Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER: 43 000 shares kindly check my answer!!! ABC Corporation was authorized to issue 100,000 ordinary shares at P50 par value. The corporation sold the

ANSWER: 43 000 shares

kindly check my answer!!!

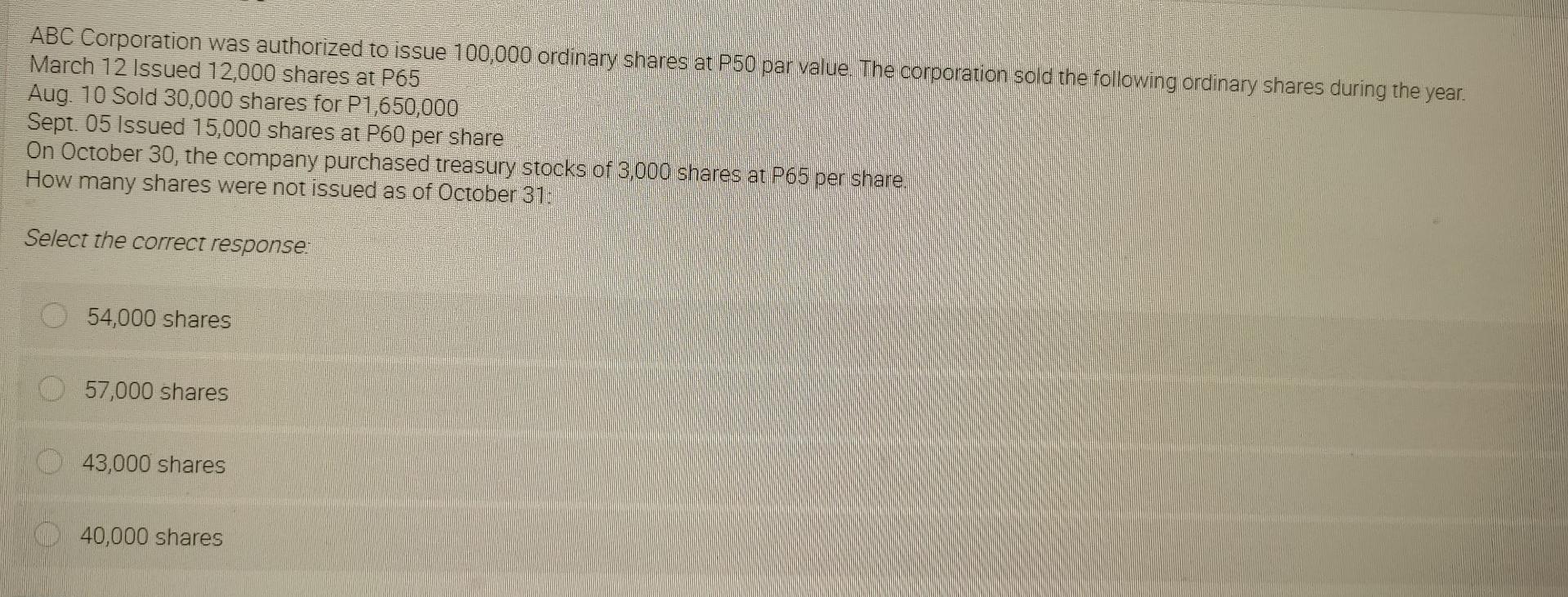

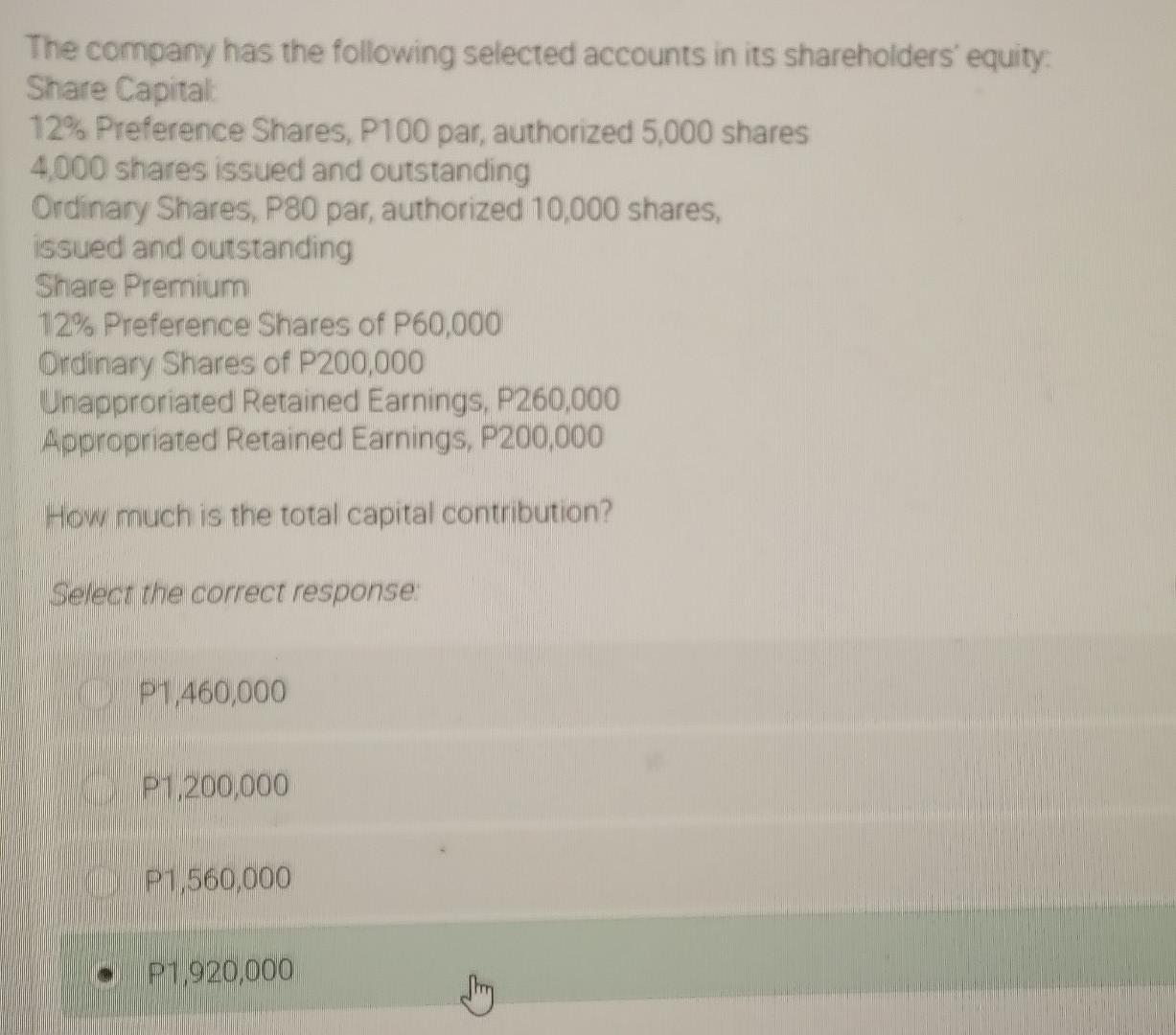

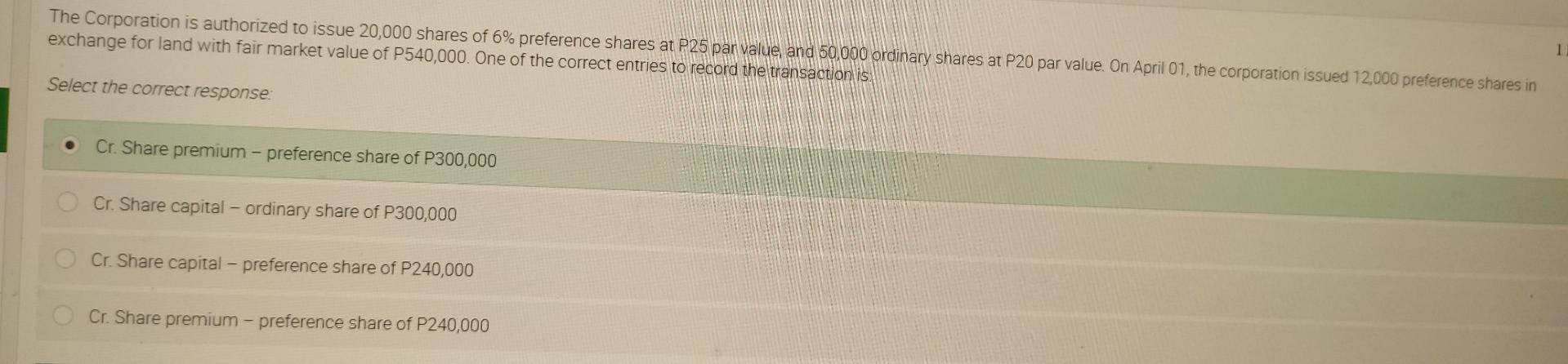

ABC Corporation was authorized to issue 100,000 ordinary shares at P50 par value. The corporation sold the following ordinary shares during the year. March 12 Issued 12,000 shares at P65 Aug. 10 Sold 30,000 shares for P1,650,000 Sept. 05 Issued 15,000 shares at P60 per share On October 30, the company purchased treasury stocks of 3,000 shares at P65 per share. How many shares were not issued as of October 31: Select the correct response 54,000 shares 57,000 shares 43,000 shares 40,000 shares The company has the following selected accounts in its shareholders' equity Share Capital 12% Preference Shares, P100 par, authorized 5,000 shares 4,000 shares issued and outstanding Ordinary Shares, P80 par, authorized 10,000 shares, issued and outstanding Share Premium 12% Preference Shares of P60,000 Ordinary Shares of P200,000 Unapproriated Retained Earnings, P260,000 Appropriated Retained Earnings, P200,000 How much is the total capital contribution? Select the correct response P1,460,000 P1,200,000 P1,560,000 P1,920,000 ny The Corporation is authorized to issue 20,000 shares of 6% preference shares at P25 par value and 50,000 ordinary shares at P20 par value. On April 01, the corporation issued 12,000 preference shares in exchange for land with fair market value of P540,000. One of the correct entries to record the transaction is. 1 Select the correct response Cr. Share premium - preference share of P300,000 Cr. Share capital - ordinary share of P300,000 Cr. Share capital - preference share of P240,000 Cr. Share premium - preference share of P240,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started