Answered step by step

Verified Expert Solution

Question

1 Approved Answer

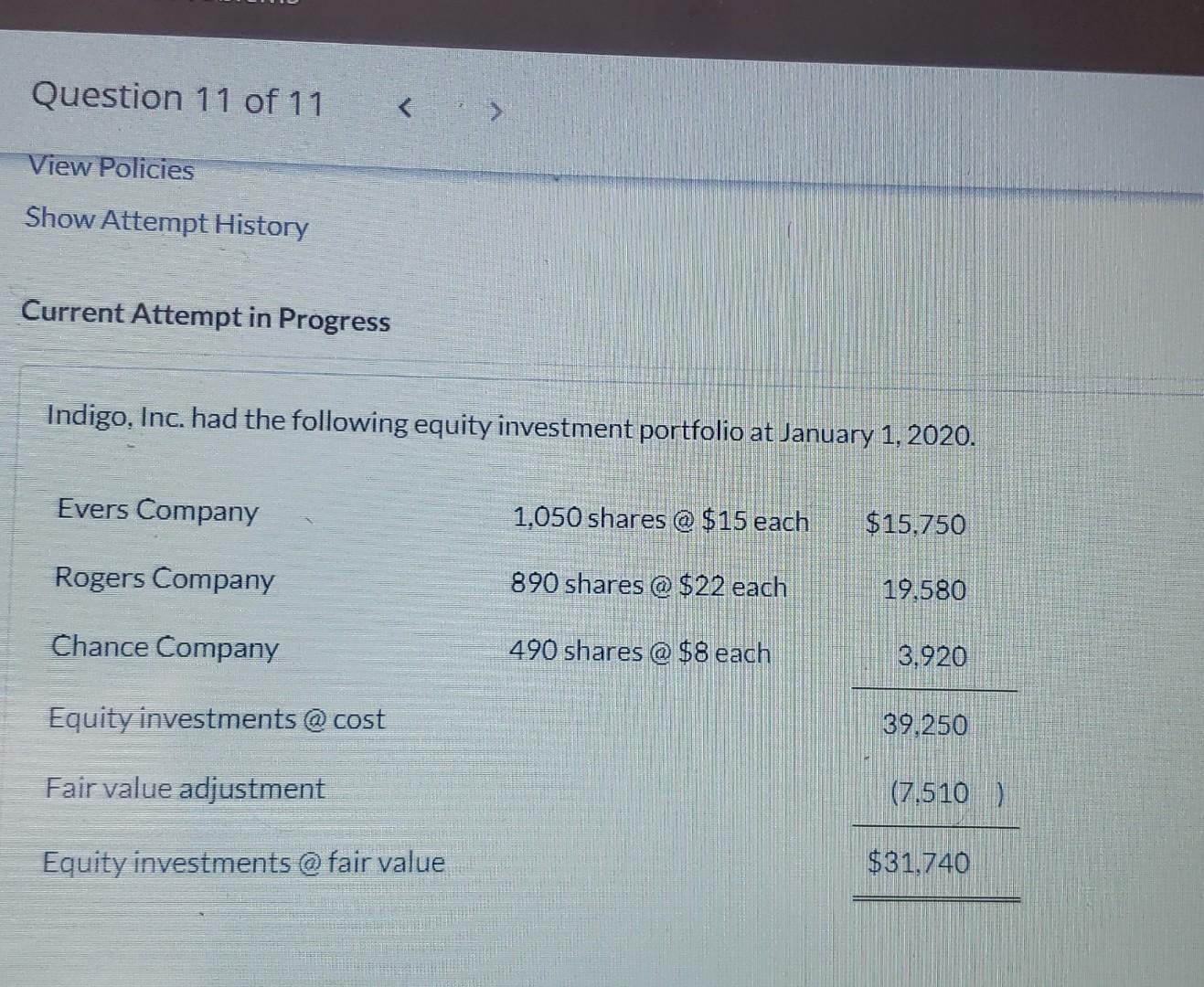

Indigo, Inc. had the following equity investment portfolio at January 1, 2020. During 2020 , the following transactions took place. 1. On March 1, Rogers

