Answered step by step

Verified Expert Solution

Question

1 Approved Answer

information about questions and then questions Part A Financial Statement Analysis You have been hired to be the assistant to the Chief Financial Officer of

information about questions and then questions

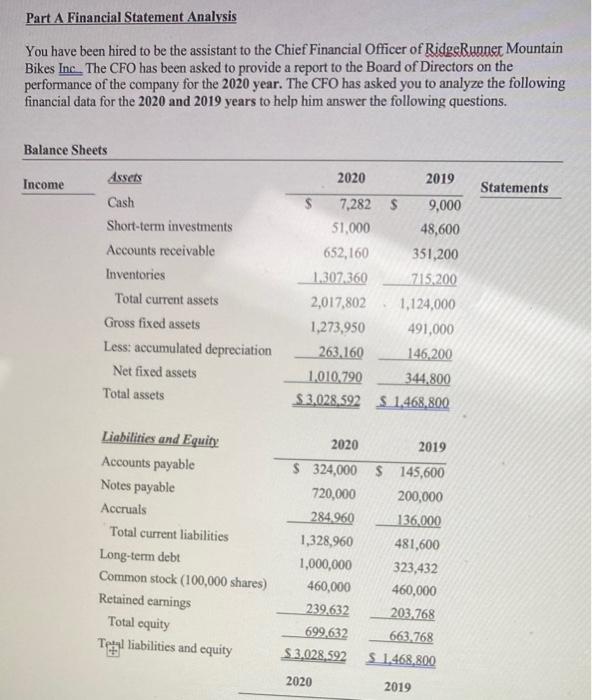

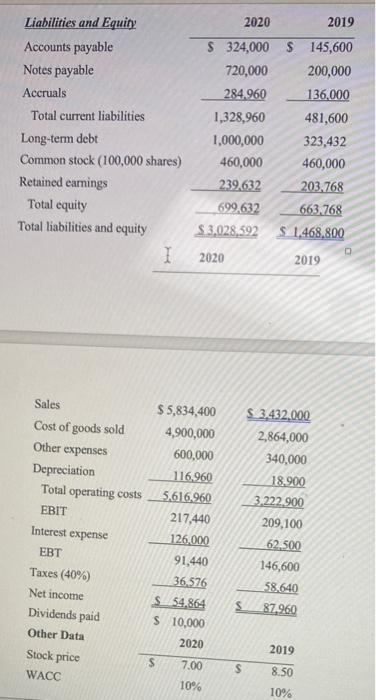

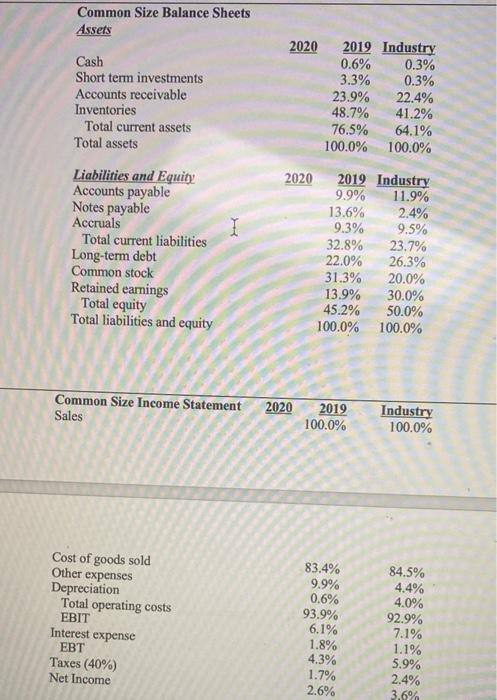

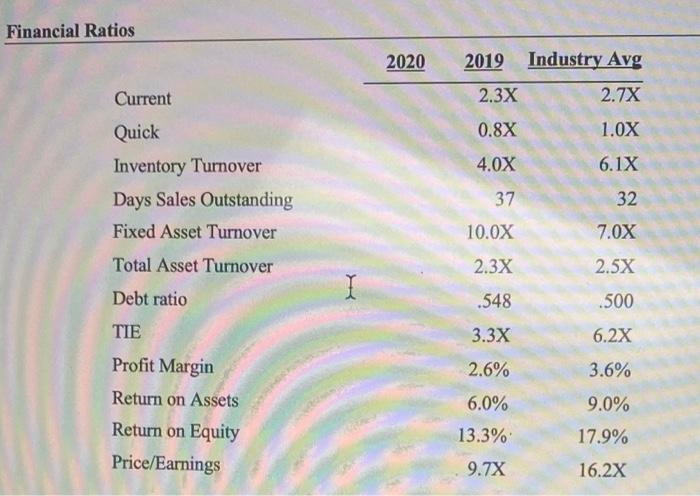

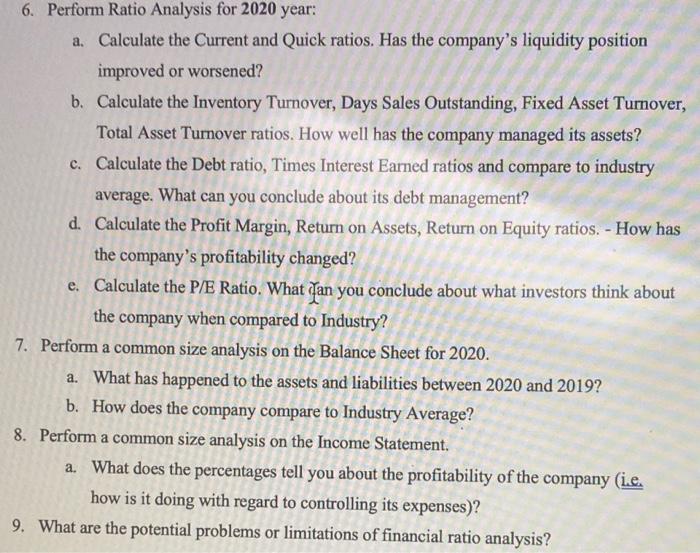

Part A Financial Statement Analysis You have been hired to be the assistant to the Chief Financial Officer of RidgeRunner Mountain Bikes Inc. The CFO has been asked to provide a report to the Board of Directors on the performance of the company for the 2020 year. The CFO has asked you to analyze the following financial data for the 2020 and 2019 years to help him answer the following questions. Balance Sheets Assets 2020 Income 2019 Statements Cash Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: accumulated depreciation Net fixed assets Total assets S 7,282 $ 9,000 51,000 48,600 652,160 351,200 1.307 360 715,200 2,017,802 1,124,000 1,273,950 491,000 263.160 146,200 1.010.790 344.800 $3,028,592 $ 1.468,800 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total cquity Tegal liabilities and equity 2020 2019 $ 324,000 $ 145,600 720,000 200,000 284.960 136,000 1,328,960 481,600 1,000,000 323,432 460,000 460,000 239.632 203.768 699.632 663.768 S 3.028,592 $ 1.468.800 2020 2019 2020 2019 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) Retained earnings Total equity Total liabilities and equity I $ 324,000 $ 145,600 720,000 200,000 284.960 136.000 1,328,960 481,600 1,000,000 323,432 460,000 460,000 239,632 203.768 699,632 663.768 $3,028,592 $ 1,468,800 2020 2019 Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income Dividends paid Other Data Stock price WACC $ 5,834,400 4,900,000 600,000 116,960 5.616.960 217,440 126,000 91.440 36,576 S54,864 $ 10,000 2020 $.3.432,000 2,864,000 340,000 18.900 3.222.900 209.100 62.500 146,600 58.640 S 87.960 2019 $ 7.00 $ 8.50 10% 10% Common Size Balance Sheets Assets 