Answered step by step

Verified Expert Solution

Question

1 Approved Answer

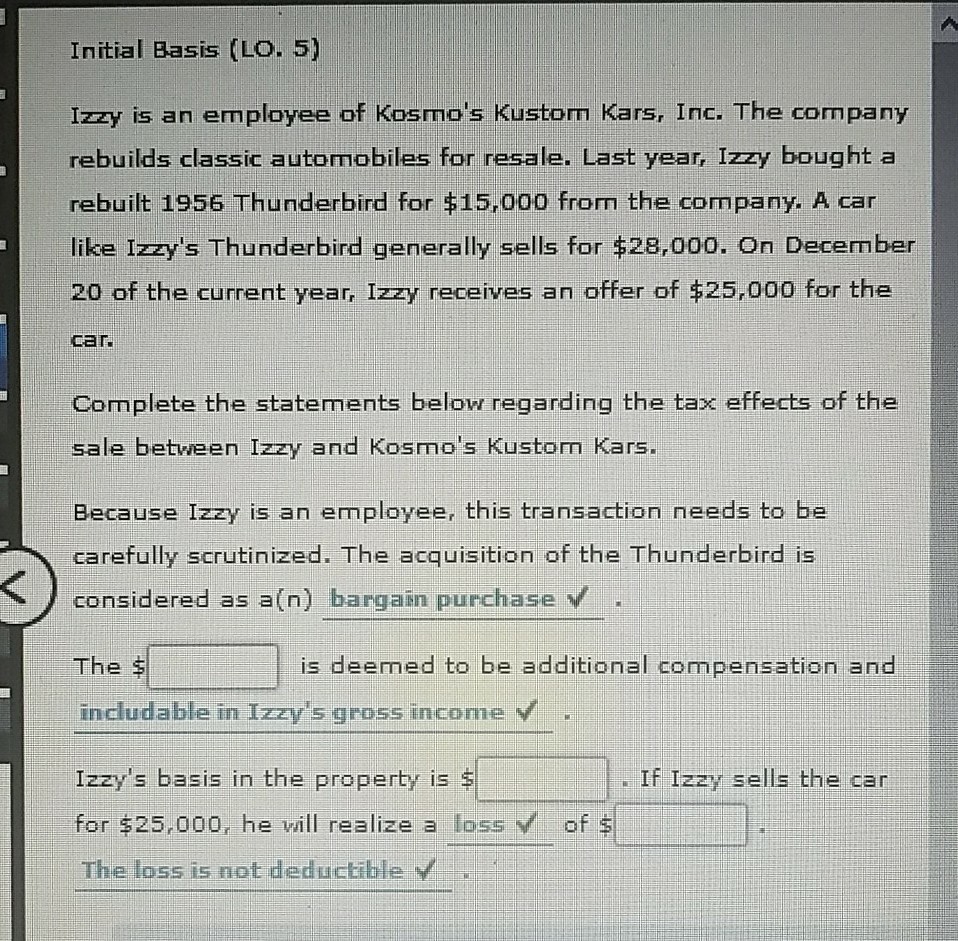

Initial Basis (LO. 5) Izzy is an employee of Kosmo's Kustom Kars, Inc. The company rebuilds classic automobiles for resale. Last year, Izzy bought a

Initial Basis (LO. 5) Izzy is an employee of Kosmo's Kustom Kars, Inc. The company rebuilds classic automobiles for resale. Last year, Izzy bought a rebuilt 1956 Thunderbird for $15,000 from the company. A car like Izzy's Thunderbird generally sells for $28,000. On Dece ber 20 of the current year, Izzy receives an ffer of $25,000 for the car Complete the statements below regarding the tax effects of the sale between Izzy and Kosmo's Kustom Kars. Because Izzy is an employee, this transaction needs to be carefully scrutinized. The acquisition of the Thunderbird is considered as a(n) bargain purchase v The $ is deemed to be additional compensation and includable in Izzy's gross income v If Izzy sells the can Izzy's basis in the property is $ for $25,000, he vill realize a loss V of $ The loss is not deductible v

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started