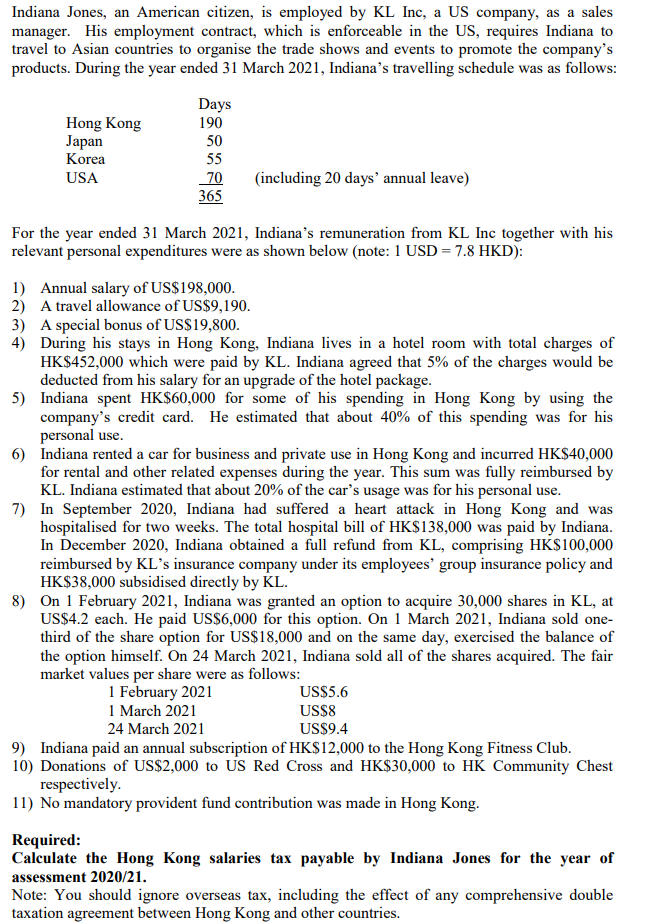

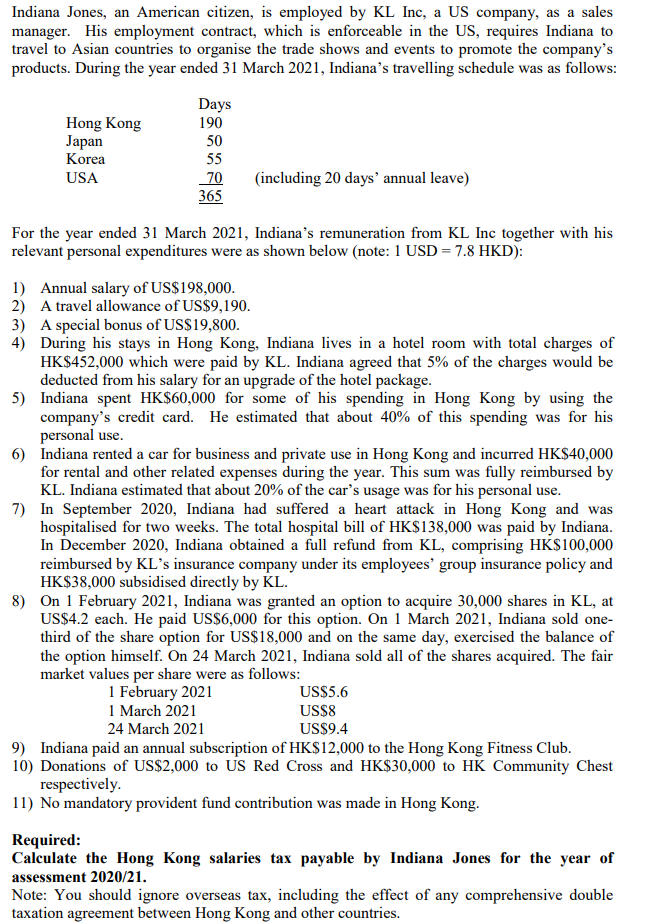

Indiana Jones, an American citizen, is employed by KL Inc, a US company, as a sales manager. His employment contract, which is enforceable in the US, requires Indiana to travel to Asian countries to organise the trade shows and events to promote the company's products. During the year ended 31 March 2021, Indiana's travelling schedule was as follows: Days Hong Kong 190 Japan 50 Korea 55 USA 70 (including 20 days' annual leave) 365 For the year ended 31 March 2021, Indiana's remuneration from KL Inc together with his relevant personal expenditures were as shown below (note: 1 USD = 7.8 HKD): 1) Annual salary of US$198,000. 2) A travel allowance of US$9,190. 3) A special bonus of US$19,800. 4) During his stays in Hong Kong, Indiana lives in a hotel room with total charges of HK$452,000 which were paid by KL. Indiana agreed that 5% of the charges would be deducted from his salary for an upgrade of the hotel package. 5) Indiana spent HK$60,000 for some of his spending in Hong Kong by using the company's credit card. He estimated that about 40% of this spending was for his personal use. 6) Indiana rented a car for business and private use in Hong Kong and incurred HK$40,000 for rental and other related expenses during the year. This sum was fully reimbursed by KL. Indiana estimated that about 20% of the car's usage was for his personal use. 7) In September 2020, Indiana had suffered a heart attack in Hong Kong and was hospitalised for two weeks. The total hospital bill of HK$138,000 was paid by Indiana. In December 2020, Indiana obtained a full refund from KL, comprising HK$100,000 reimbursed by KL's insurance company under its employees' group insurance policy and HK$38,000 subsidised directly by KL. 8) On 1 February 2021, Indiana was granted an option to acquire 30,000 shares in KL, at US$4.2 each. He paid US$6,000 for this option. On 1 March 2021, Indiana sold one- third of the share option for US$18,000 and on the same day, exercised the balance of the option himself. On 24 March 2021, Indiana sold all of the shares acquired. The fair market values per share were as follows: 1 February 2021 US$5.6 1 March 2021 US$8 24 March 2021 US$9.4 9) Indiana paid an annual subscription of HK$12,000 to the Hong Kong Fitness Club. 10) Donations of US$2,000 to US Red Cross and HK$30,000 to HK Community Chest respectively. 