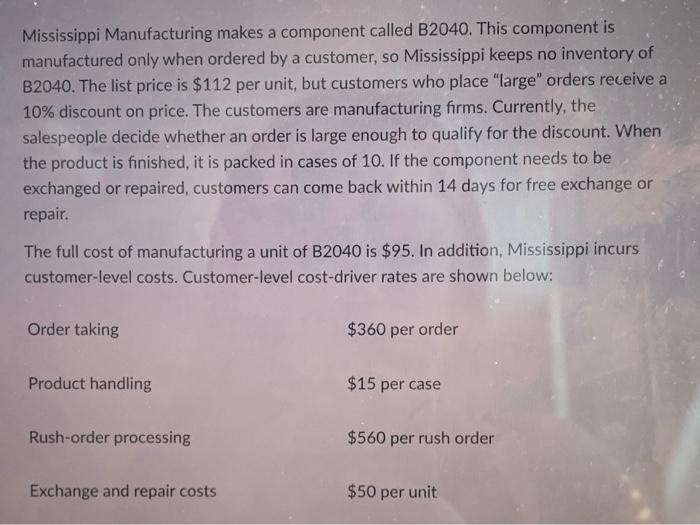

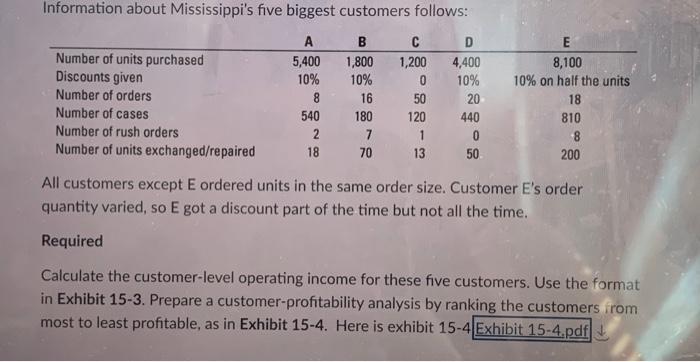

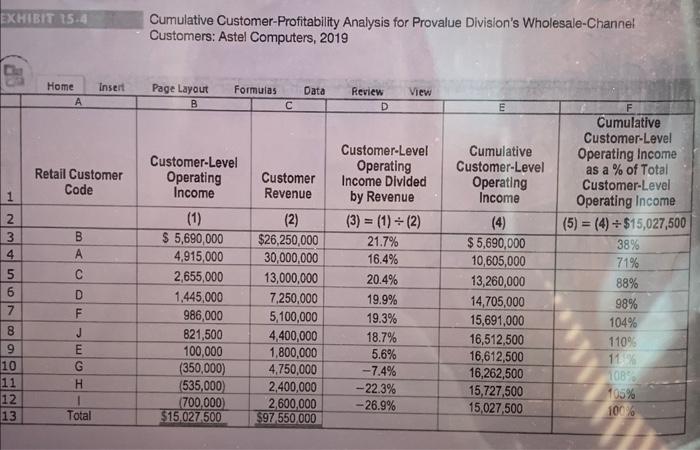

Information about Mississippi's five biggest customers follows: All customers except E ordered units in the same order size. Customer E's order quantity varied, so E got a discount part of the time but not all the time. Required Calculate the customer-level operating income for these five customers. Use the format in Exhibit 15-3. Prepare a customer-profitability analysis by ranking the customers from most to least profitable, as in Exhibit 15-4. Here is exhibit 15-4 Cumulative Customer-Profitability Analysis for Provalue Division's Wholesale-Channel Customers: Astel Computers, 2019 Customer-Profitability Profiles Customer-profitability profiles are a useful tool for managers. Exhibit 15-4 ranks the Provalue Division's 10 wholesale customers based on customer-level operating income. (We analyzed four of these customers in Exhibit 15-3.) Column 4, computed by adding the individual amounts in column 1, shows the cumulative customer-level operating income. For example, Customer C shows a cumulative income of $13,260,000 in column 4. This $13,260,000 is the sum of $5,690,000 for Customer B, $4,915,000 for Customer A, and $2,655,000 for Customer C. Column 5 shows what percentage the $13,260,000 cumulative total for customers B, A, and C is of the total customer-level operating income of $15,027,500 earned in the wholesale distribution channel from all 10 customers. The three most profitable customers contribute 88% of total customer-level operating income. These customers deserve the highest service and priority. It is common for a small number of customers to contribute a higl percentage of operating income. Microsoft uses the phrase "not all revenue dollars endowed equally in profitability" to stress this point. Companies keep their best cu ers happy in a number of ways, including special phone numbers and upgrade pri for elite-level frequent flyers and free usage of luxury hotel suites and big credit limits for high rollers at casinos. Concepts in Action: Amazon Prime and Custom s Proficability (page 603) describes how Amazon introduced Amazon Prime to support its most profitable customers. ST ALLOCATION, CUSTOMER-PROFITABILITY ANALYSIS, AND SALES-VARIANCE ANALYSIS meeting customer needs. For example, improving the efficiency of the ordering process (through electronic ordering) reduces sales-order costs even if customers place the same number of orders. Simplifying the design and reducing the weight of the newly designed Provalue II for 2020 reduces the cost per cubic foot of handling Provalue and total product-handling costs. By influencing customer behavior and improving marketing, distribution, and customer-service operations, managers aim to reduce the nonmanufacturing cost of Provalue II to $180 per computer and achieve the target cost of $720 for Provalue II. Customer-Profitability Profiles Customer-profitability profiles are a useful tool for managers. Exhibit 15-4 ranks the Provaluc Division's 10 wholesale customers based on customer-level operating income. (We analyzed four of these customers in Exhibit 15-3.) Column 4, computed by adding the individual amounts in column 1 , shows the cumulative customer-level operating income. For example, Customer C shows a cumulative come of $13,260,000 in column 4 . This $13,260,000 is the sum of $5,690,000 for Customer id $4,915,000 for Customer A, and $2,655,000 for Customer C. Column S shows what percentage the $13,260,000 cumulative total for customers f,A, and C is of the total customer-level operating income of $15,027,500 earned in the wholesale distribution channel from all 10 customers. The three most profitable cu on ors contribute 88% of total customer-level operating income. These customers deserve the lughest service and priority. It is common for a small number of customers to contribrice hich percentage of operating income. Microsoft uses the phrase "not all revenue doll ifs ifs endowed equally in profitability" to stress this point. Companies keep their best cu cor ers happy in a number of ways, including special phone numbers and upgrade privileges for elite-level frequent flyers and free usage of luxury hotel suites and big credit limits Mississippi Manufacturing makes a component called B2040. This component is manufactured only when ordered by a customer, so Mississippi keeps no inventory of B2040. The list price is $112 per unit, but customers who place "large" orders receive a 10% discount on price. The customers are manufacturing firms. Currently, the salespeople decide whether an order is large enough to qualify for the discount. When the product is finished, it is packed in cases of 10 . If the component needs to be exchanged or repaired, customers can come back within 14 days for free exchange or repair. The full cost of manufacturing a unit of B2040 is \$95. In addition, Mississippi incurs customer-level costs. Customer-level cost-driver rates are shown below: Order taking Product handling Rush-order processing Exchange and repair costs $360 per order $15 per case $560 per rush order $50 per unit