Question

Industry Supply Company (The following 3 multiple choice questions are based on the analysis) Consider the Industrial Supply Company example again. Assume that the company

Industry Supply Company

(The following 3 multiple choice questions are based on the analysis)

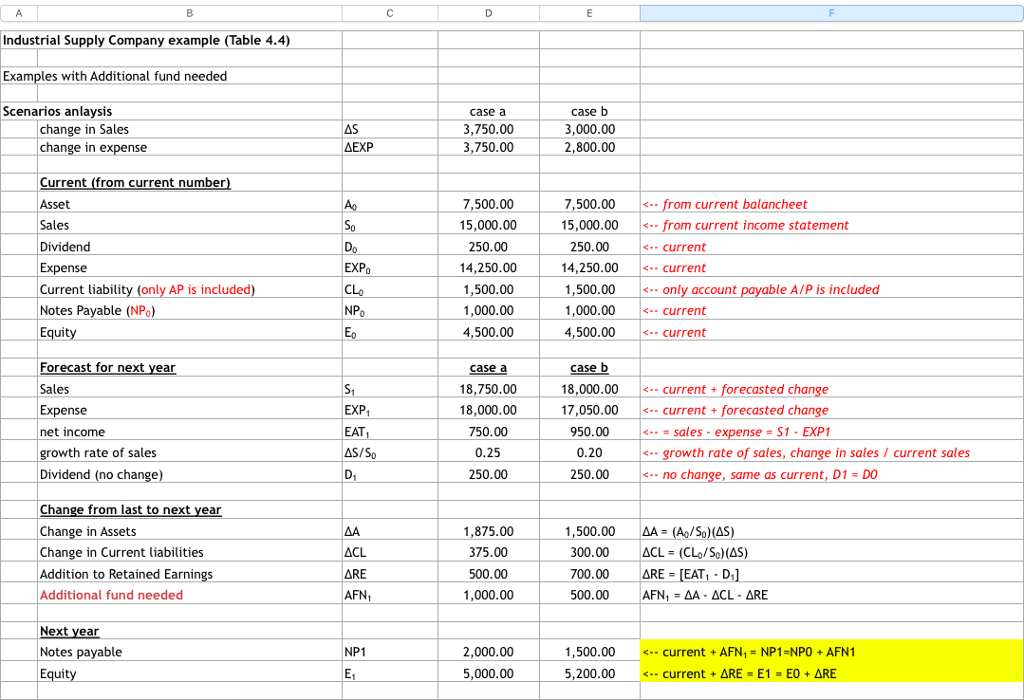

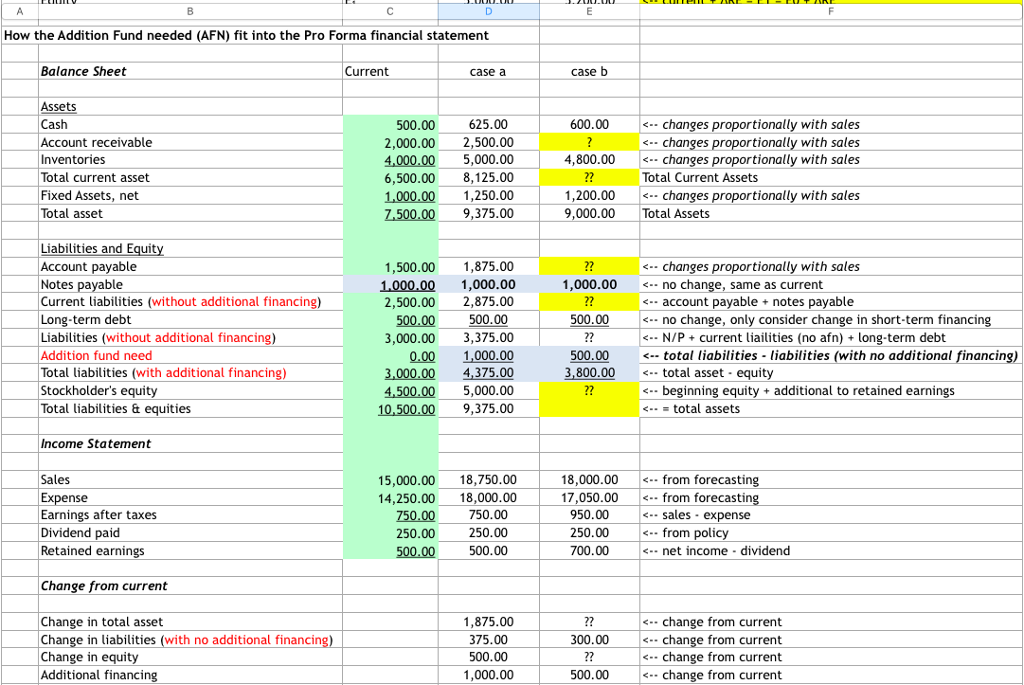

Consider the Industrial Supply Company example again. Assume that the company plans to maintain its dividend payment at the same level in 2014 as in 2013. Also assume that all of the additional financing needed is in the short-term notes payable. Work the pro forma analysis for 2014 under each of the following conditions.

- Determine the amount of additional financing need

- Work out pro forma financial statements (that is, balance sheet, income statement)

| case a | case b | ||

| change in Sales | S | 3,750.00 | 3,000.00 |

| change in expense | EXP | 3,750.00 | 2,800.00 |

In Case b, what is the change in asset?

In Case b, what is the change in liabilities without additional financing (AFN)?

In Case b, what is the additional financing needed (AFN)? Fill the ?? celds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started