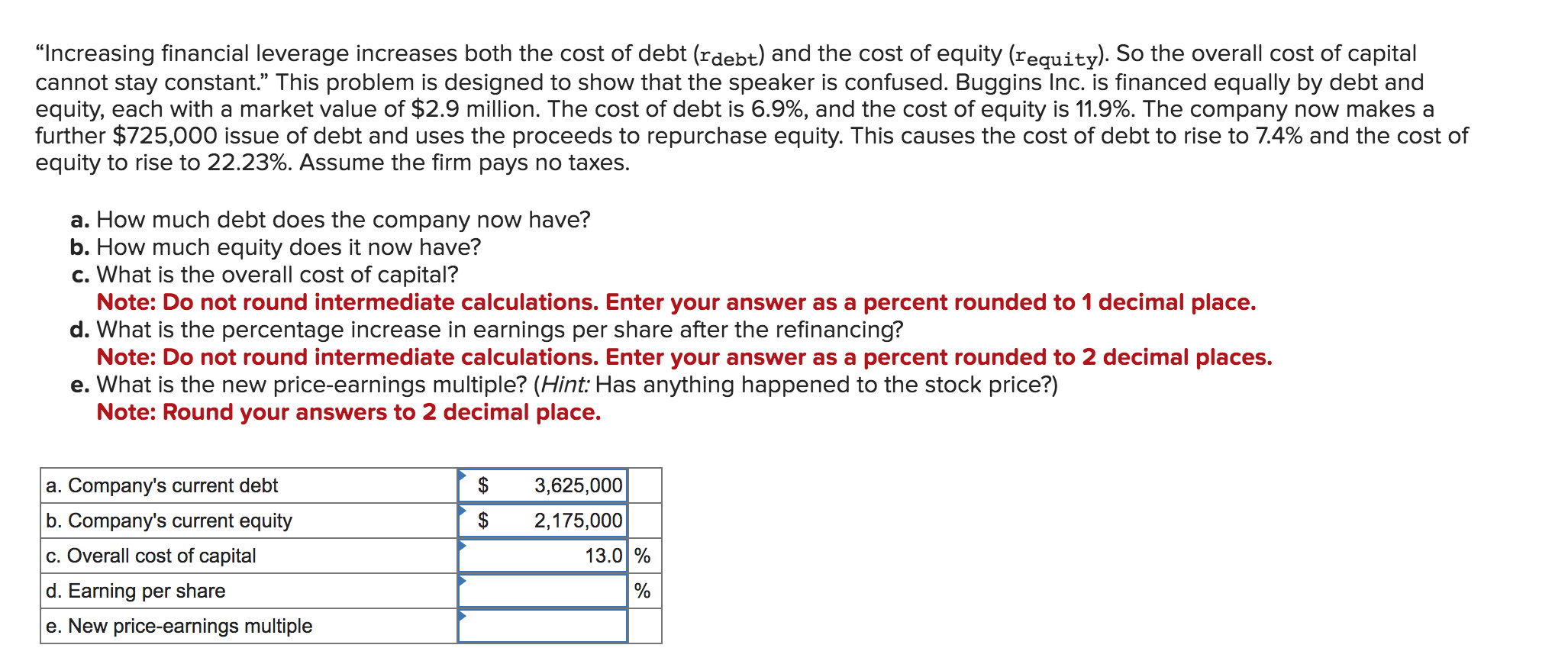

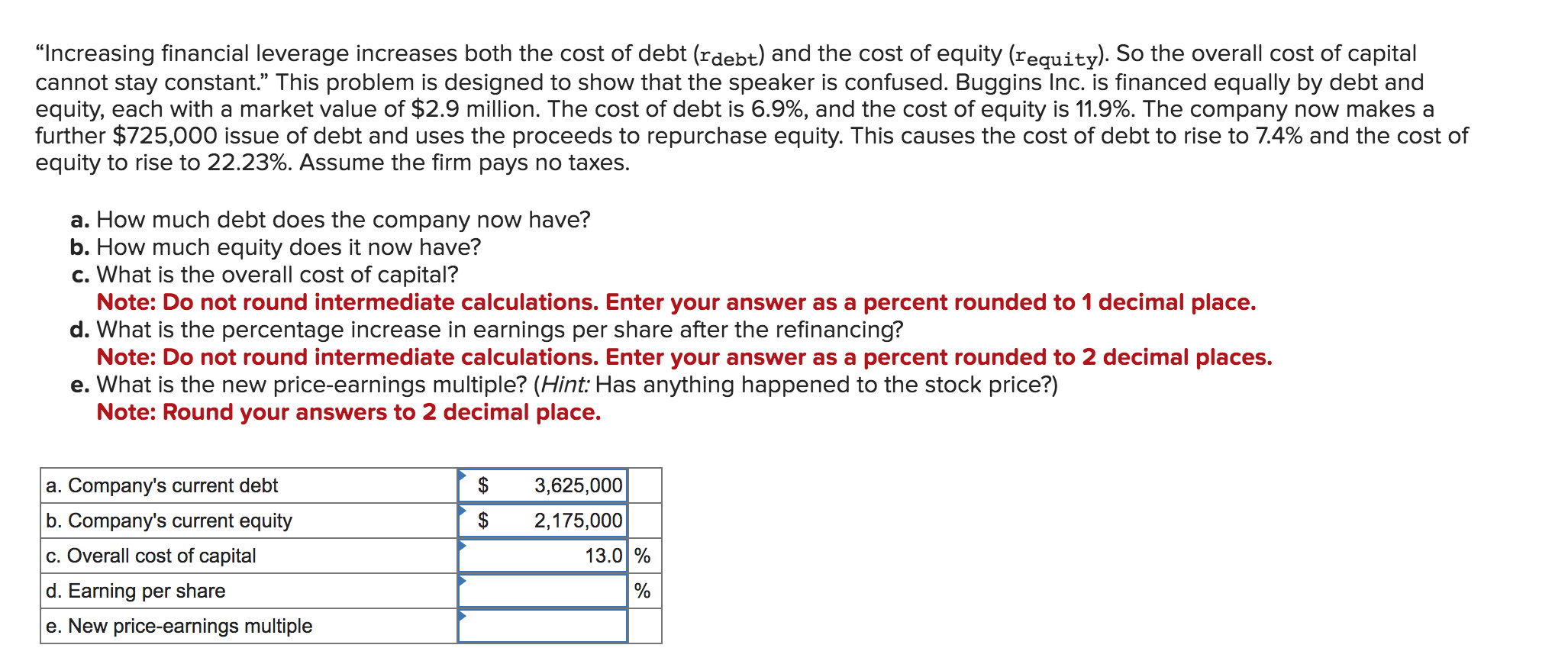

"Increasing financial leverage increases both the cost of debt (rdebt) and the cost of equity (requity). So the overall cost of capital cannot stay constant." This problem is designed to show that the speaker is confused. Buggins Inc. is financed equally by debt and equity, each with a market value of $2.9 million. The cost of debt is 6.9%, and the cost of equity is 11.9%. The company now makes a further $725,000 issue of debt and uses the proceeds to repurchase equity. This causes the cost of debt to rise to 7.4% and the cost of equity to rise to 22.23%. Assume the firm pays no taxes. a. How much debt does the company now have? b. How much equity does it now have? c. What is the overall cost of capital? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place. d. What is the percentage increase in earnings per share after the refinancing? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. e. What is the new price-earnings multiple? (Hint: Has anything happened to the stock price?) Note: Round your answers to 2 decimal place. "Increasing financial leverage increases both the cost of debt (rdebt) and the cost of equity (requity). So the overall cost of capital cannot stay constant." This problem is designed to show that the speaker is confused. Buggins Inc. is financed equally by debt and equity, each with a market value of $2.9 million. The cost of debt is 6.9%, and the cost of equity is 11.9%. The company now makes a further $725,000 issue of debt and uses the proceeds to repurchase equity. This causes the cost of debt to rise to 7.4% and the cost of equity to rise to 22.23%. Assume the firm pays no taxes. a. How much debt does the company now have? b. How much equity does it now have? c. What is the overall cost of capital? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place. d. What is the percentage increase in earnings per share after the refinancing? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. e. What is the new price-earnings multiple? (Hint: Has anything happened to the stock price?) Note: Round your answers to 2 decimal place