Answered step by step

Verified Expert Solution

Question

1 Approved Answer

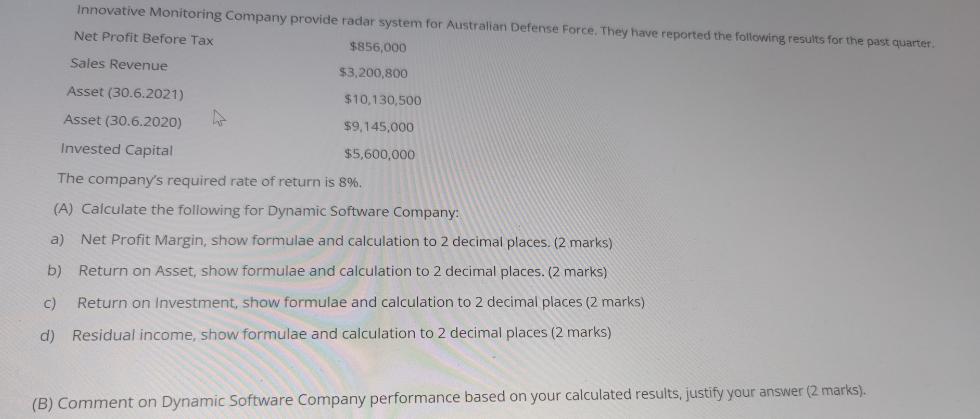

Innovative Monitoring Company provide radar system for Australian Defense Force. They have reported the following results for the past quarter. Net Profit Before Tax

Innovative Monitoring Company provide radar system for Australian Defense Force. They have reported the following results for the past quarter. Net Profit Before Tax Sales Revenue Asset (30.6.2021) Asset (30.6.2020) 4 Invested Capital $856,000 $3,200,800 $10,130,500 $9,145,000 $5,600,000 The company's required rate of return is 8%. (A) Calculate the following for Dynamic Software Company: a) Net Profit Margin, show formulae and calculation to 2 decimal places. (2 marks) b) Return on Asset, show formulae and calculation to 2 decimal places. (2 marks) (C) Return on Investment, show formulae and calculation to 2 decimal places (2 marks) d) Residual income, show formulae and calculation to 2 decimal places (2 marks) (B) Comment on Dynamic Software Company performance based on your calculated results, justify your answer (2 marks).

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A Lets calculate the requested financial performance metrics for Innovative Monitoring Company a Net Profit Margin Net Profit Margin is the ratio of n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started