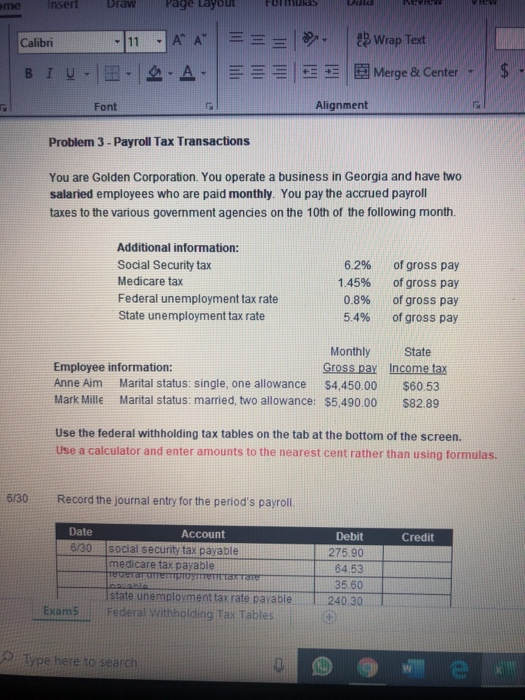

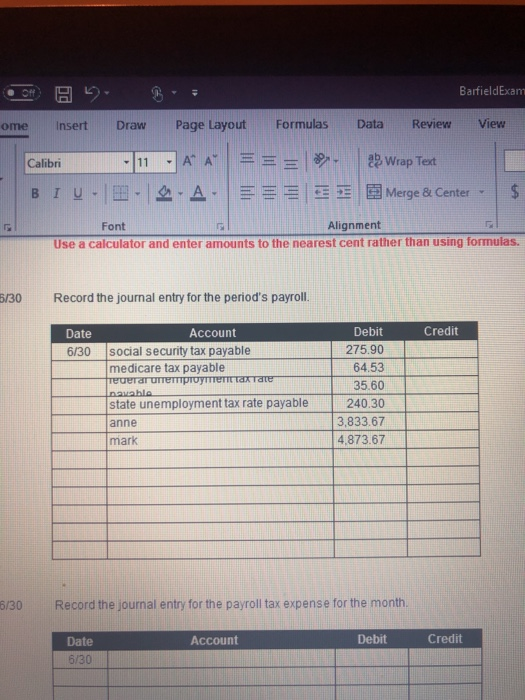

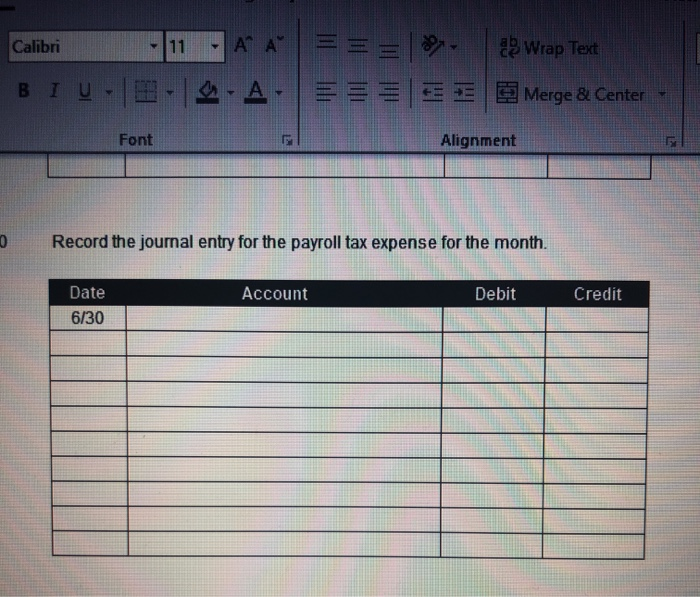

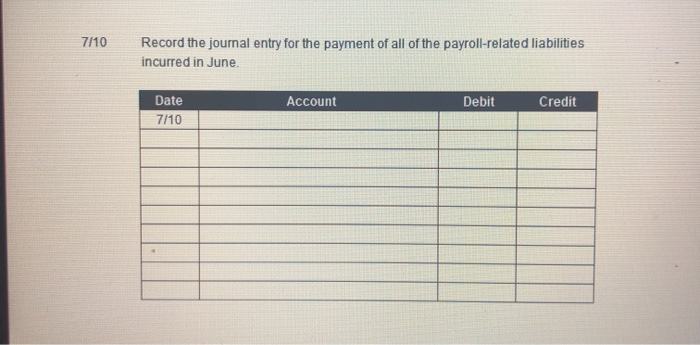

Insert Draw Page LayouT Lald INevie me = == - Wrap Text A A 11 Calibri A-E3 E Merge & Center BIU Alignment Font Problem 3- Payroll Tax Transactions You are Golden Corporation. You operate a business in Georgia and have two salaried employees who are paid monthly. You pay the accrued payroll taxes to the various government agencies on the 10th of the following month. Additional information: Social Security tax 6.2% of gross pay Medicare tax of gross pay 1.45% Federal unemployment tax rate 0.8% of gross pay State unemployment tax rate 5.4% of gross pay Monthly State Employee information: Gross pay Income tax Anne Aim Marital status: single, one allowance $4,450,00 $60.53 Mark Mille Marital status: married, two allowance: $5,490.00 $82.89 Use the federal withholding tax tables on the tab at the bottom of the screen. Use a calculator and enter amounts to the nearest cent rather than using formulas Record the journal entry for the period's payroll. 6/30 Date Account Debit Credit 6/30 Social security tax payable medicare tax pavable TroUraromemproymerTraxTarer 275.90 64.53 35.60 Istate unemplovment taxrate pavable 240.30 Exam5 Federal Withholding Tax Tables Oype here to search BarfieldExam Off Review View Page Layout Formulas Data Insert Draw ome Wrap Text 11 Calibri A B IU E E EE E Merge & Center $ Alignment Font Use a calculator and enter amounts to the nearest cent rather than using formulas. 5/30 Record the journal entry for the period's payroll. Debit Credit Account Date 275.90 social security tax payable medicare tax payable TeuerarureTTpToyent taxTate 6/30 64.53 35.60 navable state unemployment tax rate payable 240.30 anne 3,833.67 mark 4,873.67 Record the journal entry for the payroll tax expense for the month. 