2020 Cash Short term investments Accounts receivable Inventories Total current assets Total assets 2019 Industry 0.6% 0.3% 3.3% 0.3% 23.9% 22.4% 48.7% 41.2% 76.5% 64.1% 100.0% 100.0% Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total equity Total liabilities and equity 2020 2019 Industry 9.9% 11.9% 13.6% 2.4% 9.3% 9.5% 32.8% 23.7% 22.0% 26.3% 31.3% 20.0% 13.9% 30.0% 45.2% 50.0% 100.0% 100.0% Common Size Income Statement Sales 2020 2019 100.0% Industry 100.0% Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net Income 83.4% 9.9% 0.6% 93.9% 6.1% 1.8% 4.3% 1.7% 2.6% 84.5% 4.4% 4.0% 92.9% 7.1% 1.1% 5.9% 2.4% 3.6% Financial Ratios 2020 2019 Industry Avg 2.3X 2.7X Current 0.8X 1.0X 4.0X 6.1X 37 32 Quick Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt ratio 10.0X 7.0X 2.3X 2.5X .548 .500 TIE 3.3X 6.2X 2.6% 3.6% 6.0% 9.0% Profit Margin Return on Assets Return on Equity Price/Earnings 13.3% 17.9% 9.7X 16.2x 6. Perform Ratio Analysis for 2020 year: a. Calculate the Current and Quick ratios. Has the company's liquidity position improved or worsened? b. Calculate the Inventory Turnover, Days Sales Outstanding, Fixed Asset Turnover, Total Asset Turnover ratios. How well has the company managed its assets? c. Calculate the Debt ratio, Times Interest Earned ratios and compare to industry average. What can you conclude about its debt management? d. Calculate the Profit Margin, Return on Assets, Return on Equity ratios. - How has the company's profitability changed? e. Calculate the P/E Ratio. What an you conclude about what investors think about the company when compared to Industry? 7. Perform a common size analysis on the Balance Sheet for 2020. a. What has happened to the assets and liabilities between 2020 and 2019? b. How does the company compare to Industry Average? 8. Perform a common size analysis on the Income Statement. a. What does the percentages tell you about the profitability of the company (L.e. how is it doing with regard to controlling its expenses)? 9. What are the potential problems or limitations of financial ratio analysis Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started