11) No mandatory provident fund contribution was made in Hong Kong. Required: Calculate the Hong Kong salaries tax payable by Indiana Jones for the year of assessment 2020/21. Note: You should ignore overseas tax, including the effect of any comprehensive double taxation agreement between Hong Kong and other countries. Indiana Jones, an American citizen, is employed by KL Inc, a US company, as a sales manager. His employment contract, which is enforceable in the US, requires Indiana to travel to Asian countries to organise the trade shows and events to promote the company's products. During the year ended 31 March 2021, Indiana's travelling schedule was as follows: Days Hong Kong 190 Japan 50 Korea 55 USA 70 (including 20 days' annual leave) 365 For the year ended 31 March 2021, Indiana's remuneration from KL Inc together with his relevant personal expenditures were as shown below (note: 1 USD = 7.8 HKD): 1) Annual salary of US$198,000. 2) A travel allowance of US$9,190. 3) A special bonus of US$19,800. 4) During his stays in Hong Kong, Indiana lives in a hotel room with total charges of HK$452,000 which were paid by KL. Indiana agreed that 5% of the charges would be deducted from his salary for an upgrade of the hotel package. 5) Indiana spent HK$60,000 for some of his spending in Hong Kong by using the company's credit card. He estimated that about 40% of this spending was for his personal use. 6) Indiana rented a car for business and private use in Hong Kong and incurred HK$40,000 for rental and other related expenses during the year. This sum was fully reimbursed by KL. Indiana estimated that about 20% of the car's usage was for his personal use. 7) In September 2020, Indiana had suffered a heart attack in Hong Kong and was hospitalised for two weeks. The total hospital bill of HK$138,000 was paid by Indiana. In December 2020, Indiana obtained a full refund from KL, comprising HK$100,000 reimbursed by KL's insurance company under its employees' group insurance policy and HK$38,000 subsidised directly by KL. 8) On 1 February 2021, Indiana was granted an option to acquire 30,000 shares in KL, at US$4.2 each. He paid US$6,000 for this option. On 1 March 2021, Indiana sold one- third of the share option for US$18,000 and on the same day, exercised the balance of the option himself. On 24 March 2021, Indiana sold all of the shares acquired. The fair market values per share were as follows: 1 February 2021 US$5.6 1 March 2021 US$8 24 March 2021 US$9.4 9) Indiana paid an annual subscription of HK$12,000 to the Hong Kong Fitness Club. 10) Donations of US$2,000 to US Red Cross and HK$30,000 to HK Community Chest respectively. 11) No mandatory provident fund contribution was made in Hong Kong. Required: Calculate the Hong Kong salaries tax payable by Indiana Jones for the year of assessment 2020/21. Note: You should ignore overseas tax, including the effect of any comprehensive double taxation agreement between Hong Kong and other countries