Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INFORMATION: Extracts of the Statement of Comprehensive Income and Statement of Financial Position for the year ended 3 1 December 2 0 2 4 are

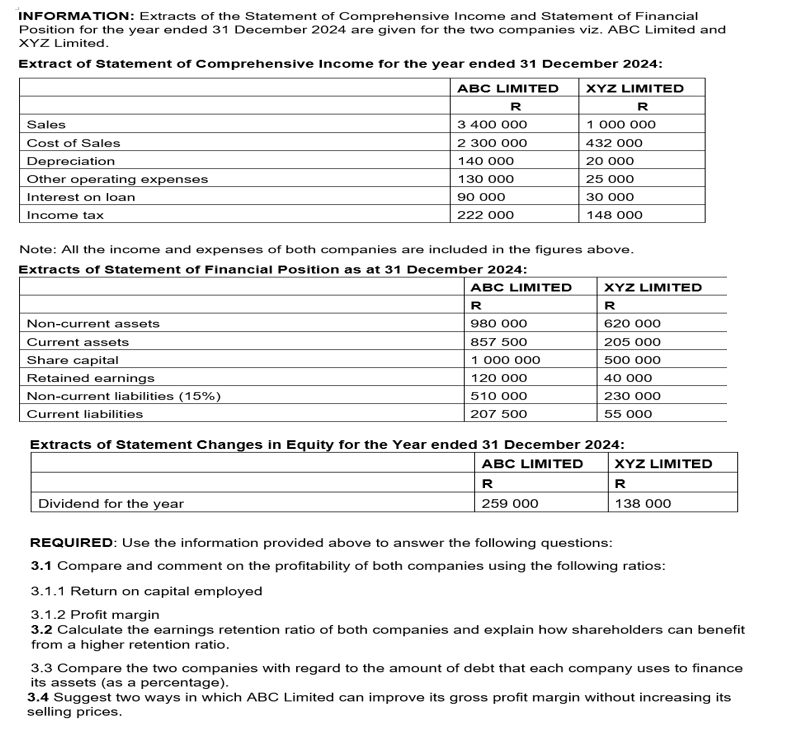

INFORMATION: Extracts of the Statement of Comprehensive Income and Statement of Financial Position for the year ended December are given for the two companies viz. ABC Limited and Limited. Extract of statement of Comprehensive Income for the year ended December : Note: All the income and expenses of both companies are included in the figures above. Extracts of Statement of Financial Position as at December : Extracts of Statement Changes in Equity for the Year ended December : REQUIRED: Use the information provided above to answer the following questions: Compare and comment on the profitability of both companies using the following ratios: Return on capital employed Profit margin Calculate the earnings retention ratio of both companies and explain how shareholders can benefit from a higher retention ratio. Compare the two companies with regard to the amount of debt that each company uses to finance its assets as a percentage Suggest two ways in which ABC Limited can improve its gross profit margin without increasing its selling prices.

INFORMATION: Extracts of the Statement of Comprehensive Income and Statement of Financial

Position for the year ended December are given for the two companies viz. ABC Limited and

Limited.

Extract of statement of Comprehensive Income for the year ended December :

Note: All the income and expenses of both companies are included in the figures above.

Extracts of Statement of Financial Position as at December :

Extracts of Statement Changes in Equity for the Year ended December :

REQUIRED: Use the information provided above to answer the following questions:

Compare and comment on the profitability of both companies using the following ratios:

Return on capital employed

Profit margin

Calculate the earnings retention ratio of both companies and explain how shareholders can benefit

from a higher retention ratio.

Compare the two companies with regard to the amount of debt that each company uses to finance

its assets as a percentage

Suggest two ways in which ABC Limited can improve its gross profit margin without increasing its

selling prices.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started