Question

INFORMATION: HEDRON, INC. ANNUAL BUDGET: NO FORMULAS = NO CREDIT Hedron, Inc. is a company that re-sells one product, a particularly comfortable lawn chair. An

INFORMATION: HEDRON, INC. ANNUAL BUDGET: NO FORMULAS = NO CREDIT

- Hedron, Inc. is a company that re-sells one product, a particularly comfortable lawn chair. An overseas contractor makes the product exclusively for Hedron, so Hedron has no manufacturing-related costs.

- As of 11/01/2019, each lawn chair costs Hedron $4 per unit. Hedron sells each chair for $10 per unit.

- The estimated sales (in units) are as follows:

| Nov 2019 | 11,250 |

| Dec 2019 | 11,600 |

| Jan. 2020 | 10,000 |

| Feb. 2020 | 11,400 |

| Mar. 2020 | 12,000 |

| Apr. 2020 | 15,600 |

| May 2020 | 18,000 |

| June 2020 | 22,000 |

| July 2020 | 18,000 |

- Per an existing contract, the cost of each chair is scheduled to increase by 5% on March 1, 2020. In addition, because of increasing costs of plastic webbing, the cost is anticipated to increase by an additional 5% on May 1, 2020. To offset these increases, the company plans to raise the sales price to $11.25 per unit beginning May 1, 2020. The sales forecast (i.e., estimated sales in units) takes this price increase into account.

- Thirty percent of any months sales are for cash, and the remaining 70% are on credit. Thirty percent of the credit sales are collected in the month of sale, 50% are collected in the following month, and 16% are collected in the second month after the sale. The remaining receivables are deemed uncollectible. Bad debts are written off in the month the debt is deemed uncollectible (e.g. if the sale is made in January and is not collected by the end of March, it is written off in March.) No accrual for estimated bad debts is made in the month of sale.

- The firms policy regarding inventory is to stock (i.e. have in ending inventory) 40% of the forecasted demand in units (i.e., estimated sales) for the next month. Hedron uses the first-in, first-out (FIFO) method in accounting for inventories.

- Forty percent of the inventory purchases are paid for in the month of purchase and the remaining 60% are paid in the following month (i.e. all the previous months Accounts Payable are paid off by the end of any month.)

- Per a prior contract, a cash payment of $50,000 for equipment previously purchased is due in January. Another payment of $30,000 is due in February. Depreciation on the equipment previously purchased is included in the overhead cost detailed in item 11 below. Also, dividends of $12,000 are to be paid in March.

- Monthly operating expenses consist of the following (if these are cash expenses, they are paid when incurred):

| Salaries and Wages | $3,000 |

| Sales Commissions | 7% of sales revenue |

| Rent | $8,000 |

| Other Variable Cash Expenses | 6% of sales revenue |

| Supplies Expense: See note (1) | $2,000 |

| Other: See note (2) | $48,000 |

Note: 1. Hedron maintains, on hand, one months worth of supplies.

2. Other general and administrative overhead is expected to be $48,000 per month.

Of this amount, $24,000 represents depreciation and other non-cash expenses

- The company must maintain a minimum cash balance of $15,000. Borrowing can make up shortfalls. For simplicity, assume that the bank will only lend (and accept repayments) in $1,000 increments. Ignore interest on the loan in your calculations, but minimize the amount borrowed and pay off any loans as soon as possible.

- Cash on hand as of December 31, 2019 is expected to be $15,000. In addition, there will be no notes payable as of this date.

- See below the other Balance Sheet accounts with their balances as of December 31, 2019:

- Supplies..............................................$ 2,000

- Property, Plant and Equipment.......... 970,000

- Accumulated Depreciation................. 526,475

- Common Stock................................... 200,000

- Retained Earnings.............................. 322,811

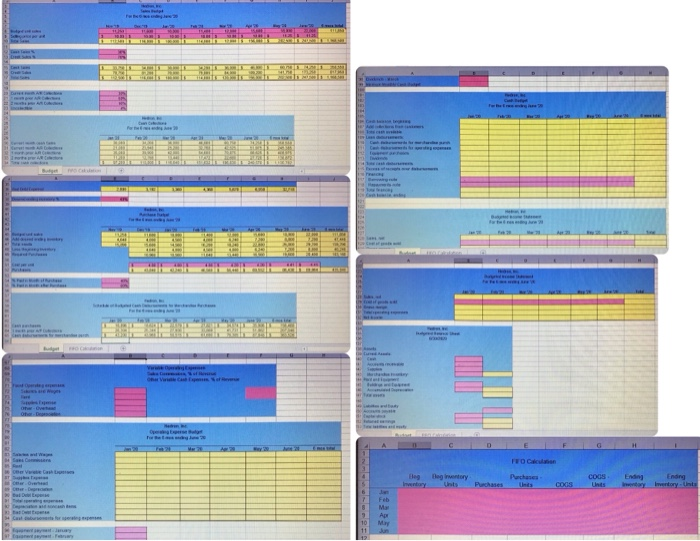

Cash Receipts Budget

Total Cash Receipts, January: $104,200

Total Cash Receipts, Jan June: $842,847

Uncollectible, January: $ 3,150

Uncollectible, Jan June: $ 20,118

Purchase Budget

Total Purchases, Jan June: $391,200

Cash Budget

Total Cash Disbursements, Jan June: $799,726

Ending Cash Balance, June: $ 58,121

Budgeted Income Statement

Operating Expenses, Total: $508,318

Net Income, Total: $ 56,234

Budgeted Balance Sheet

Total Assets: $621,023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started