Answered step by step

Verified Expert Solution

Question

1 Approved Answer

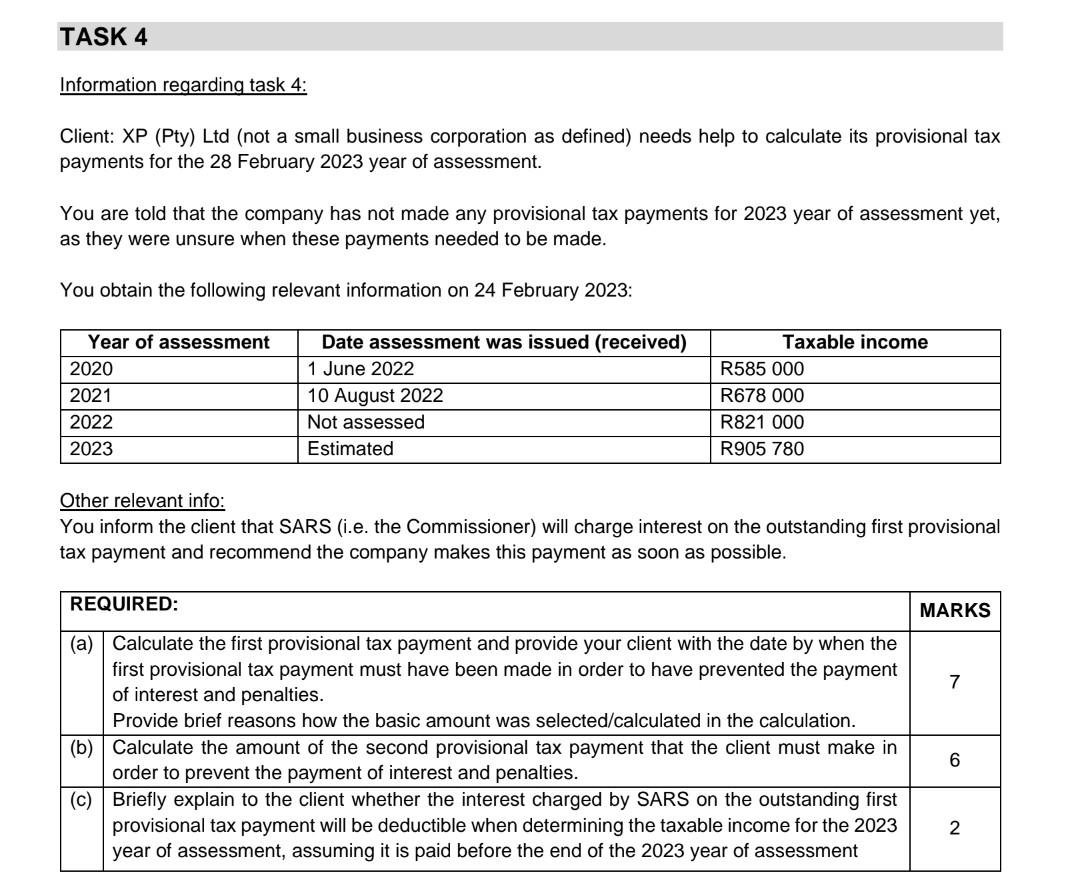

Information regarding task 4: Client: XP (Pty) Ltd (not a small business corporation as defined) needs help to calculate its provisional tax payments for the

Information regarding task 4: Client: XP (Pty) Ltd (not a small business corporation as defined) needs help to calculate its provisional tax payments for the 28 February 2023 year of assessment. You are told that the company has not made any provisional tax payments for 2023 year of assessment yet, as they were unsure when these payments needed to be made. You obtain the following relevant information on 24 February 2023 : Other relevant info: You inform the client that SARS (i.e. the Commissioner) will charge interest on the outstanding first provisional tax payment and recommend the company makes this payment as soon as possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started