignment is based on the case study "Oregon Public Employees Retirement Fund: Push and Pull Over GP?LP Compensation" 1. What is motivating the pushback by LPs about GP compensation? What are some specific complains? (10 points) 2. Given that TPG is one of the largest, most successful funds, why is it making concessions, especially after the fund has already closed? (10 points) 3. Use the table below to summarize the performance metrics for various changes in compensation structure. (50 points) 4. Calculate the interim IRR for the LPs at the end of the first year under Scenario 1. (Hint: You have to assume the fund is fully liquidated by the end of the first year). Is the interim IRR you have calculated consistent with the shape of the J curve for a typical private equity fund? Please explain. (15 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started