Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information has been provided regarding a three year project investment option embarked upon by Explora- a mining exploration company for your evaluation as senior

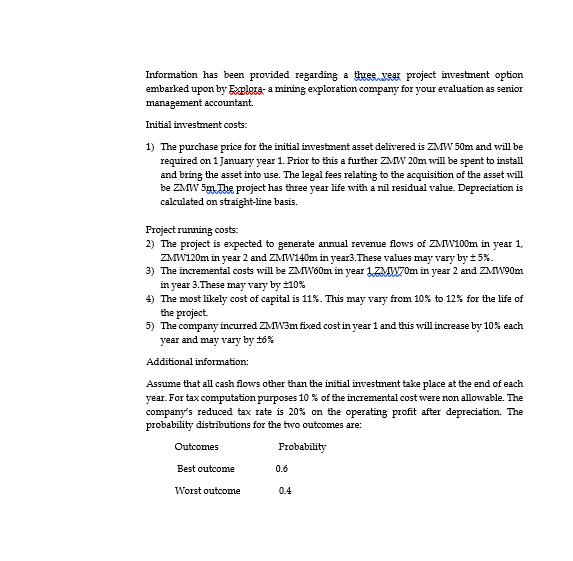

Information has been provided regarding a three year project investment option embarked upon by Explora- a mining exploration company for your evaluation as senior management accountant. Initial investment costs: 1) The purchase price for the initial investment asset delivered is ZMW 50m and will be required on 1 January year 1. Prior to this a further ZMW 20m will be spent to install and bring the asset into use. The legal fees relating to the acquisition of the asset will be ZMW 5m. The project has three year life with a nil residual value. Depreciation is calculated on straight-line basis. Project running costs: 2) The project is expected to generate annual revenue flows of ZMW100m in year 1, ZMW120m in year 2 and ZMW140m in year3.These values may vary by 5%. 3) The incremental costs will be ZMW60m in year 170m in year 2 and ZMW90m in year 3. These may vary by 10% 4) The most likely cost of capital is 11%. This may vary from 10% to 12% for the life of the project. 5) The company incurred ZMW3m fixed cost in year 1 and this will increase by 10% each year and may vary by 6% Additional information: Assume that all cash flows other than the initial investment take place at the end of each year. For tax computation purposes 10 % of the incremental cost were non allowable. The company's reduced tax rate is 20% on the operating profit after depreciation. The probability distributions for the two outcomes are: Probability Outcomes Best outcome Worst outcome 0.6 0.4 Required: a) Provide an analysis of the above information to show net profit for each year and net present value (NPV) of the project for: i The best outcome ii. The worst outcome b) Using information from (a) above determine what Expected Net Profit and Expected Net Present Value (NPV) would be for the project arising from the two outcomes. (5 Marks) c) Present an argument to support the need to use Simulation in risk evaluation, where a project has multiple dynamic variables as oppose to Sensitivity Analysis. (5 Marks)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solved Answ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started