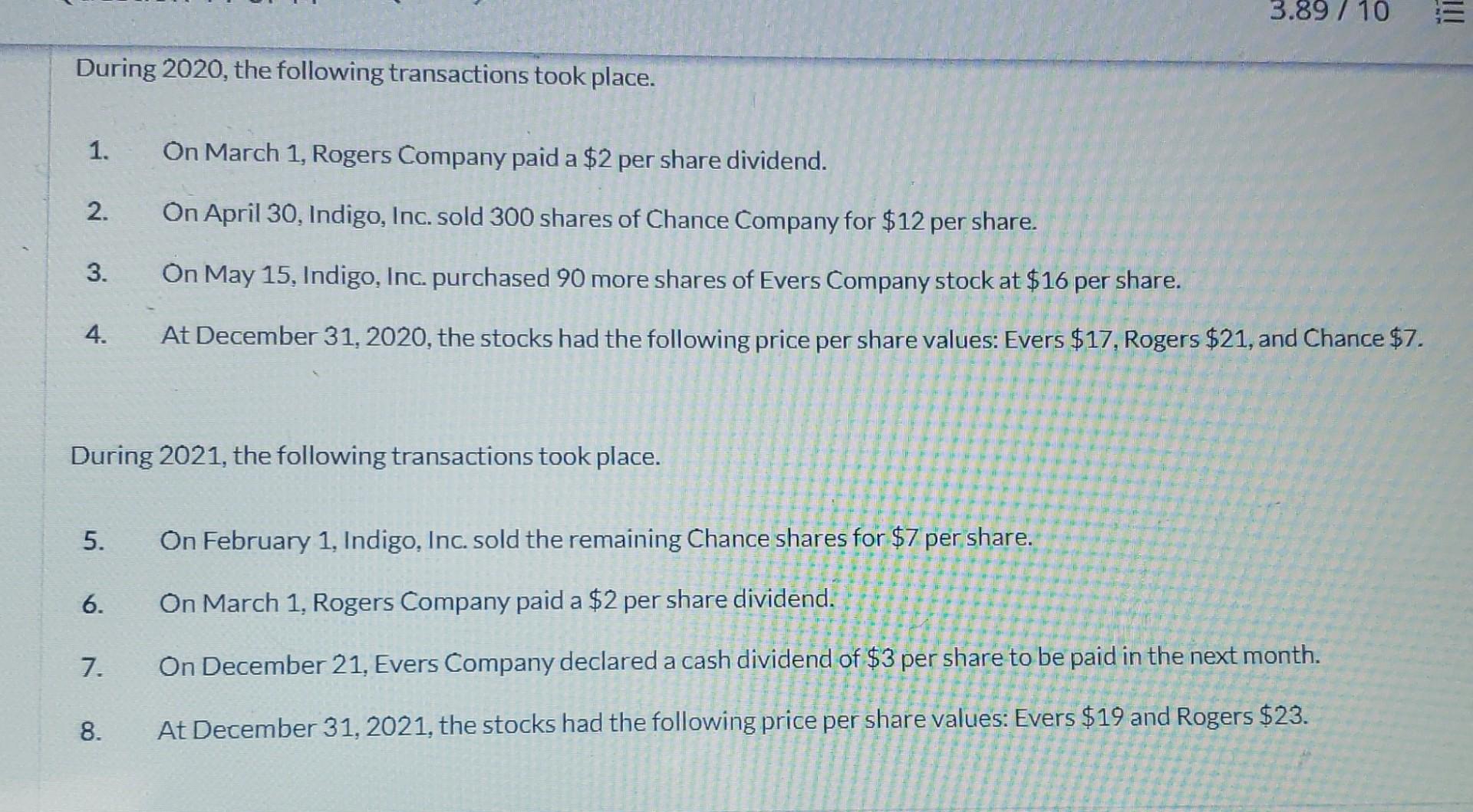

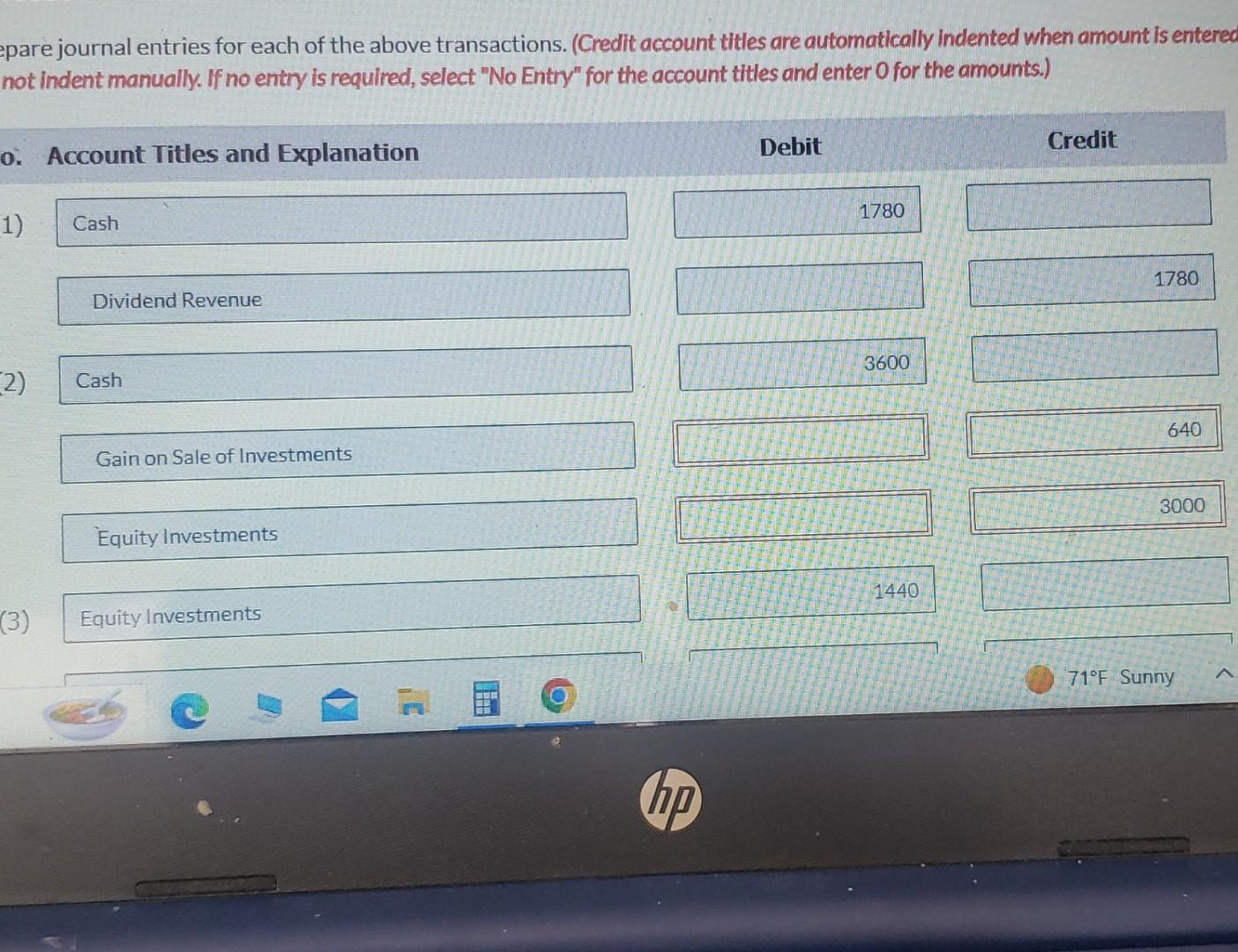

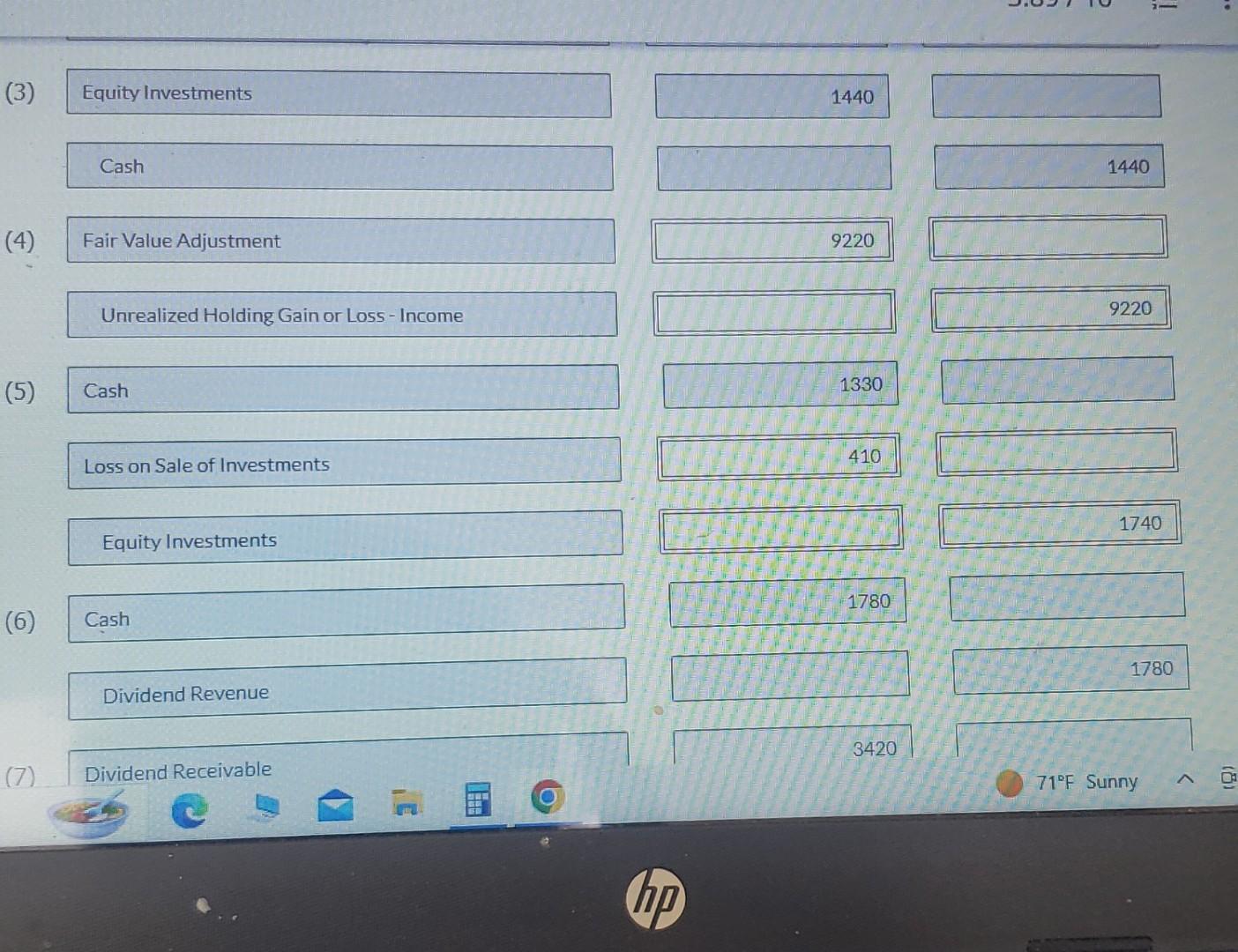

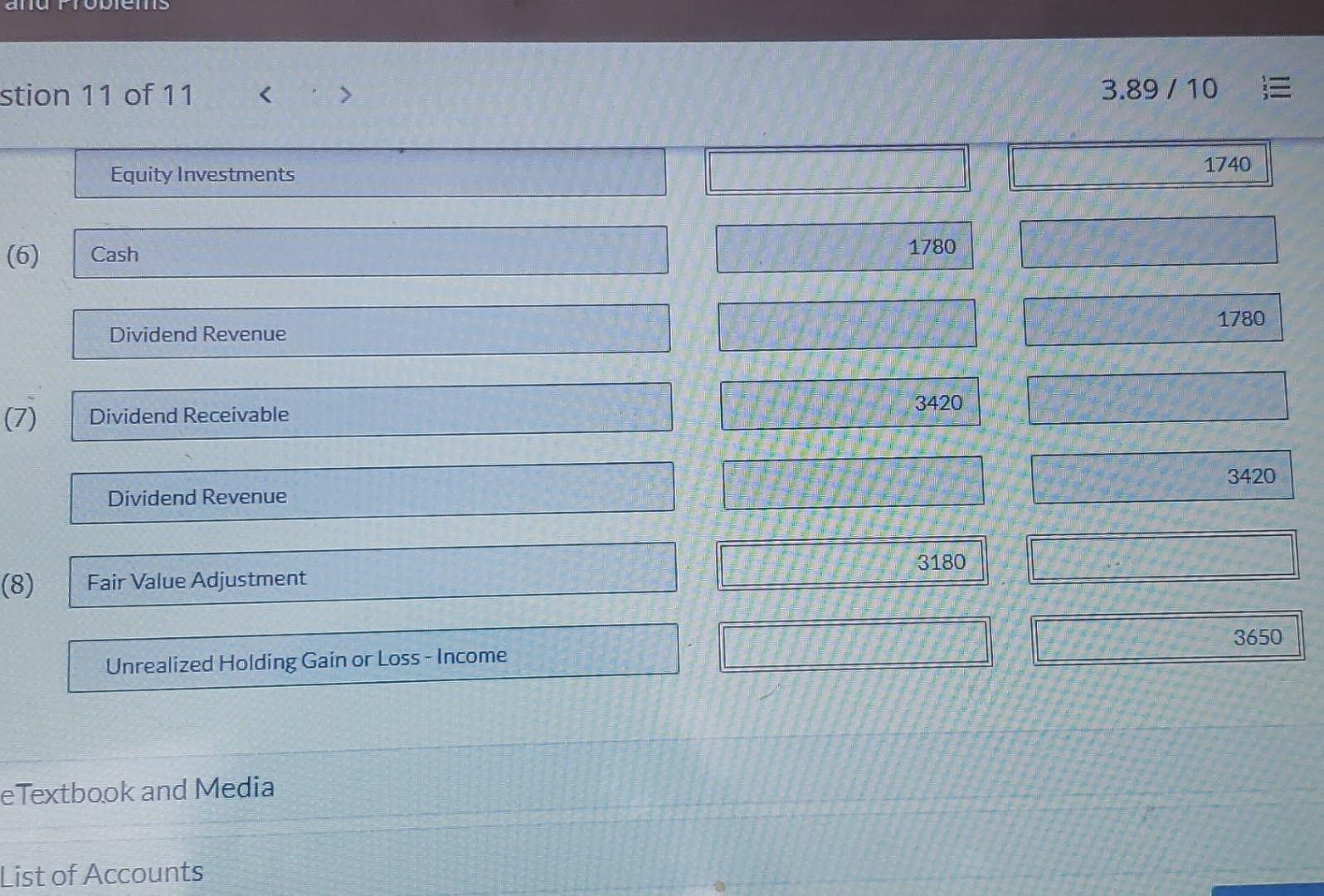

Indigo, Inc. had the following equity investment portfolio at January 1, 2020. During 2020 , the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30 , Indigo, Inc. sold 300 shares of Chance Company for $12 per share. 3. On May 15, Indigo, Inc. purchased 90 more shares of Evers Company stock at \$16 per share. 4. At December 31,2020 , the stocks had the following price per share values: Evers $17, Rogers $21, and Chance $7. During 2021, the following transactions took place. 5. On February 1, Indigo, Inc. sold the remaining Chance shares for $7 per share. 6. On March 1, Rogers Company paid a \$2 per share dividend. 7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31,2021 , the stocks had the following price per share values: Evers $19 and Rogers $23. pare journal entries for each of the above transactions. (Credit account titles are automatically indented when amount is entereo not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (3) Equity Investments Cash (4) Fair Value Adjustment Unrealized Holding Gain or Loss - Income (5) Cash 1330 Loss on Sale of Investments 410 Equity Investments (6) Cash 1780 \begin{tabular}{|r|} \hline \\ \hline \end{tabular} Dividend Revenue (7) Dividend Receivable 3420 71F Sunny List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started