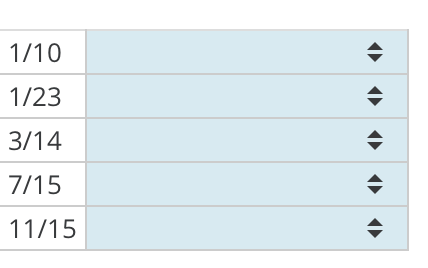

Increase or decrease EPS:

Increase or decrease EPS:

This is the entire question. Nothing else is given.

This is the entire question. Nothing else is given.

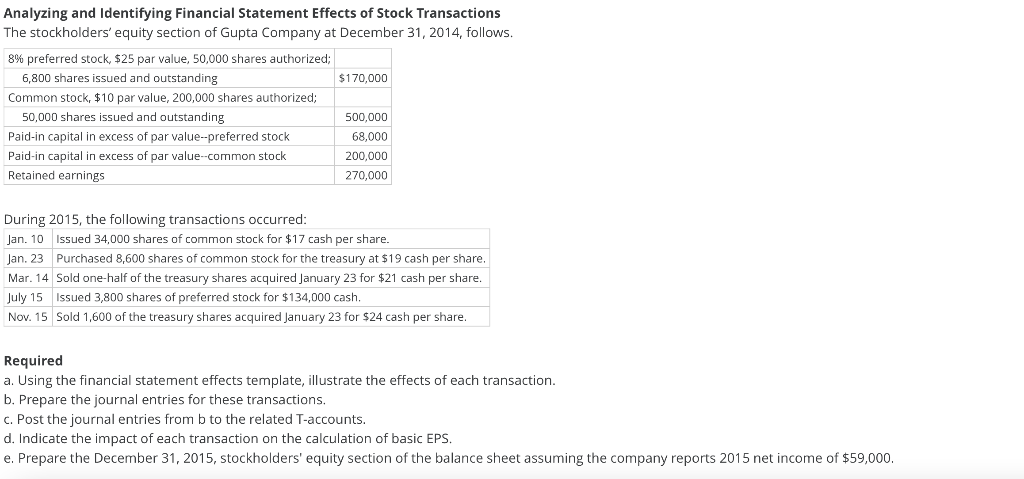

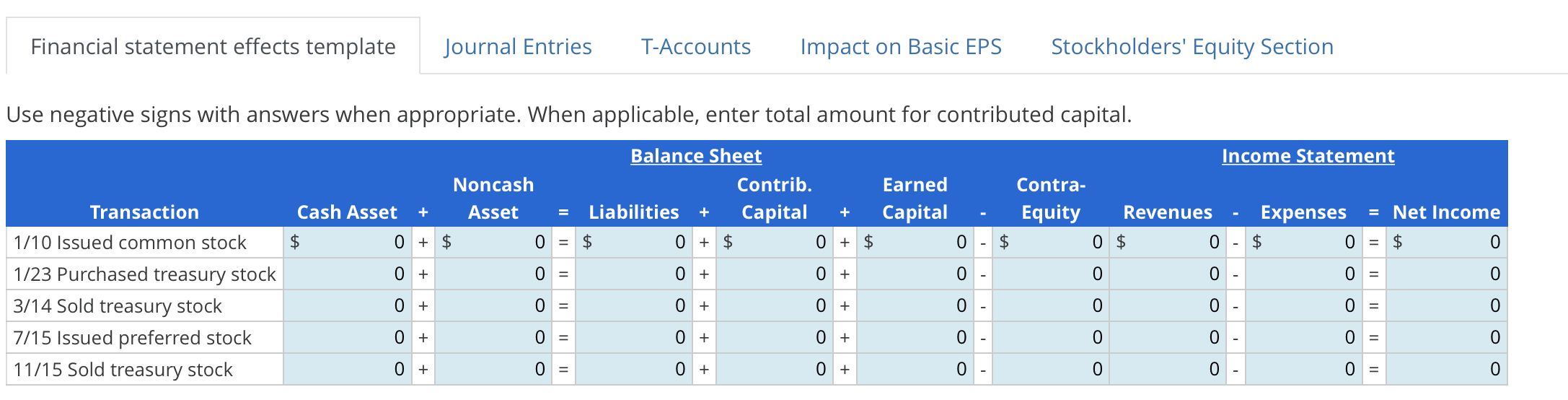

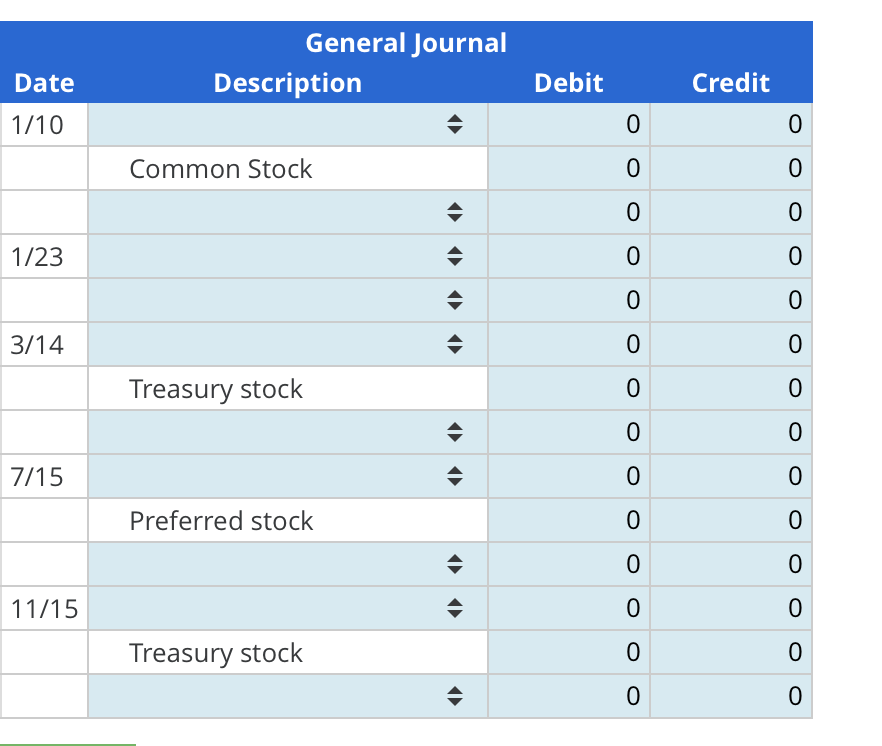

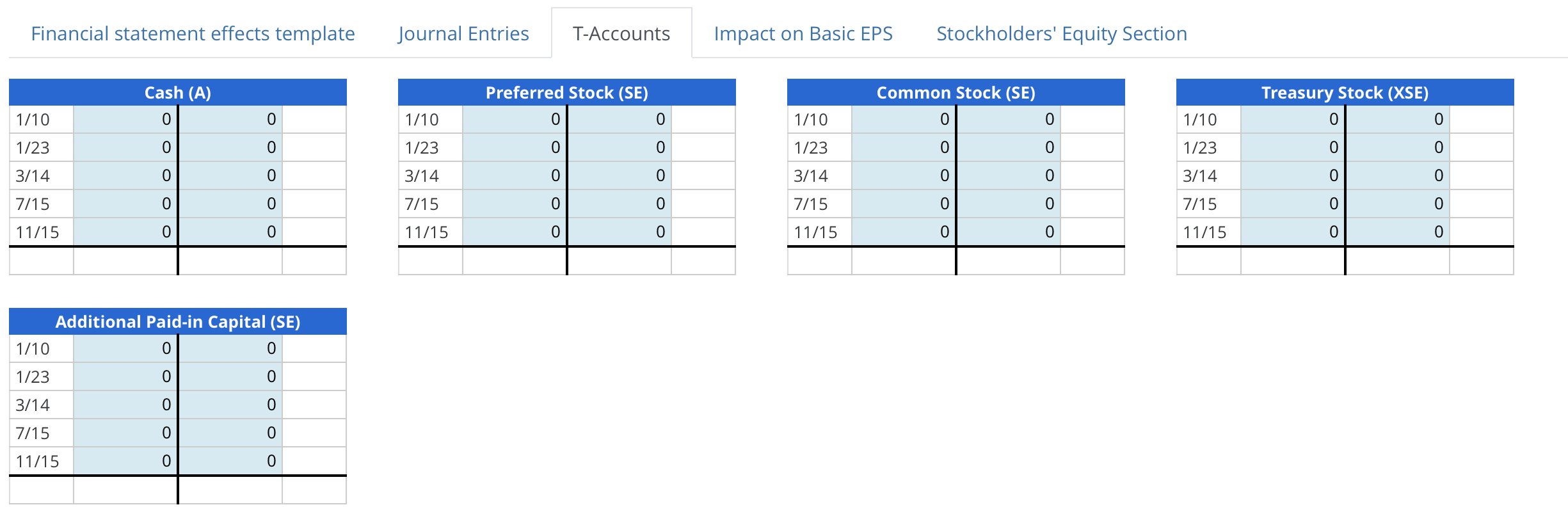

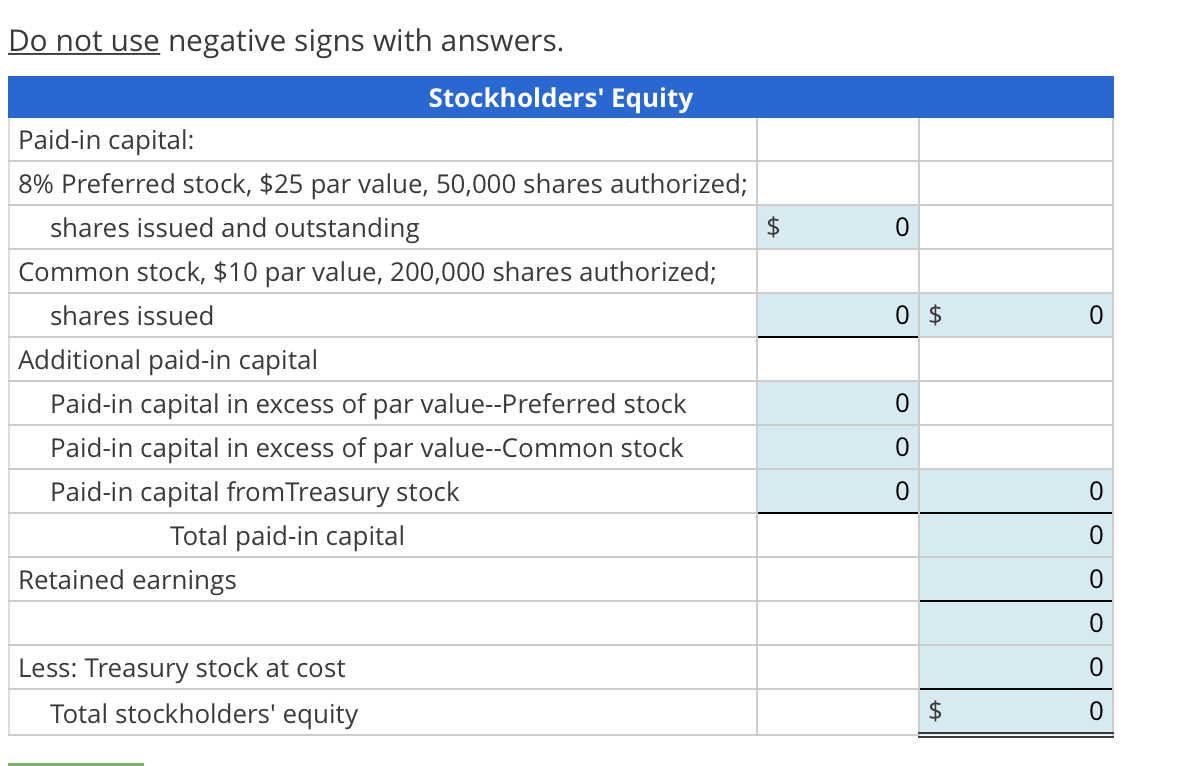

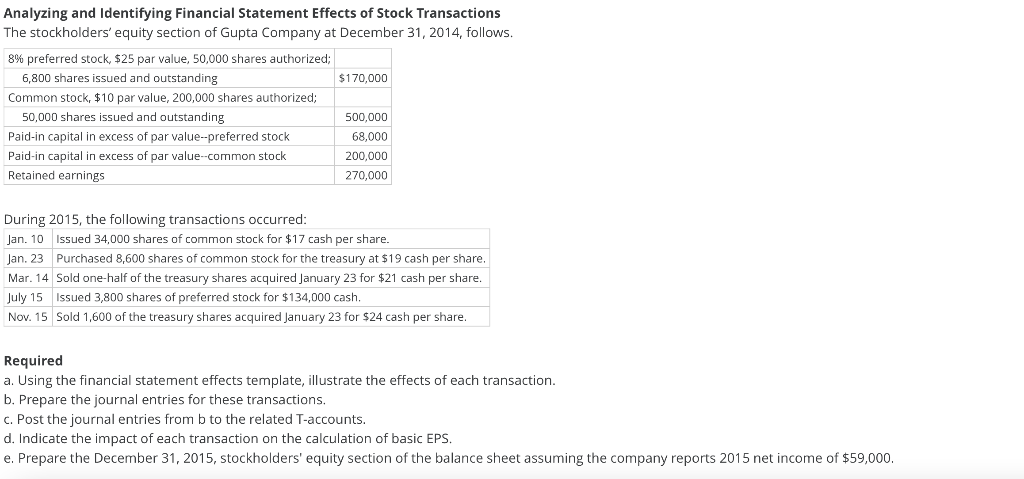

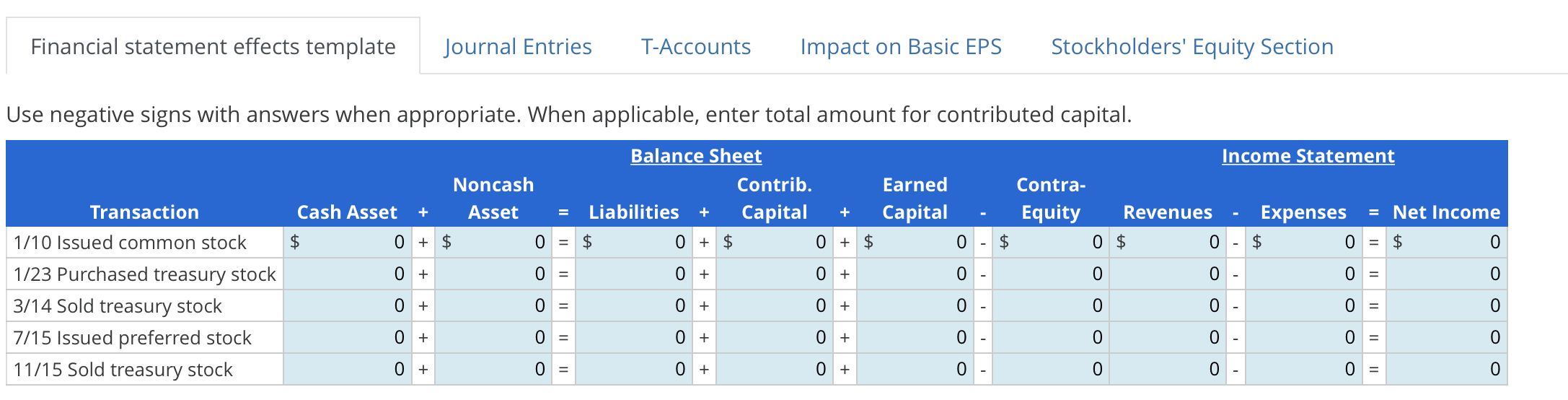

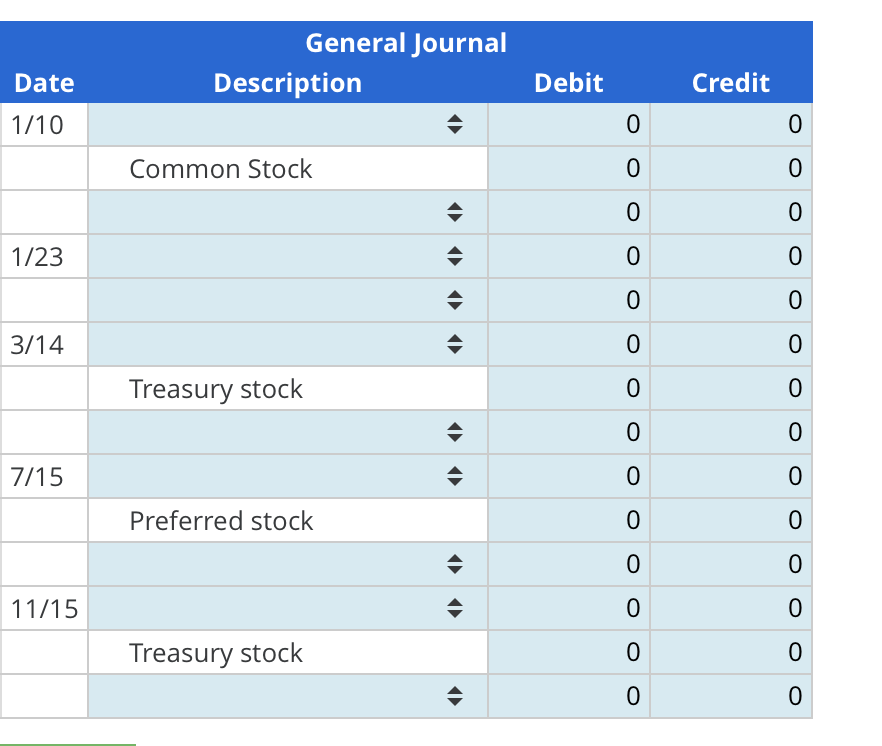

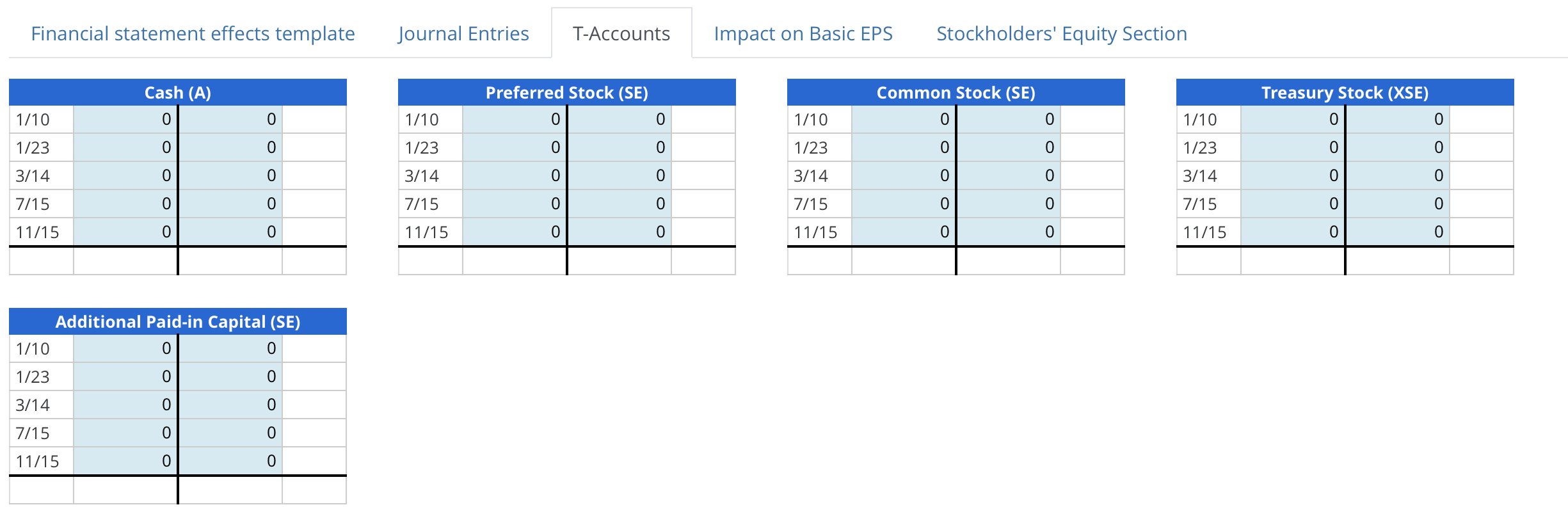

