Question

INFORMATION NEEDED TO ANSWER THE QUESTIONS: Russell and Amy Jones live in Oklahoma City, Oklahoma. Russell and Amy are married and they have a daughter,

INFORMATION NEEDED TO ANSWER THE QUESTIONS:

Russell and Amy Jones live in Oklahoma City, Oklahoma. Russell and Amy are married and they have a daughter, Sara. Sara lives with Russell and Amy and they provide all of her support. The familys address is 123 Sooner Way, Oklahoma City, OK 73102.

Name Date of birth Social Security #

Russell Jones 2/13/1991 123-45-6789

Amy Jones 4/1/1993 234-56-7890

Sara Jones 5/20/2017 345-67-8910

During 2020, Russells main source of income was his salary of $110,000 for his work as an Information Technology specialist. He also received a $10,000 bonus from his employer. Russells employer withheld $15,000 of federal income tax from his wages in 2020. Amy did not earn any income in 2020.

Russell and Amy reported the following cash expenditures in 2020:

- $5,400 primary residence mortgage interest -FROM AGI DEDUCTION

- $3,100 real estate taxes for primary residence-FROM AGI DEDUCTION

- $18,000 cost of groceries for the year

- $3,200 contribution to United Methodist Church-FROM AGI DEDUCTION

- $1,000 purchase of personal-use computer

- $2,900 Oklahoma state income tax-FROM AGI DEDUCTION

- $10,000 purchase of personal-use boat

Russell and Amy own a sizable portfolio of investments. The following transactions occurred during 2020.

| Item | Method of Acquisition | Date acquired | Original cost | Adjusted basis | Date of sale | Sales proceeds, net of commission |

| A Co. stock | Purchase | 5/12/2020 | $4,200 | $4,200 | 10/10/2020 | $3,000 |

| B Co. stock | Purchase | 3/20/2017 | $23,000 | $23,000 | 6/21/2020 | $10,000 |

| C Co. stock | Purchase | 2/1/2014 | $200,000 | $200,000 | 6/3/2020 | $202,000 |

Russell also owns a business that operates as a sole proprietorship. The business keeps its tax records according to the cash method. The sole proprietorship operates in an industry that is eligible for the QBI deduction. During 2020, Russells business recorded the following:

Cash received for services rendered $60,000

Cash received from sales of property (see below) $26,500

Depreciation expense $3,000 + ?

Cash expenditures:

Supplies $10,000

Salaries $21,000

The amount of depreciation expense for the assets that were sold in 2020 is $3,000. In addition, Russell owns two other business-use assets in addition to the warehouse he received in the like-kind exchange transaction. Additional information about Russells business use depreciable assets:

- Computer, purchased in 2018, original cost $2,000, half-year MACRS

- Furniture, purchased in 2020, original cost $8,000, half-year MACRS

Additional information on the business property sales:

| Item | Method of Acquisition | Date acquired | Original cost | Adjusted basis | Date of sale | Sales proceeds |

| Equipment | Purchase | 5/2/2020 | $12,000 | $7,500 | 8/1/2020 | $10,000 |

| Building | Purchase | 1/3/2020 | $120,000 | $120,000 | 7/22/2020 | Warehouse |

| Machine | Purchase | 1/20/2015 | $5,600 | $3,000 | 7/13/2020 | $9,000 |

| Land | Purchase | 2/3/2015 | $8,000 | $8,000 | 9/30/2020 | $7,500 |

- The building was sold to a local business in a transaction structured as a like-kind exchange. The buyer gave Russell a warehouse (FMV = $160,000, adjusted basis = $80,000) in exchange for Russells building (FMV = $160,000, adjusted basis $120,000).

Russell also received a Schedule K-1 from his ownership interest in Maverick, LLC (partnership). Russells outside basis in his partnership interest is $18,000 at the beginning of 2020. The Schedule K-1 reported the following information:

Ordinary income/(loss) ($10,500)

Interest income 600

Net short-term capital gain 8,100

Net long-term capital gain (0/15/20) 4,200

Cash distribution 2,000

QUESTIONS:

- Calculate the following items:

- Russell and Amys taxable income for 2020.

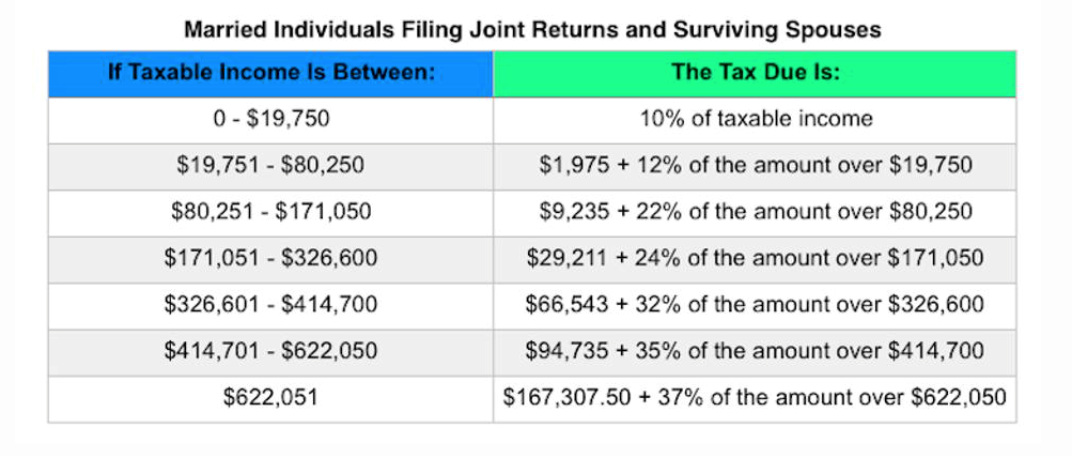

- Use the tax rate schedule to compute Russell and Amys tax for 2020. Do they owe additional tax or will they receive a refund?

- Russells outside basis in the partnership interest at the end of 2020.

- Submit the following tax forms :

- Form 1040

- Schedule 1

- Schedule C complete Parts I and II through line 31

- Schedule D complete Parts I, II and III through line 21

- Form 4797 complete Parts I, II, and III through line 32

- Form 8824 complete Parts I and III

If you have any questions please ask an actual question not just "???"

Married Individuals Filing Joint Returns and Surviving Spouses If Taxable income Is Between: The Tax Due is: 0 - $19,750 10% of taxable income $19,751 - $80,250 $1,975 + 12% of the amount over $19,750 $80,251 - $171,050 $9,235 + 22% of the amount over $80,250 $171,051 - $326,600 $29,211 + 24% of the amount over $171,050 $326,601 - $414,700 $66,543 + 32% of the amount over $326,600 $414,701 - $622,050 $94,735 + 35% of the amount over $414,700 $622,051 $167,307.50 + 37% of the amount over $622,050 Married Individuals Filing Joint Returns and Surviving Spouses If Taxable income Is Between: The Tax Due is: 0 - $19,750 10% of taxable income $19,751 - $80,250 $1,975 + 12% of the amount over $19,750 $80,251 - $171,050 $9,235 + 22% of the amount over $80,250 $171,051 - $326,600 $29,211 + 24% of the amount over $171,050 $326,601 - $414,700 $66,543 + 32% of the amount over $326,600 $414,701 - $622,050 $94,735 + 35% of the amount over $414,700 $622,051 $167,307.50 + 37% of the amount over $622,050Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started