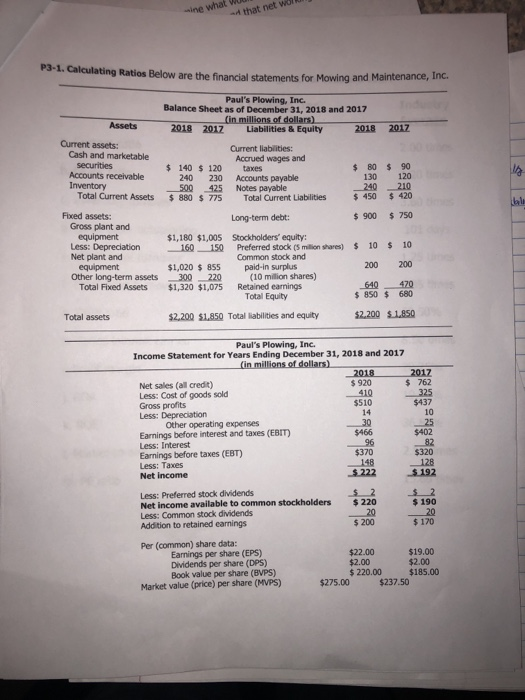

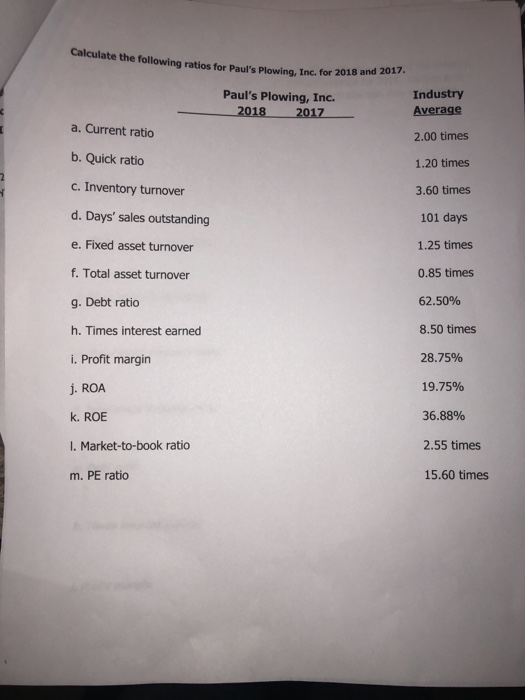

ine what that net P3-1. Calculating Ratios Below are the financial statements for Mowing and Maintenance, Inc. Assets 2017 Current assets: Cash and marketable securities Accounts receivable Inventory Total Current Assets $ 90 Paul's Plowing, Inc. Balance Sheet as of December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Liabilities & Equity 2018 Current liabilities: Accrued wages and $ 140 $ 120 taxes $ 80 240 230 Accounts payable 130 500 425 Notes payable 240 $ 880 $ 775 Total Current Liabilities $ 450 Long-term debt: $ 900 15 120 210 $ 420 $ 750 $ 10 $ 10 Fixed assets: Gross plant and equipment Less: Depreciation Net plant and equipment Other long-term assets Total Fixed Assets $1,180 $1,005 Stockholders' equity: 160 150 Preferred stock (5 million shares) Common stock and $1,020 $ 855 paid-in surplus 300_220 (10 milion shares) $1,320 $1,075 Retained earnings Total Equity 200 200 640 470 $ 850 $ 680 Total assets $2,200 $1,850 Total liabilities and equity $2.200 $ 1.850 Paul's Plowing, Inc. Income Statement for Years Ending December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Net sales (all credit) $ 920 $ 762 Less: Cost of goods sold 410 325 Gross profits $510 $437 Less: Depreciation 14 10 Other operating expenses 30 25 Earnings before interest and taxes (EBIT) $466 $402 Less: Interest 96 82 Earnings before taxes (EBT) $370 $320 Less: Taxes 148 128 Net Income $ 222 $ 192 Less: Preferred stock dividends S2 S2 Net Income available to common stockholders $ 220 $ 190 Less: Common stock dividends 20 20 Addition to retained earnings $ 200 $ 170 Per (common) share data: Earnings per share (EPS) $22.00 $19.00 Dividends per share (DPS) $2.00 $2.00 Book value per share (BVPS) $ 220.00 $185.00 Market value (price) per share (MVPS) $275.00 $237.50 Calculate the following ratios for Paul's Plowing, Inc. for 2018 and 2017. Paul's Plowing, Inc. 2018 2017 Industry Average a. Current ratio 2.00 times b. Quick ratio 1.20 times C. Inventory turnover 3.60 times d. Days' sales outstanding 101 days e. Fixed asset turnover 1.25 times 0.85 times f. Total asset turnover 9. Debt ratio h. Times interest earned 62.50% 8.50 times i. Profit margin 28.75% j. ROA 19.75% K. ROE 36.88% I. Market-to-book ratio 2.55 times m. PE ratio 15.60 times