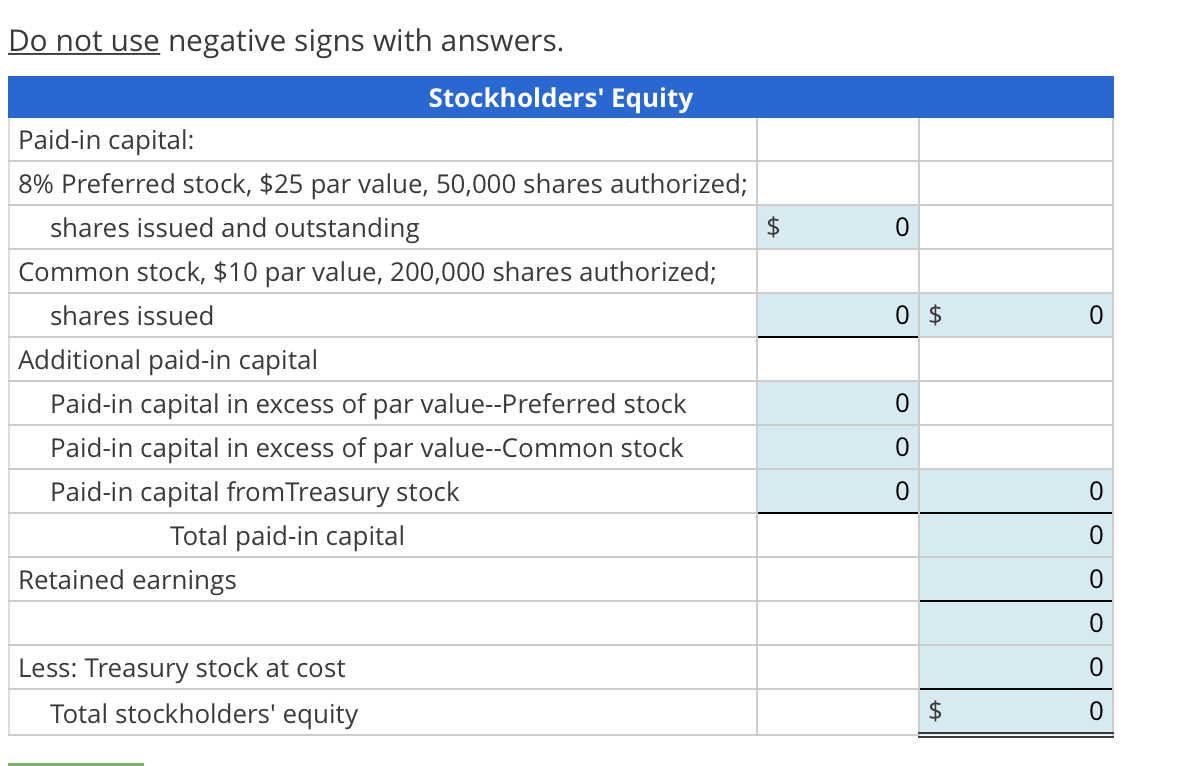

Analyzing and Identifying Financial Statement Effects of Stock Transactions The stockholders' equity section of Gupta Company at December 31, 2014, follows. 8% preferred stock, $25 par value, 50,000 shares authorized; 6,800 shares issued and outstanding $170,000 Common stock, $10 par value, 200,000 shares authorized; 50,000 shares issued and outstanding 500,000 Paid-in capital in excess of par value--preferred stock 68,000 Paid-in capital in excess of par value--common stock 200,000 Retained earnings 270,000 During 2015, the