Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inheritance received upon death U1 au Jackson (a cousin) repaid a loan Aiden made to him in 2012 (no interest was provided for) Itemized deductions

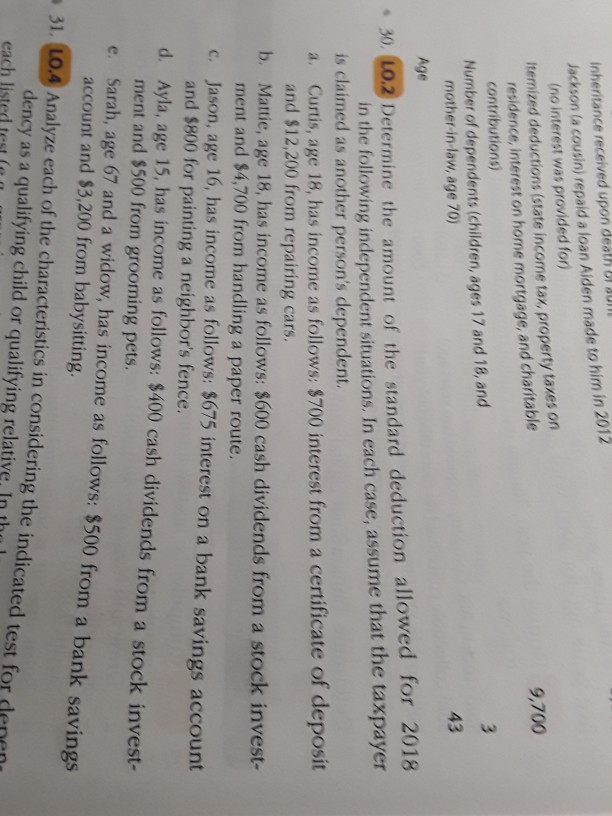

Inheritance received upon death U1 au Jackson (a cousin) repaid a loan Aiden made to him in 2012 (no interest was provided for) Itemized deductions (state income tax, property taxes on 9,700 residence, interest on home mortgage, and charitable contributions) Number of dependents (children, ages 17 and 18, and mother-in-law, age 70) 43 Age 30. LO.2 Determine the amount of the standard deduction allowed for 2018 in the following independent situations. In each case, assume that the taxpayer a. Curtis, age 18, has income as follows: $700 interest from a certificate of deposit b. Mattie, age 18, has income as follows: $600 cash dividends from a stock invest- c. Jason, age 16, has income as follows: $675 interest on a bank savings account d. Ayla, age 15, has income as follows: $400 cash dividends from a stock invest- Sarah, age 67 and a widow, has income as follows: $500 from a bank savings 31. LO.4 Analyze each of the characteristics in considering the indicated test for denern is claimed as another person's dependent. and $12,200 from repairing cars. ment and $4,700 from handling a paper route. and $800 for painting a neighbor's fence ment and $500 from grooming pets. account and $3,200 from babysitting. e. dency as a qualifying child or qualifying relative, In tha l each listed test (e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started