Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information related to Swifty Co. is presented below. 1. On April 5, purchased merchandise on account from Larkspur Company for $28,600, terms 3/10, net/30, FOB

Information related to Swifty Co. is presented below.

| 1. | On April 5, purchased merchandise on account from Larkspur Company for $28,600, terms 3/10, net/30, FOB shipping point. | |

| 2. | On April 6, paid freight costs of $820 on merchandise purchased from Larkspur. | |

| 3. | On April 7, purchased equipment on account for $29,200. | |

| 4. | On April 8, returned $4,100 of merchandise to Larkspur Company. | |

| 5. | On April 15, paid the amount due to Larkspur Company in full. |

Question:

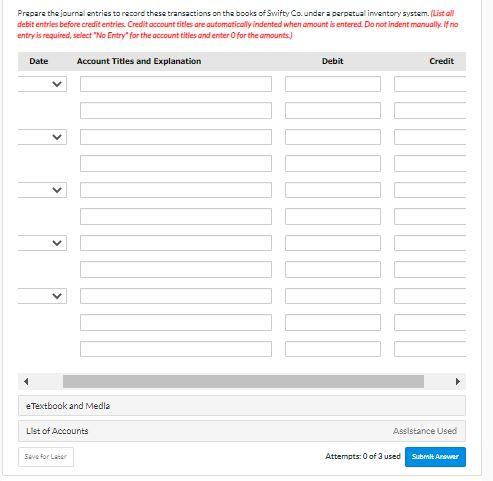

Prepare the journal entries to record these transactions on the books of Swifty Co. under a perpetual inventory system. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Summary Words:

- Accounts Payable

- Accounts Receivable

- Accumulated Depreciation-Buildings

- Accumulated Depreciation-Equipment

- Advertising Expense

- Buildings

- Cash

- Casuality Loss from Vandalism

- Cost of Goods Sold

- Depreciation Expense

- Dividend Revenue

- Equipment

- Freight-In

- Freight-Out

- Income Summary

- Insurance Expense

- Interest Expense

- Interest Payable

- Interest Revenue

- Inventory

- Land

- Loss on Disposal of Plant Assets

- Maintenance and Repairs Expense

- Notes Payable

- Operating Expenses

- Owner's Capital

- Owner's Drawings

- Prepaid Insurance

- Property Tax Expense

- Property Taxes Payable

- Purchase Discounts

- Purchase Returns and Allowances

- Purchases

- Rent Expense

- Salaries and Wages Expense

- Salaries and Wages Payable

- Sales Commissions Expense

- Sales Commissions Payable

- Sales Discounts

- Sales Returns and Allowances

- Sales Revenue

- Supplies

- Supplies Expense

- Unearned Service Revenue

- Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started