Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate whether each of the following statements is true or false. Support your answers with the relevant explanations. A. Modigliani and Miller's Proposition II assumes

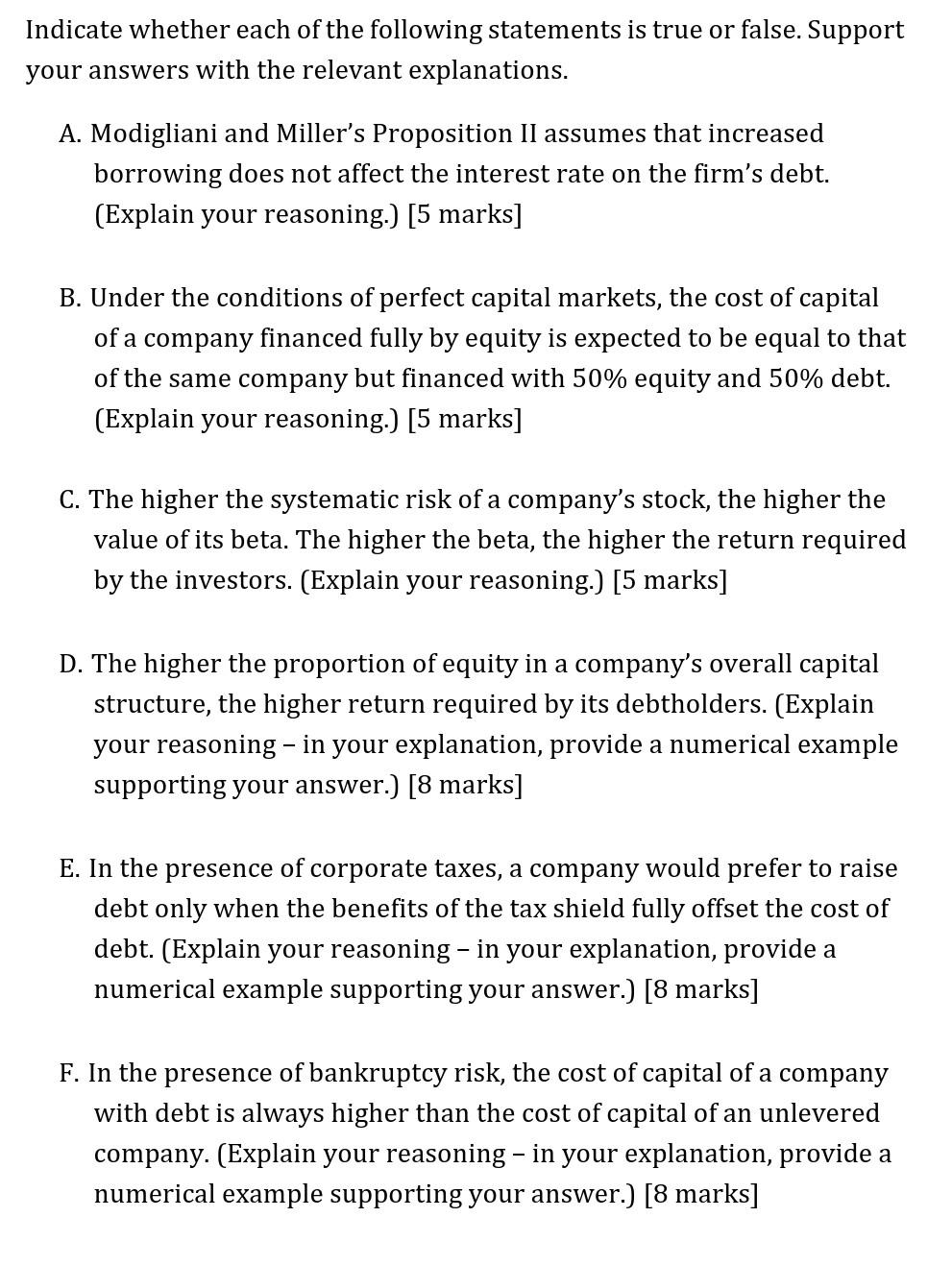

Indicate whether each of the following statements is true or false. Support your answers with the relevant explanations. A. Modigliani and Miller's Proposition II assumes that increased borrowing does not affect the interest rate on the firm's debt. (Explain your reasoning.) [5 marks] B. Under the conditions of perfect capital markets, the cost of capital of a company financed fully by equity is expected to be equal to that of the same company but financed with 50% equity and 50% debt. (Explain your reasoning.) [5 marks] C. The higher the systematic risk of a company's stock, the higher the value of its beta. The higher the beta, the higher the return required by the investors. (Explain your reasoning.) [5 marks] D. The higher the proportion of equity in a company's overall capital structure, the higher return required by its debtholders. (Explain your reasoning - in your explanation, provide a numerical example supporting your answer.) [8 marks] E. In the presence of corporate taxes, a company would prefer to raise debt only when the benefits of the tax shield fully offset the cost of debt. (Explain your reasoning - in your explanation, provide a numerical example supporting your answer.) [8 marks] F. In the presence of bankruptcy risk, the cost of capital of a company with debt is always higher than the cost of capital of an unlevered company. (Explain your reasoning - in your explanation, provide a numerical example supporting your answer.) [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started