Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Info Tech wishes to upgrade its computer networks in order to save costs. A suitable system costing R480 000 can either be purchased or leased.

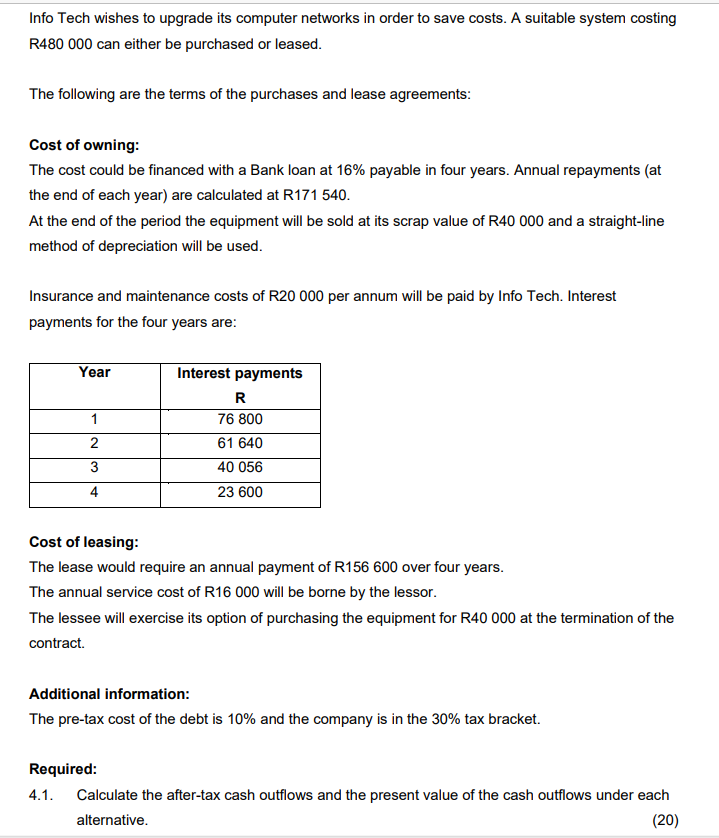

Info Tech wishes to upgrade its computer networks in order to save costs. A suitable system costing R480 000 can either be purchased or leased. The following are the terms of the purchases and lease agreements: Cost of owning: The cost could be financed with a Bank loan at 16% payable in four years. Annual repayments (at the end of each year) are calculated at R171 540. At the end of the period the equipment will be sold at its scrap value of R40 000 and a straight-line method of depreciation will be used. Insurance and maintenance costs of R20 000 per annum will be paid by Info Tech. Interest payments for the four years are: Cost of leasing: The lease would require an annual payment of R156 600 over four years. The annual service cost of R16 000 will be borne by the lessor. The lessee will exercise its option of purchasing the equipment for R40 000 at the termination of the contract. Additional information: The pre-tax cost of the debt is 10% and the company is in the 30% tax bracket. Required: 4.1. Calculate the after-tax cash outflows and the present value of the cash outflows under each alternative. (20)

Info Tech wishes to upgrade its computer networks in order to save costs. A suitable system costing R480 000 can either be purchased or leased. The following are the terms of the purchases and lease agreements: Cost of owning: The cost could be financed with a Bank loan at 16% payable in four years. Annual repayments (at the end of each year) are calculated at R171 540. At the end of the period the equipment will be sold at its scrap value of R40 000 and a straight-line method of depreciation will be used. Insurance and maintenance costs of R20 000 per annum will be paid by Info Tech. Interest payments for the four years are: Cost of leasing: The lease would require an annual payment of R156 600 over four years. The annual service cost of R16 000 will be borne by the lessor. The lessee will exercise its option of purchasing the equipment for R40 000 at the termination of the contract. Additional information: The pre-tax cost of the debt is 10% and the company is in the 30% tax bracket. Required: 4.1. Calculate the after-tax cash outflows and the present value of the cash outflows under each alternative. (20) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started