Answered step by step

Verified Expert Solution

Question

1 Approved Answer

information not sure how to apply this, please explain December 31 The final pay period of the year will not be paid to employees until

information not sure how to apply this, please explain

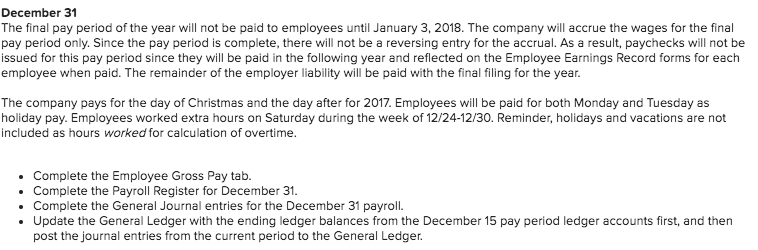

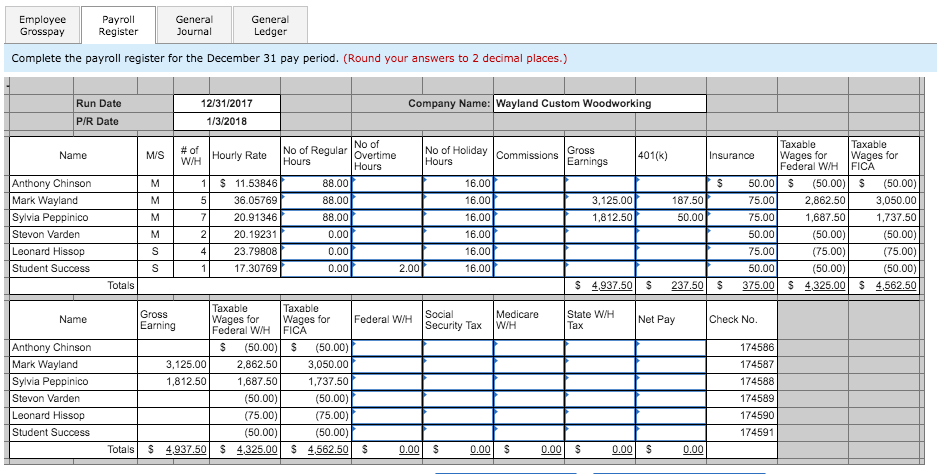

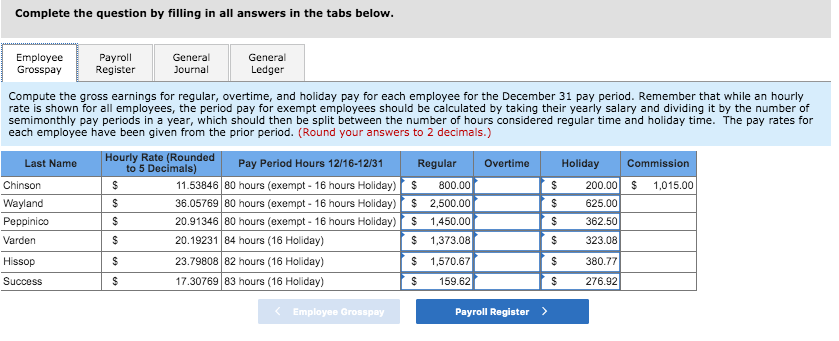

December 31 The final pay period of the year will not be paid to employees until January 3, 2018. The company will accrue the wages for the final pay period only. Since the pay period is complete, there will not be a reversing entry for the accrual. As a result, paychecks will not be issued for this pay period since they will be paid in the following year and reflected on the Employee Earnings Record forms for each employee when paid. The remainder of the employer liability will be paid with the final filing for the year. The company pays for the day of Christmas and the day after for 2017. Employees will be paid for both Monday and Tuesday as holiday pay. Employees worked extra hours on Saturday during the week of 12/24-12/30. Reminder, holidays and vacations are not included as hours worked for calculation of overtime. Complete the Employee Gross Pay tab Complete the Payroll Register for December 31. Complete the General Journal entries for the December 31 payroll. Update the General Ledger with the ending ledger balances from the December 15 pay period ledger accounts first, and then post the journal entries from the current period to the General Ledger. General Journal General Ledger Payroll Register Employee Grosspay Complete the payroll register for the December 31 pay period. (Round your answers to 2 decimal places.) Company Name: Wayland Custom Woodworking Run Date 12/31/2017 P/R Date 1/3/2018 No of able Wages for Federal W/H Taxable Wages for FICA Gross No of Holiday Commissions Earnings INo of RegularOvertime Hours # of WH Hourly Rate Name M/S 401(k) Insurance Hours Hours Anthony Chinson Mark Wayland S 11.53846 S M 88,00 16.00 50,00 (50.00) (50.00) 88.00 5 36.05769 16.00 3,125.00 187.50 75.00 2,862.50 3,050.00 Sylvia Peppinico Stevon Varden Leonard Hissop 88.00 M 7 20.91346 16.00 1,812.50 50.00 75.00 1,687.50 1,737.50 M 2 20.19231 0.00 16.00 50.00 (50.00) (50.00) (75.00) S 4 23.79808 0.00 16.00 75.00 (75.00) Student Success S 1 17.30769 0.00 2.00 16.00 50.00 (50.00) (50.00) S 4,937.50 237.50 S 4,325.00 $ 4,562.50 Totals S 375,00 Taxable Wages for Federal W/H Taxable Wages for FICA Gross Earning State W/H Medicare WH Social Federal WH Net Pay Name Check No. Security Tax Anthony Chinson Mark Wayland (50.00) S (50.00) 174586 3,125.00 2,862.50 3,050.00 174587 Sylvia Peppinico Stevon Varden 1,812.50 1,687.50 1,737.50 174588 (50.00) (50.00) 174589 Leonard Hissop (75.00) (75.00) 174590 (50.00) $ 4,325.00 (50.00) Student Success 174591 $ 4,937.50 Totals 4,562.50 S 0.00 S 0.00 $ 0.00 S 0.00 $ 0.00 Complete the question by filling in all answers in the tabs below. Payroll Register Employee Grosspay General General Journal Ledger Compute the gross earnings for regular, overtime, and holiday pay for each employee for the December 31 pay period. Remember that while an hourly rate is shown for all employees, the period pay for exempt employees should be calculated by taking their yearly salary and dividing it by the number of semimonthly pay periods in a year, which should then be split between the number of hours considered regular time and holiday time. The pay rates for each employee have been given from the prior period. (Round your answers to 2 decimals.) Hourly Rate (Rounded to 5 Decimals) Last Name Pay Period Hours 12/16-12/31 Regular Overtime Holiday Commission 11.53846 80 hours (exempt-16 hours Holiday) Chinson 800.00 200.00 1,015.00 36.05769 80 hours (exempt 16 hours Holiday) Wayland S S 2,500,00 S 625.00 20.91346 80 hours (exempt 16 hours Holiday) Peppinico S S 1,450.00 S 362.50 20.19231 84 hours (16 Holiday) 