Answered step by step

Verified Expert Solution

Question

1 Approved Answer

variable costs unusual costs UESTION 6 Costs that vary in total dollar amount as the level of activity changes are called what? variable costs faxed

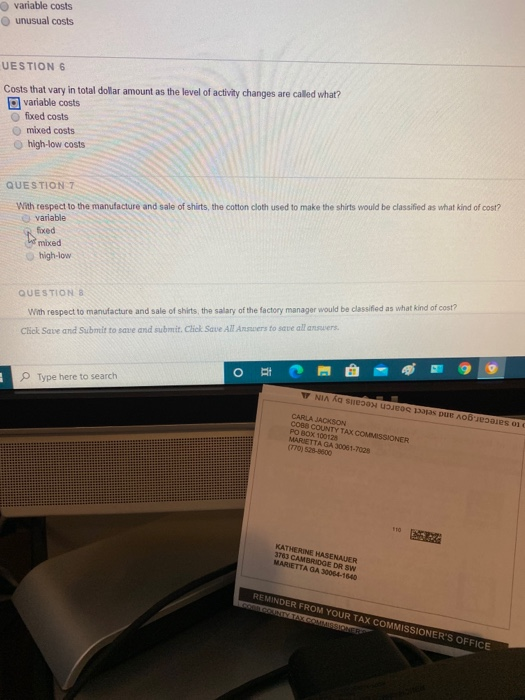

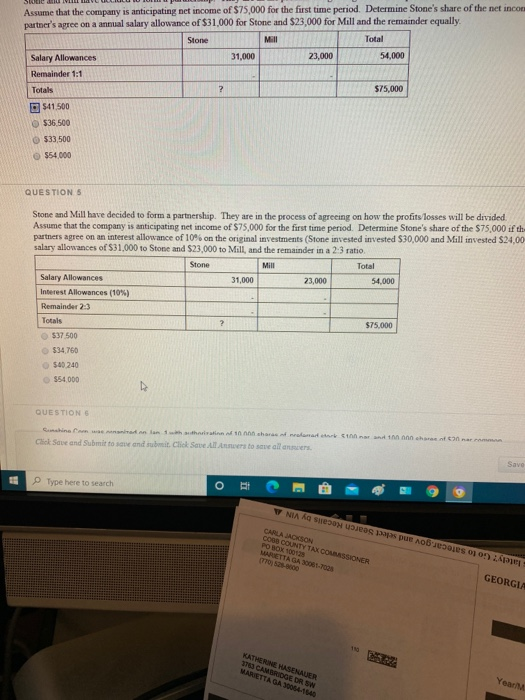

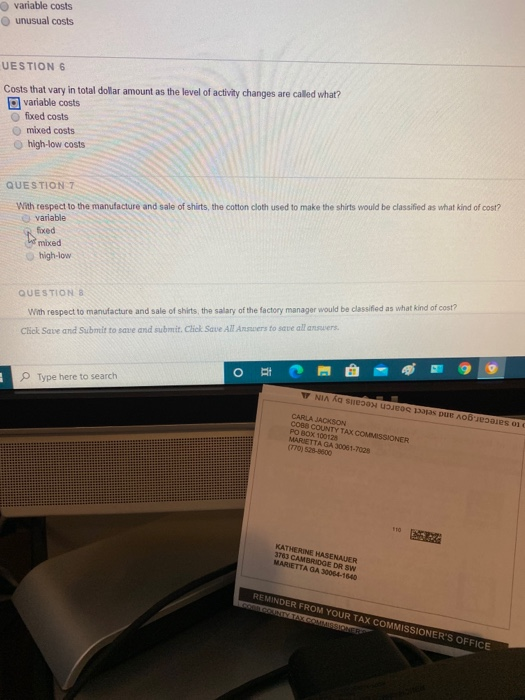

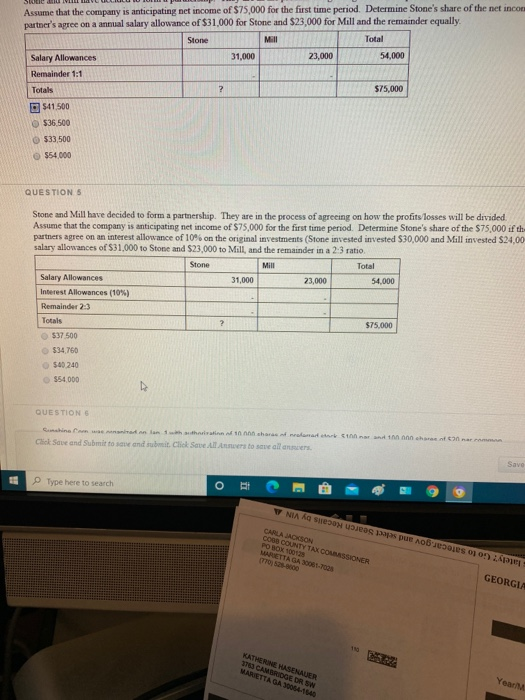

variable costs unusual costs UESTION 6 Costs that vary in total dollar amount as the level of activity changes are called what? variable costs faxed costs mixed costs high-low costs QUESTION 7 With respect to the manufacture and sale of shirts, the cotton cloth used to make the shirts would be classified as what kind of cost? variable foxed mixed high-low QUESTION 8 With respect to manufacture and sale of shirts, the salary of the factory manager would be classified as what kind of cost? Click Save and Submit to save and submit. Click Save All Answers to save all answers. Type here to search Y NIA ka Sueon U S Dapas pue no es o CARLA JACKSON COBB COUNTY TAX COMMISSIONER PO BOX 100128 MARIETTA GA 30061-7008 (770) 5230 KATHERINE HASENAUER 3703 CAMBRIDGE DR SW MARIETTA GA 30054-1640 REMINDER FROM YOUR TAX COMMISSIONER'S OFFICE Stone Assume that the company is anticipating net income of $75,000 for the first time period. Determine Stone's share of the net incon partner's apree on a annual salary allowance of $31,000 for Stone and $23,000 for Mill and the remainder equally Total Salary Allowances 31,000 23,000 54,000 Remainder 1:1 Totals $75,000 541 500 536,500 $33,500 $54.000 QUESTION 5 Stone and Mill have decided to form a partnership. They are in the process of agreeing on how the profits losses will be divided Assume that the company is anticipating net income of $75,000 for the first time period. Determine Stone's share of the $75,000 if th partners agree on an interest allowance of 10% on the original investments (Stone invested invested $30,000 and Mill invested $24,00 salary allowances of $31,000 to Stone and $23,000 to Mill, and the remainder in a 2-3 ratio. Stone Mill Total Salary Allowances | 31,000 23,000 54.000 Interest Allowances (10%) Remainder 2:3 Totals $75.000 537.500 $34.750 545240 $54.000 QUESTIONS China Caw an lant ain shamokomast Click Save and Submit to save and submit. Click Save All A wers to save all answers inn Type here to search W NIA KG SW50 bees mapes pue nobis 009: GEORGIA CARLA JACKSON COBB COUNTY TAX COWASSIONER PO BOX 100128 MARIETTA GA 30061-7000 KATHERINE HASENMUER 7 CAMBRIDGE DR SW MARIETTA GA 300641546 Year