6/30 Debit Credit Account Date 6/30 A A Calibri Wrap Text 11 u-A B IU E Merge & Center Font Alignment Record the journal entry for the payroll tax expense for the month. Date Account Debit Credit 6/30 7/10 Record the journal entry for the payment of all of the payroll-related liabilities incurred in June. Date Account Debit Credit 7/10 Insert Draw Page LayouT Lald INevie me = == - Wrap Text A A 11 Calibri A-E3 E Merge & Center BIU Alignment Font Problem 3- Payroll Tax Transactions You are Golden Corporation. You operate a business in Georgia and have two salaried employees who are paid monthly. You pay the accrued payroll taxes to the various government agencies on the 10th of the following month. Additional information: Social Security tax 6.2% of gross pay Medicare tax of gross pay 1.45% Federal unemployment tax rate 0.8% of gross pay State unemployment tax rate 5.4% of gross pay Monthly State Employee information: Gross pay Income tax Anne Aim Marital status: single, one allowance $4,450,00 $60.53 Mark Mille Marital status: married, two allowance: $5,490.00 $82.89 Use the federal withholding tax tables on the tab at the bottom of the screen. Use a calculator and enter amounts to the nearest cent rather than using formulas Record the journal entry for the period's payroll. 6/30 Date Account Debit Credit 6/30 Social security tax payable medicare tax pavable TroUraromemproymerTraxTarer 275.90 64.53 35.60 Istate unemplovment taxrate pavable 240.30 Exam5 Federal Withholding Tax Tables Oype here to search BarfieldExam Off Review View Page Layout Formulas Data Insert Draw ome Wrap Text 11 Calibri A B IU E E EE E Merge & Center $ Alignment Font Use a calculator and enter amounts to the nearest cent rather than using formulas. 5/30 Record the journal entry for the period's payroll. Debit Credit Account Date 275.90 social security tax payable medicare tax payable TeuerarureTTpToyent taxTate 6/30 64.53 35.60 navable state unemployment tax rate payable 240.30 anne 3,833.67 mark 4,873.67 Record the journal entry for the payroll tax expense for the month. 6/30 Debit Credit Account Date 6/30 A A Calibri Wrap Text 11 u-A B IU E Merge & Center Font Alignment Record the journal entry for the payroll tax expense for the month. Date Account Debit Credit 6/30 7/10 Record the journal entry for the payment of all of the payroll-related liabilities incurred in June. Date Account Debit Credit 7/10