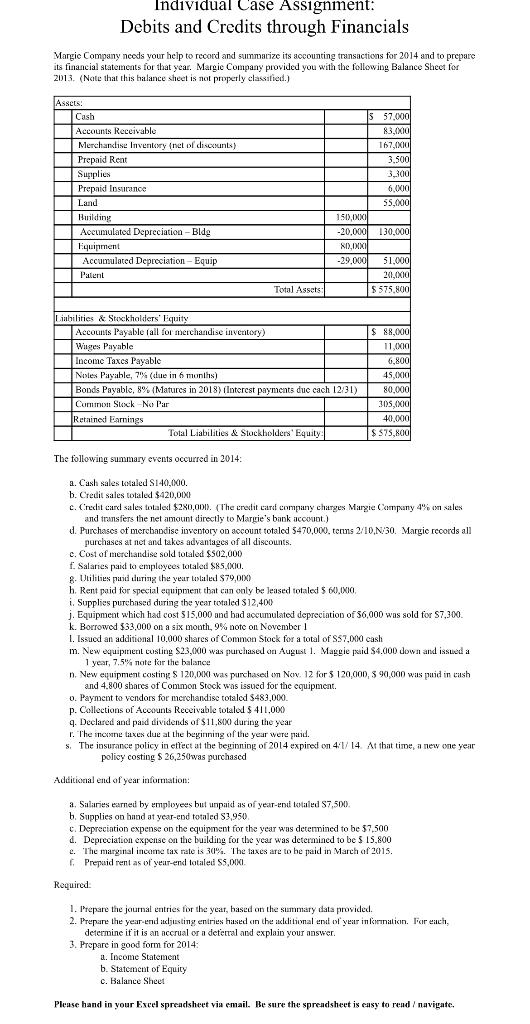

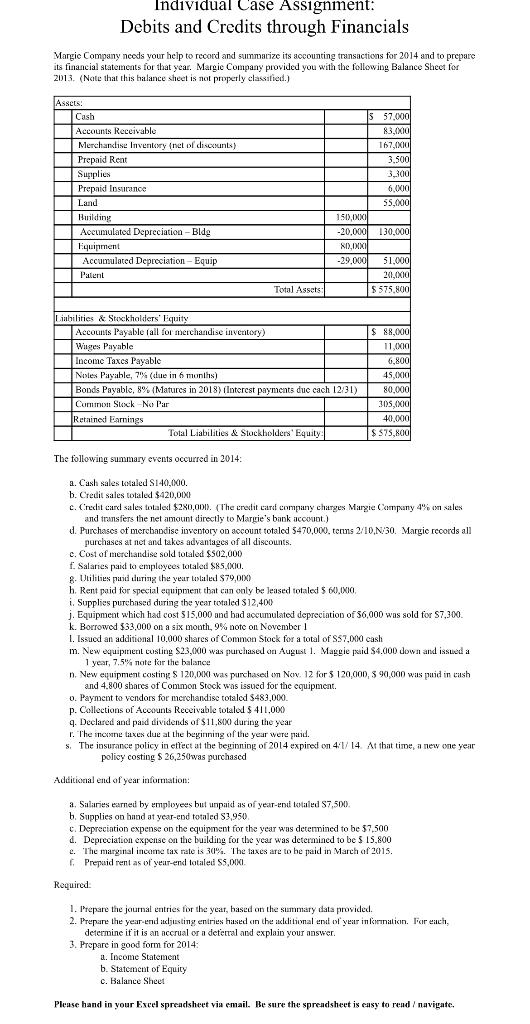

Individual Case Assignment: Debits and Credits through Financials Margic Company needs your help to record and summatize its accounting transactions for 2014 and to prepare its financial statemeats for that year. Margie Company provided you with the following Balance Sheet for 2013. (Note that this balance sheet is not properly classified.) The following summary events occurred in 2014: a. Cash sales totaled S140,iN00. b. Cretit sales totaled $420,0Xl c. (redit carch sales thaleel $280,001 ). (The crotht carnt company charges Margie Company 4% on sales and transfers the net amount directly to Margie's bank acoonot.) d. Purchases of merchandise iwventory on account totaled 5470,000 , terns 2/10,N/30. Margie records al] purchases at net and takes advantages of all discounts. c. Cost of merchandise sold totaled $502,000 f. Salaries paid to employees hotaled $85,1010. g. Utilities paid during the year wlaled $79,0001 b. Rent paid for special equipment that can ooly be leased totaled $ fv), (XiI, i. Supplies purchased during the year totaled $12,400 j. Equipment which had cost 515,000 and bad accumulated depreciation of 56,000 was sold for $7,300. k. Borrowed $33,000 on a six mouth, 9% note on November 1 1. Issued an additional 10,000 shares of Common Stock for a total of $57,000 cash m. New equipnent costing $23, 000 was purchased on August 1. Maggie paid $4.000 down and issued a 1 year, 7.5\%/4 note far the balance n. New equipment costing $120,001 was purchased on Nov. 12 for $120,000,390,000 was puid in cash and 4.800 shares of Common Stock was issued for the equipment. o. Payment to vendors for merehandise totalod $483,000. p. Collections of Accounts Receivable totaled $411,000 q. Declared and paid dividends of $11,8100 during the year r. The incosne taxes due at the beginning of the year were paid. 8. The insurance policy in effect at the beginning of 2014 expired on 4:1/14. At that time, a new sne year policy costing $26,250 was purchased Adehitional end of year information: a. Salaries earned by employees but unpaid as of year-endi tolaled S7,500. b. Supplies on hand at year-end totaled $3,950. c. Deprecintion expense on the equipnent for the year was detennined to be $7,500 d. Depreciation expense on the building for the year was deterained to be 515,800 e. The marginal income tax rate is 30%. The laxes are to be paid in March of 26115. f. Prepaid rent as of year-end totaled \$5, 01KI. Required: 1. Irepare the journal entries for the year, based on the sammary data provided. 2. Prepare the year-end adyusting eniries hased an the akdditional end of year information. For each, determine if it is an accrual or a deterzl and explain your answer. 