variable costs unusual costs UESTION 6 Costs that vary in total dollar amount as the level of activity changes are called what? variable costs faxed costs mixed costs high-low costs QUESTION 7 With respect to the manufacture and sale of shirts, the cotton cloth used to make the shirts would be classified as what kind of cost? variable foxed mixed high-low QUESTION 8 With respect to manufacture and sale of shirts, the salary of the factory manager would be classified as what kind of cost? Click Save and Submit to save and submit. Click Save All Answers to save all answers. Type here to search Y NIA ka Sueon U S Dapas pue no es o CARLA JACKSON COBB COUNTY TAX COMMISSIONER PO BOX 100128 MARIETTA GA 30061-7008 (770) 5230 KATHERINE HASENAUER 3703 CAMBRIDGE DR SW MARIETTA GA 30054-1640 REMINDER FROM YOUR TAX COMMISSIONER'S OFFICE Stone Assume that the company is anticipating net income of $75,000 for the first time period. Determine Stone's share of the net incon partner's apree on a annual salary allowance of $31,000 for Stone and $23,000 for Mill and the remainder equally Total Salary Allowances 31,000 23,000 54,000 Remainder 1:1 Totals $75,000 541 500 536,500 $33,500 $54.000 QUESTION 5 Stone and Mill have decided to form a partnership. They are in the process of agreeing on how the profits losses will be divided Assume that the company is anticipating net income of $75,000 for the first time period. Determine Stone's share of the $75,000 if th partners agree on an interest allowance of 10% on the original investments (Stone invested invested $30,000 and Mill invested $24,00 salary allowances of $31,000 to Stone and $23,000 to Mill, and the remainder in a 2-3 ratio. Stone Mill Total Salary Allowances | 31,000 23,000 54.000 Interest Allowances (10%) Remainder 2:3 Totals $75.000 537.500 $34.750 545240 $54.000 QUESTIONS China Caw an lant ain shamokomast Click Save and Submit to save and submit. Click Save All A wers to save all answers inn Type here to search W NIA KG SW50 bees mapes pue nobis 009: GEORGIA CARLA JACKSON COBB COUNTY TAX COWASSIONER PO BOX 100128 MARIETTA GA 30061-7000 KATHERINE HASENMUER 7 CAMBRIDGE DR SW MARIETTA GA 300641546 Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started