following transactions occurred: Jan. 10 Issued 34,000 shares of common stock for $17 cash per share. Jan. 23 Purchased 8,600 shares of common stock for the treasury at $19 cash per share. Mar. 14 Sold one-half of the treasury shares acquired January 23 for $21 cash per share. July 15 Issued 3,800 shares of preferred stock for $134,000 cash. Nov. 15 Sold 1,600 of the treasury shares acquired January 23 for $24 cash per share. Required a. Using the financial statement effects template, illustrate the effects of each transaction. b. Prepare the journal entries for these transactions, c. Post the journal entries from b to the related T-accounts. d. Indicate the impact of each transaction on the calculation of basic EPS. e. Prepare the December 31, 2015, stockholders' equity section of the balance sheet assuming the company reports 2015 net income of $59,000. Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Use negative signs with answers when appropriate. When applicable, enter total amount for contributed capital. Balance Sheet Noncash Contrib. Cash Asset + Asset = Liabilities + Capital $ 0 + $ 0 = $ 0 + $ 0 + $ + Transaction 1/10 Issued common stock Income Statement Earned Contra- Capital Equity Revenues Expenses = Net Income 0 - $ 0 $ 0 - $ 0 = $ $ 0 0 0 0 - 0 = 0 = 0 + 0 = 0 + 0 + O 0 + 0 = 0 + 0 + 0 0 0 0 - 0 = 0 1/23 Purchased treasury stock 3/14 Sold treasury stock 7/15 Issued preferred stock 11/15 Sold treasury stock 0 + 0 = 0 + 0 + 0 - 0 0 - 0 = 0 0 + 0 = 0 + 0 + 0 - 0 0- 0 = 0 General Journal Description Date Debit Credit 1/10 0 0 0 Common Stock 0 O O 0 1/23 0 0 0 0 3/14 0 0 Treasury stock 0 0 0 0 7/15 0 0 Preferred stock 0 0 0 0 11/15 A 0 0 Treasury stock 0 0 0 0 Financial