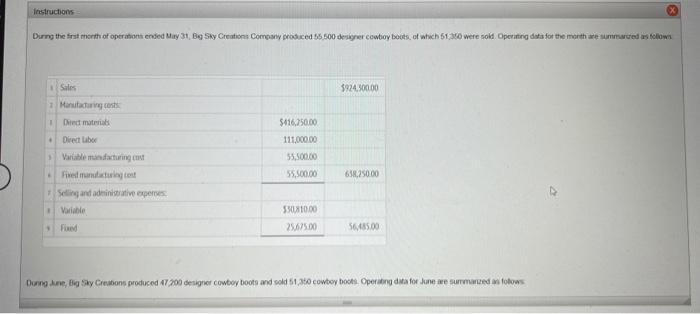

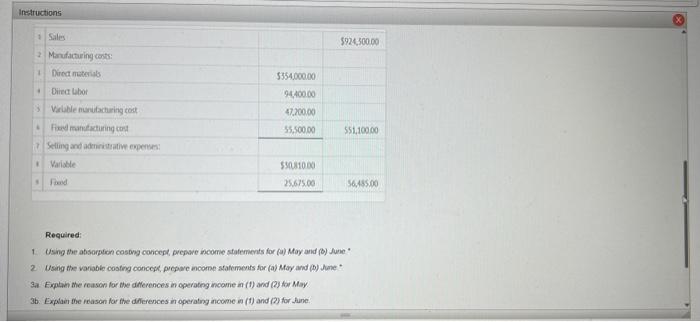

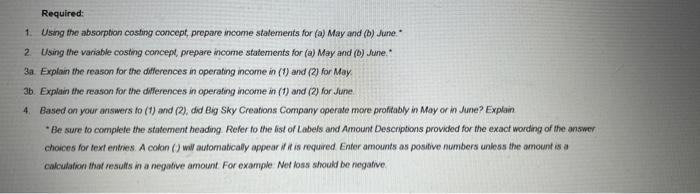

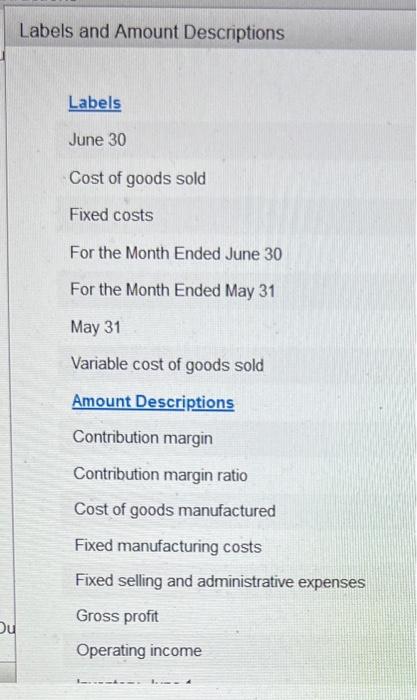

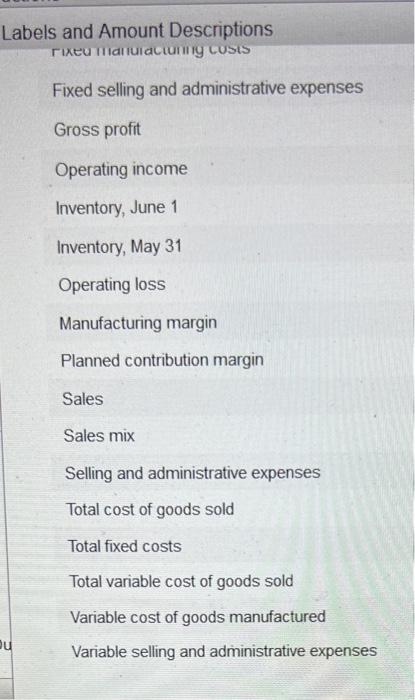

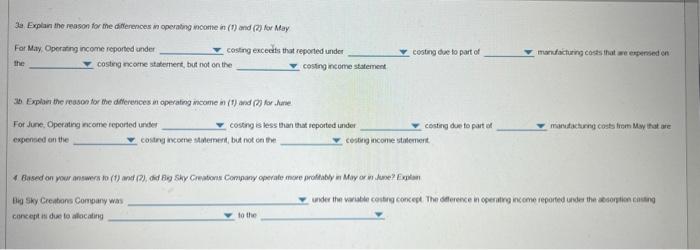

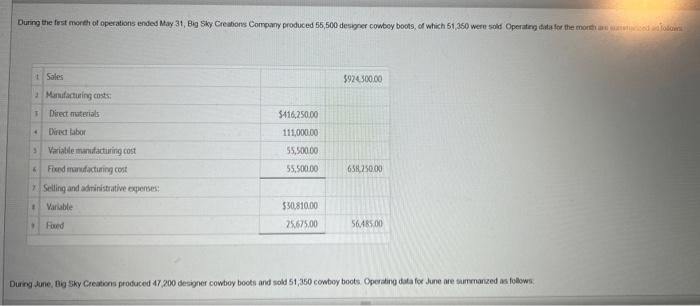

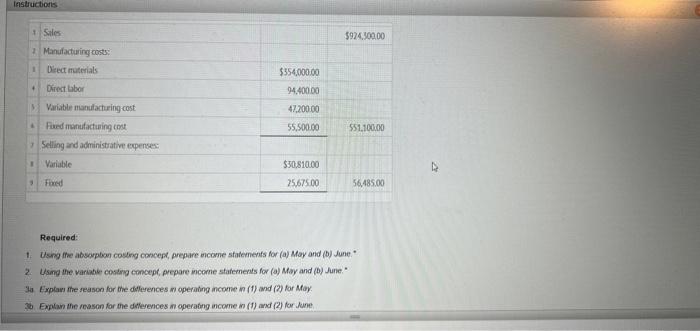

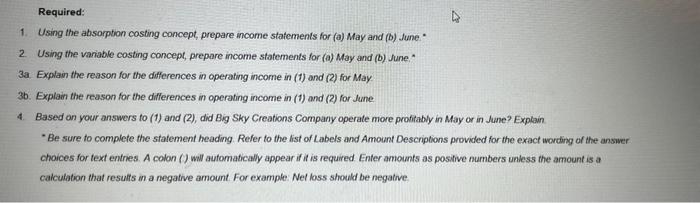

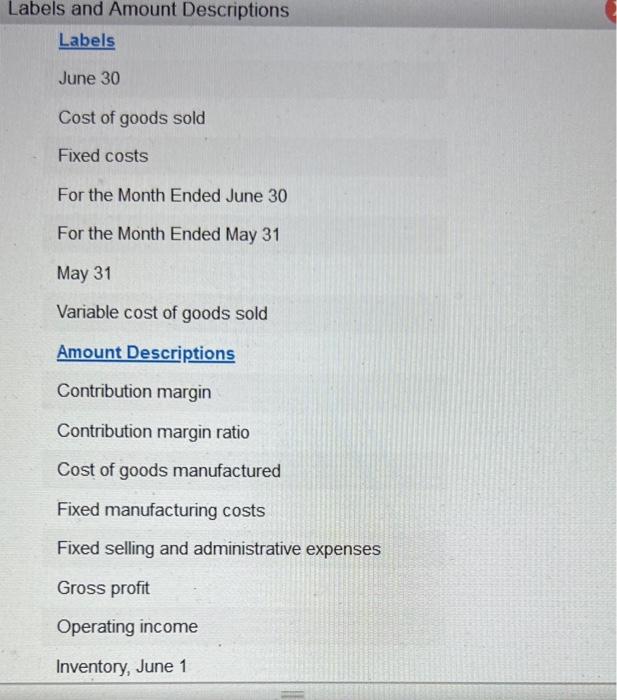

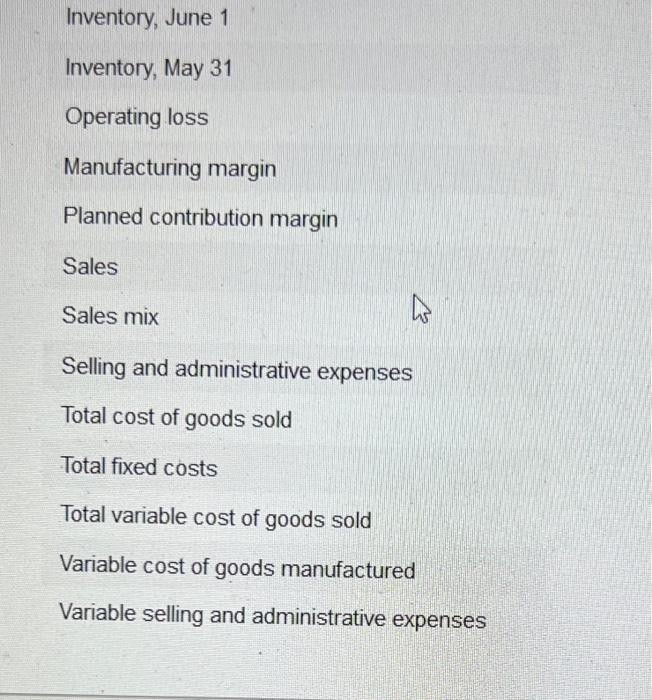

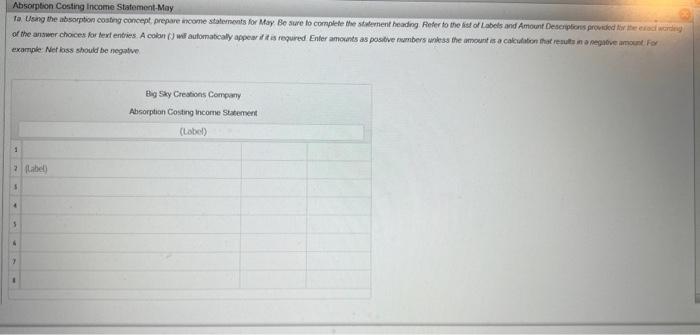

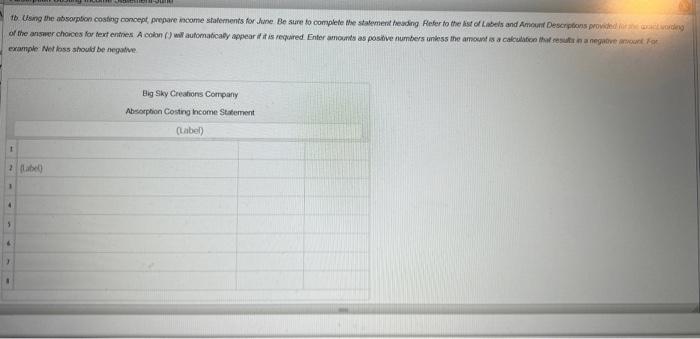

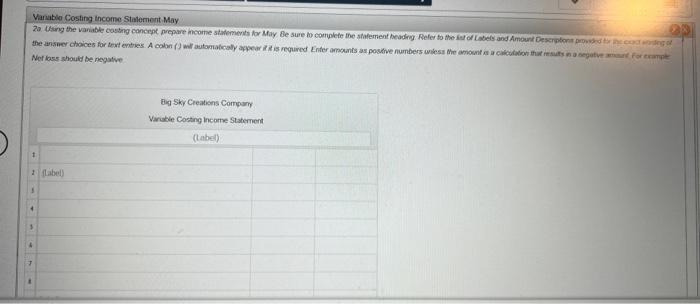

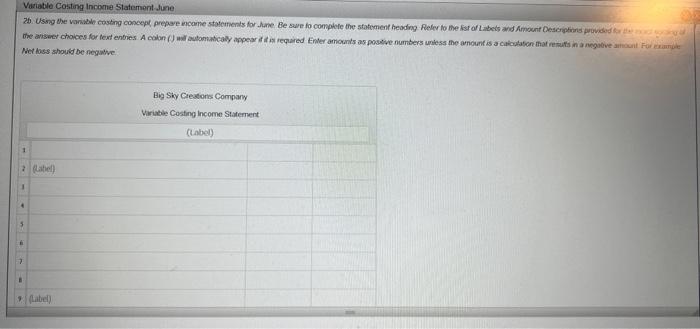

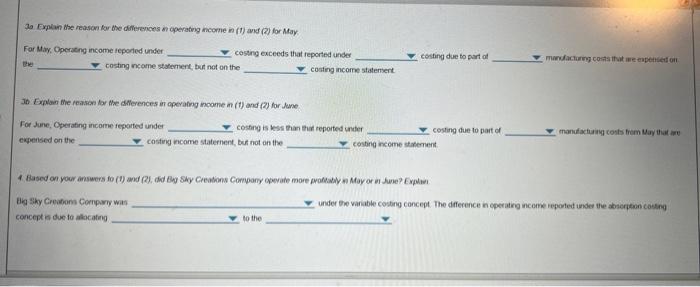

insiructions 1924,30000 1. Meritactariog conts 1) Diect matriak 4 Oieet labor 3) Variale mtindactiring tas - Fixed mandatirioy ied 7. Selitive and adtinisustive eperoes: 1 Vaiable. 