Question

Information for adjusting entries: (a) On May 1, 2020, the studio borrowed $16,000 by signing a 9-month notes payable to First Federal Bank of St.

Information for adjusting entries:

(a) On May 1, 2020, the studio borrowed $16,000 by signing a 9-month notes payable to First Federal Bank of St. Louis with an interest rate of 6% per annum. The entire principal plus interest will be due in full next year.

(b) Recordsshowthat$4,800ofthecustomersadvancedpaymentshadalreadybeenearnedas of December 31, 2020.

(c) Records show that $5,000 in studio revenue had been earned but not yet billed or recorded as of December 31, 2020.

(d) StudiosuppliesonhandonDecember31,2020amountto$5,800.

(e) On August 1, 2020, the studio purchased a six-month insurance policy (the only insurance policy as of December 31, 2020).

(f) The studio prepays rent quarterly. The latest payment of $6,000 was made on November 1, 2020.

(g) Theusefullifeofthestudiosrecordingequipmentisestimatedtobefiveyearswithnoscrap value. The straight-line method of depreciation is used.

Required

Record the adjusting entries for the month ended December 31, 2020.

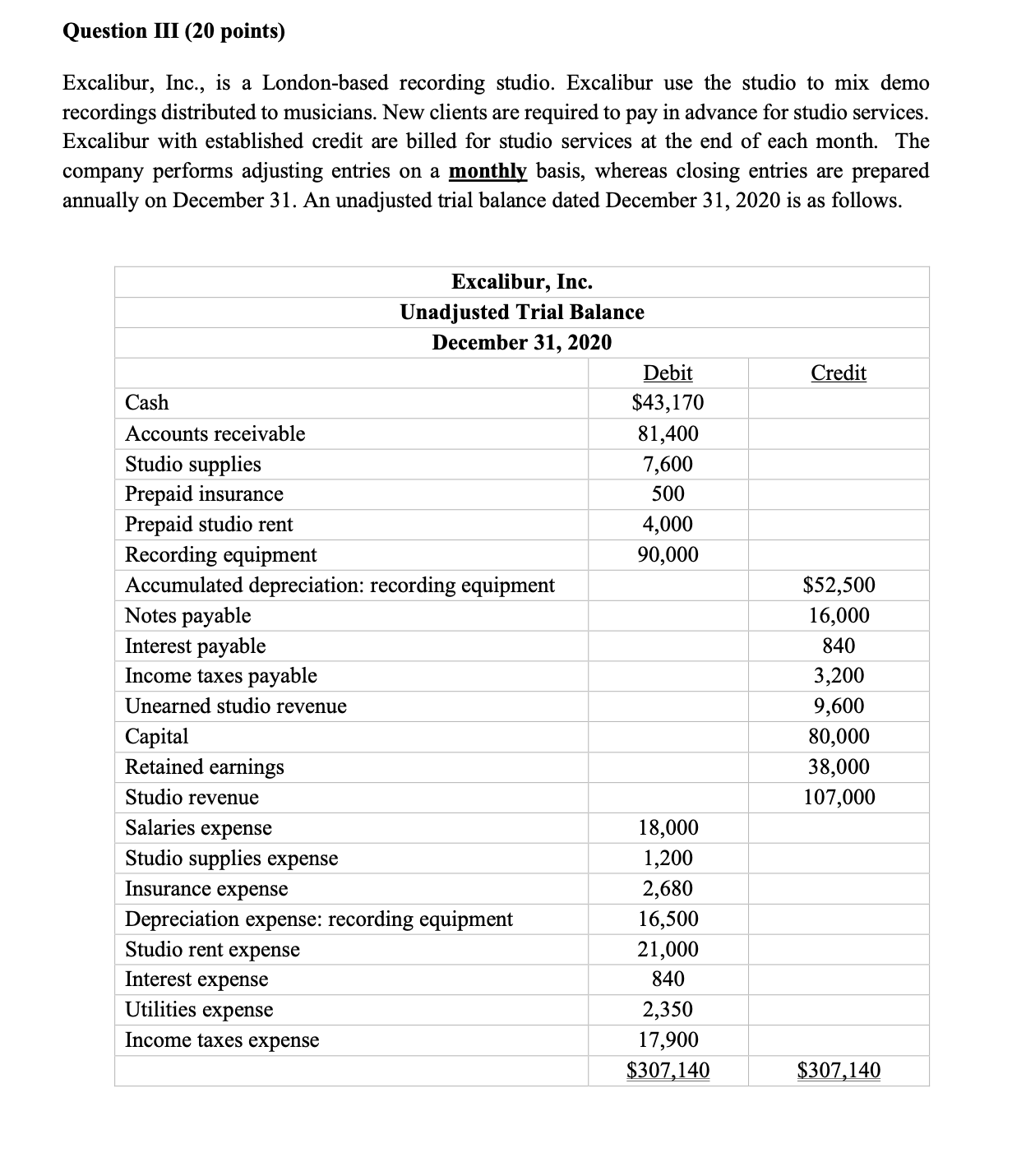

Question III (20 points) Excalibur, Inc., is a London-based recording studio. Excalibur use the studio to mix demo recordings distributed to musicians. New clients are required to pay in advance for studio services. Excalibur with established credit are billed for studio services at the end of each month. The company performs adjusting entries on a monthly basis, whereas closing entries are prepared annually on December 31. An unadjusted trial balance dated December 31, 2020 is as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started