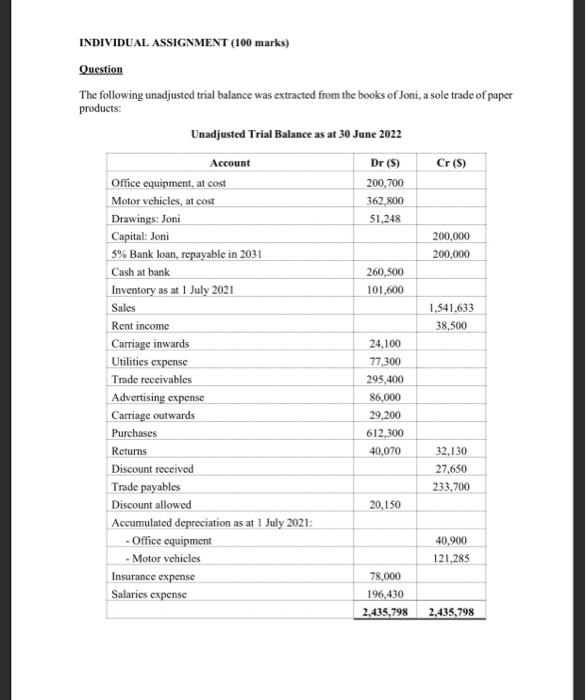

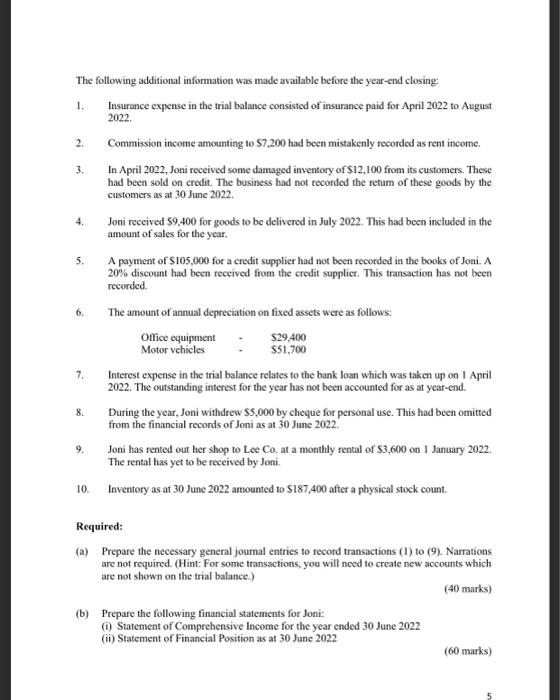

INDIVIDUAL ASSIGNMENT (100 marks) Question The following unadjusted trial balance was extracted from the books of Joni, a sole trade of paper products: Unadjusted Trial Balance as at 30 June 2022 The following additional information was made available before the year-end closing: 1. Insurance expense in the trial balance consisted of insurance paid for April 2022 to August 2022. 2. Commission income amounting to $7,200 had been mistakenly recorded as rent income. 3. In April 2022, Joni received some damaged inventory of $12, 100 from its customers. These had been sold on credit. The business had not recorded the retum of these goods by the customers as at 30 June 2022 . 4. Joni received $9,400 for goods to be delivered in July 2022 . This had been included in the amount of sales for the year. 5. A payment of $105,000 for a credit supplier had not been recorded in the books of Joni. A 20% discount had becn received from the credit supplier. This transaction has not been recorded. 6. The amount of annual depreciation on fixed assets were as follows: 8. During the year, Joni withdrew $5,000 by cheque for personal use. This had been omitted from the financial records of Joni as at 30 June 2022 . 9. Joni has rented out her shop to Lee Co. at a monthly rental of $3,600 on 1 January 2022. The rental has yet to be received by Joni. 10. Inventory as at 30 June 2022 amounted to $187,400 after a physical stock count. Required: (a) Prepare the necessary general joumal entries to record transactions (1) to (9). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Joni: (i) Statement of Comprehensive Income for the year ended 30 June 2022 (ii) Statement of Financial Position as at 30 Jane 2022 ( 60 marks) INDIVIDUAL ASSIGNMENT (100 marks) Question The following unadjusted trial balance was extracted from the books of Joni, a sole trade of paper products: Unadjusted Trial Balance as at 30 June 2022 The following additional information was made available before the year-end closing: 1. Insurance expense in the trial balance consisted of insurance paid for April 2022 to August 2022. 2. Commission income amounting to $7,200 had been mistakenly recorded as rent income. 3. In April 2022, Joni received some damaged inventory of $12, 100 from its customers. These had been sold on credit. The business had not recorded the retum of these goods by the customers as at 30 June 2022 . 4. Joni received $9,400 for goods to be delivered in July 2022 . This had been included in the amount of sales for the year. 5. A payment of $105,000 for a credit supplier had not been recorded in the books of Joni. A 20% discount had becn received from the credit supplier. This transaction has not been recorded. 6. The amount of annual depreciation on fixed assets were as follows: 8. During the year, Joni withdrew $5,000 by cheque for personal use. This had been omitted from the financial records of Joni as at 30 June 2022 . 9. Joni has rented out her shop to Lee Co. at a monthly rental of $3,600 on 1 January 2022. The rental has yet to be received by Joni. 10. Inventory as at 30 June 2022 amounted to $187,400 after a physical stock count. Required: (a) Prepare the necessary general joumal entries to record transactions (1) to (9). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Joni: (i) Statement of Comprehensive Income for the year ended 30 June 2022 (ii) Statement of Financial Position as at 30 Jane 2022 ( 60 marks)