statement effects template Journal Entries T-Accounts Impact on Basic EPS Stockholders' Equity Section Cash (A) Preferred Stock (SE) 0 0 Common Stock (SE) 0 0 Treasury Stock (XSE) 0 0 1/10 0 0 1/10 1/10 1/10 1/23 0 0 1/23 0 0 1/23 0 1/23 0 0 3/14 0 0 3/14 0 0 3/14 0 0 3/14 0 0 7/15 0 0 7/15 0 0 7/15 0 0 7/15 0 0 11/15 0 0 11/15 0 0 11/15 0 0 11/15 0 0 Additional Paid-in Capital (SE) 1/10 0 O O 1/23 0 3/14 O 0 7/15 0 O O 11/15 0 1/10 1/23 3/14 7/15 11/15 Do not use negative signs with answers. $ 0 0 $ 0 Stockholders' Equity Paid-in capital: 8% Preferred stock, $25 par value, 50,000 shares authorized; shares issued and outstanding Common stock, $10 par value, 200,000 shares authorized; shares issued Additional paid-in capital Paid-in capital in excess of par value--Preferred stock Paid-in capital in excess of par value--Common stock Paid-in capital from Treasury stock Total paid-in capital Retained earnings 0 0 o O 0 0 0 0 Less: Treasury stock at cost Total stockholders' equity $ 0

Increase or decrease EPS:

Increase or decrease EPS: This is the entire question. Nothing else is given.

This is the entire question. Nothing else is given.