323.08 Varden 1,373.08 S 23.79808 82 hours (16 Holiday) Hissop 1,570.67 380.77 17.30769 83 hours (16 Holiday) 276.92 Success S 159.62 Payroll Register> Employee Grosspay December 31 The final pay period of the year will not be paid to employees until January 3, 2018. The company will accrue the wages for the final pay period only. Since the pay period is complete, there will not be a reversing entry for the accrual. As a result, paychecks will not be issued for this pay period since they will be paid in the following year and reflected on the Employee Earnings Record forms for each employee when paid. The remainder of the employer liability will be paid with the final filing for the year. The company pays for the day of Christmas and the day after for 2017. Employees will be paid for both Monday and Tuesday as holiday pay. Employees worked extra hours on Saturday during the week of 12/24-12/30. Reminder, holidays and vacations are not included as hours worked for calculation of overtime. Complete the Employee Gross Pay tab Complete the Payroll Register for December 31. Complete the General Journal entries for the December 31 payroll. Update the General Ledger with the ending ledger balances from the December 15 pay period ledger accounts first, and then post the journal entries from the current period to the General Ledger. General Journal General Ledger Payroll Register Employee Grosspay Complete the payroll register for the December 31 pay period. (Round your answers to 2 decimal places.) Company Name: Wayland Custom Woodworking Run Date 12/31/2017 P/R Date 1/3/2018 No of able Wages for Federal W/H Taxable Wages for FICA Gross No of Holiday Commissions Earnings INo of RegularOvertime Hours # of WH Hourly Rate Name M/S 401(k) Insurance Hours Hours Anthony Chinson Mark Wayland S 11.53846 S M 88,00 16.00 50,00 (50.00) (50.00) 88.00 5 36.05769 16.00 3,125.00 187.50 75.00 2,862.50 3,050.00 Sylvia Peppinico Stevon Varden Leonard Hissop 88.00 M 7 20.91346 16.00 1,812.50 50.00 75.00 1,687.50 1,737.50 M 2 20.19231 0.00 16.00 50.00 (50.00) (50.00) (75.00) S 4 23.79808 0.00 16.00 75.00 (75.00) Student Success S 1 17.30769 0.00 2.00 16.00 50.00 (50.00) (50.00) S 4,937.50 237.50 S 4,325.00 $ 4,562.50 Totals S 375,00 Taxable Wages for Federal W/H Taxable Wages for FICA Gross Earning State W/H Medicare WH Social Federal WH Net Pay Name Check No. Security Tax Anthony Chinson Mark Wayland (50.00) S (50.00) 174586 3,125.00 2,862.50 3,050.00 174587 Sylvia Peppinico Stevon Varden 1,812.50 1,687.50 1,737.50 174588 (50.00) (50.00) 174589 Leonard Hissop (75.00) (75.00) 174590 (50.00) $ 4,325.00 (50.00) Student Success 174591 $ 4,937.50 Totals 4,562.50 S 0.00 S 0.00 $ 0.00 S 0.00 $ 0.00 Complete the question by filling in all answers in the tabs below. Payroll Register Employee Grosspay General General Journal Ledger Compute the gross earnings for regular, overtime, and holiday pay for each employee for the December 31 pay period. Remember that while an hourly rate is shown for all employees, the period pay for exempt employees should be calculated by taking their yearly salary and dividing it by the number of semimonthly pay periods in a year, which should then be split between the number of hours considered regular time and holiday time. The pay rates for each employee have been given from the prior period. (Round your answers to 2 decimals.) Hourly Rate (Rounded to 5 Decimals) Last Name Pay Period Hours 12/16-12/31 Regular Overtime Holiday Commission 11.53846 80 hours (exempt-16 hours Holiday) Chinson 800.00 200.00 1,015.00 36.05769 80 hours (exempt 16 hours Holiday) Wayland S S 2,500,00 S 625.00 20.91346 80 hours (exempt 16 hours Holiday) Peppinico S S 1,450.00 S 362.50 20.19231 84 hours (16 Holiday) 323.08 Varden 1,373.08 S 23.79808 82 hours (16 Holiday) Hissop 1,570.67 380.77 17.30769 83 hours (16 Holiday) 276.92 Success S 159.62 Payroll Register> Employee Grosspay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started