Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve using equity accounting following GAAP? Please show your work. You may need to enlarge your browser's view (i.e., zoom in) to read the

Please solve using equity accounting following GAAP? Please show your work. You may need to enlarge your browser's view (i.e., zoom in) to read the smaller print.

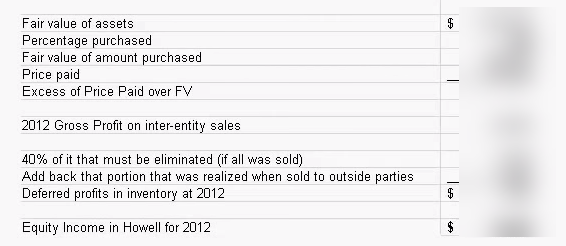

Here is a hint that shows the logic that must be followed. I've blurred the solutions so that you can work through this on your own.

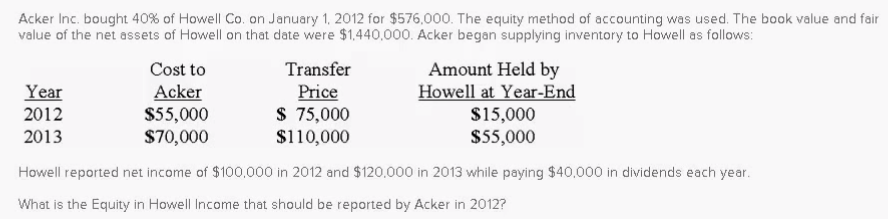

Acker Inc. bought 40% of Howell Co. on January 1, 2012 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1.440,000. Acker began supplying inventory to Howell as follows: Cost to Acker $55,000 $70,000 Transfer Price $ 75,000 $110,000 Amount Held by Year 2012 2013 Howell at Year-End $15,000 $55,000 Howell reported net income of $100,000 in 2012 and $120,000 in 2013 while paying $40,000 in dividends each year. What is the Equity in Howell Income that should be reported by Acker in 2012? Fair value of assets Percentage purchased Fair value of amount purchased Price paid Excess of Price Paid over FV 2012 Gross Profit on inter-entity sales 40% of it that must be eliminated (if all was sold) Add back that portion that was realized when sold to outside parties Deferred profits in inventory at 2012 Equity Income in Howell for 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started