Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ini of the deduction and whether it is for or from AGI for the following situations M's hoat is a 5Q fort yacht, und he

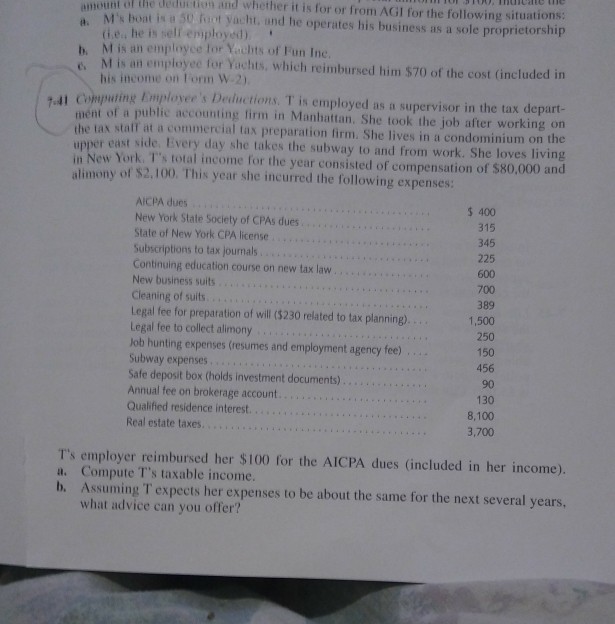

ini of the deduction and whether it is for or from AGI for the following situations M's hoat is a 5Q fort yacht, und he operates his business as a sole proprietorship G.e, he is self employed) M is an employce for Yachts of Fun Ine M is an employee for Yachts, which reimbursed him $70 of the cost (included in his income on Fornm W-2) uting Employee's Deductions. T is employed as a supervisor in the tax depart- t of a public accounting firm in Manbattan. She took the job after working on tax stalf at a commercial tax preparation firm. She lives in a condominium on the amou b. at Comp the per east side. Every day she takes the subway to and from work. She loves living ew York. T's total income for the year consisted of compensation of $80,000 and limony of $2.100. This year she incurred the following expenses: AICPA dues New York State Society of CPAs dues State of New York CPA license Subscriptions to tax journals Continuing education course on new tax law New business suits Cleaning of suits Legal fee for preparation of will ($230 related to tax planning). Legal fee to collect alimony Job hunting expenses (resumes and employment agency fee) Subway expenses Safe deposit box (holds investment documents) Annual fee on brokerage account... Qualified residence interest. Real estate taxes. $ 400 315 345 225 600 700 389 1,500 250 150 456 90 130 8,100 3,700 T's employer reimbursed her $100 for the AICPA dues (included in her income). a. Compute T's taxable income. b. Assuming T expects her expenses to be about the same for the next several years, what advice can you offer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started