3. Prepare in good form for 2014 : a. Incone Statement b. Statement of Equity c. Balance Sheet Please hand in your Excel spreadsheet via email. Bhe sure the spreadsheet is easy to read / navigate. Individual Case Assignment: Debits and Credits through Financials Margic Company needs your help to record and summatize its accounting transactions for 2014 and to prepare its financial statemeats for that year. Margie Company provided you with the following Balance Sheet for 2013. (Note that this balance sheet is not properly classified.) The following summary events occurred in 2014: a. Cash sales totaled S140,iN00. b. Cretit sales totaled $420,0Xl c. (redit carch sales thaleel $280,001 ). (The crotht carnt company charges Margie Company 4% on sales and transfers the net amount directly to Margie's bank acoonot.) d. Purchases of merchandise iwventory on account totaled 5470,000 , terns 2/10,N/30. Margie records al] purchases at net and takes advantages of all discounts. c. Cost of merchandise sold totaled $502,000 f. Salaries paid to employees hotaled $85,1010. g. Utilities paid during the year wlaled $79,0001 b. Rent paid for special equipment that can ooly be leased totaled $ fv), (XiI, i. Supplies purchased during the year totaled $12,400 j. Equipment which had cost 515,000 and bad accumulated depreciation of 56,000 was sold for $7,300. k. Borrowed $33,000 on a six mouth, 9% note on November 1 1. Issued an additional 10,000 shares of Common Stock for a total of $57,000 cash m. New equipnent costing $23, 000 was purchased on August 1. Maggie paid $4.000 down and issued a 1 year, 7.5\%/4 note far the balance n. New equipment costing $120,001 was purchased on Nov. 12 for $120,000,390,000 was puid in cash and 4.800 shares of Common Stock was issued for the equipment. o. Payment to vendors for merehandise totalod $483,000. p. Collections of Accounts Receivable totaled $411,000 q. Declared and paid dividends of $11,8100 during the year r. The incosne taxes due at the beginning of the year were paid. 8. The insurance policy in effect at the beginning of 2014 expired on 4:1/14. At that time, a new sne year policy costing $26,250 was purchased Adehitional end of year information: a. Salaries earned by employees but unpaid as of year-endi tolaled S7,500. b. Supplies on hand at year-end totaled $3,950. c. Deprecintion expense on the equipnent for the year was detennined to be $7,500 d. Depreciation expense on the building for the year was deterained to be 515,800 e. The marginal income tax rate is 30%. The laxes are to be paid in March of 26115. f. Prepaid rent as of year-end totaled \$5, 01KI. Required: 1. Irepare the journal entries for the year, based on the sammary data provided. 2. Prepare the year-end adyusting eniries hased an the akdditional end of year information. For each, determine if it is an accrual or a deterzl and explain your answer. 3. Prepare in good form for 2014 : a. Incone Statement b. Statement of Equity c. Balance Sheet Please hand in your Excel spreadsheet via email. Bhe sure the spreadsheet is easy to read / navigate