Answered step by step

Verified Expert Solution

Question

1 Approved Answer

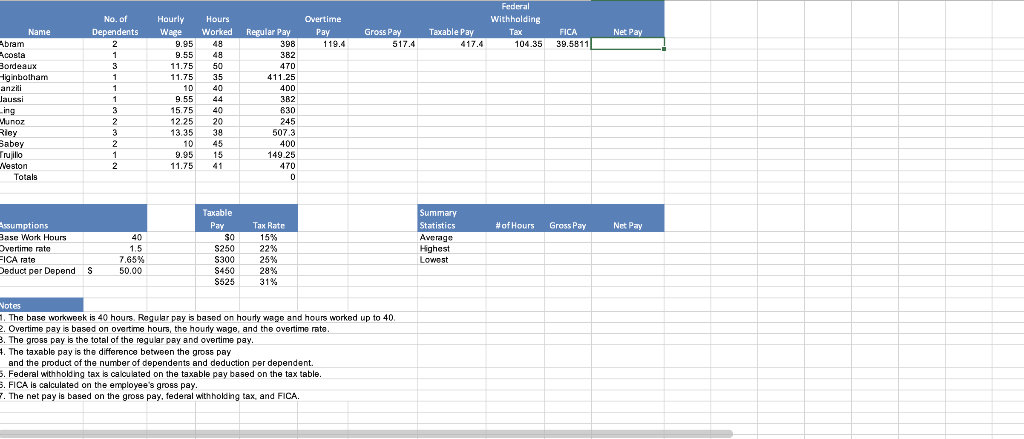

Insert appropriate functions to calculate the average, highest, and lowest values in the Summary Statistics area (the range I21:K23) of the worksheet. Format the #

| Insert appropriate functions to calculate the average, highest, and lowest values in the Summary Statistics area (the range I21:K23) of the worksheet. Format the # of hours calculations as Number format with one decimal and the remaining calculations with Accounting number format. |

1. The base workweek is 40 hours. Regular pay is based on houny wage and hours worked up to 40 . 2. Overtime pay is based on overtime hours, the hounly wage, and the overtime rate. 3. The gross pay is the total of the regular pay and overtime pay. 4. The taxable pay is the difference between the gross pay and the product of the number of dependents and deduction per dependent. Federal withholdhig tex is calculated on the taxable pay based on the tax table. 5. FICA is calculated on the employee's gross pay. 7. The net pay is based on the gross pay, federal withholding tax, and FICA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started