530810.00 (4) fiaed 25675005645500 Required: 1. Using the absorpten cosbng concepd, prepave income statements for (a) May and (b) June * 2 Using the varibbe costing concesk, prepare income stalements for (a) May and (b) June * 3a. Exptah the reason far the diferences an operatng incowie in (1) and (2) tar May 36. Explaer the reason for the diflerences in operating ancome in (1) and (2) for thine. Required: 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare incorne stadements for (a) May and (b) .tune." 3a. Explain the reason for the differences in operafing income in (1) and (2) for May. 36. Explain the reason for the diferences in operating income in (1) and (2) for June 4. Based an your answers fo (1) and (2). did Big Sky Creations Company operate more profitably in May or in Jume? Explain * Be sure to complefe the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colan (J wal automaticaly appear if i is required Enter amounts as positive numbers uniess the amnount is a cakculation that resuifs in a negative amount. For example Net loss should be negative. Labels and Amount Descriptions Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Labels and Amount Descriptions rixeumalluiactuning custs Fixed selling and administrative expenses Gross profit Operating income Inventory, June 1 Inventory, May 31 Operating loss Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses 23. Explan the reason for me direrences moperating income in (n) and (2) Hor Meay For May Operarng income reported ander coskng excecits that reported under costing decto part of manifacturing costs that me epersed in the casteng meome statenert, but not on the cossing ricome staterinent 26. Explaer the reasos tor the diterences in operating nicome n (1) and (2) for . Arie. For June: Operating ncame reporied under_ coscng is less than that reported under costing due to pat of expensed on the costry incorne statemert, but not on tive cesteig inconive staicment. 4 Based on your answers to (1) and (2), da Big Shy Greatons Company operate more problably a May or wi due? Eintan. Hig Shy Creatans Corrpany was . under the varible cesterg concept. The deference in cseratrg ins ame reported usbe the icsoption caseng cancept it dus to alacaling to the During the fost mereh of operations ended May 31, Big siy Creabons Company produced 55,500 designer conbey boots, of which 51,350 were sold Operateng dita for the monti an During dune, Big Sky Creations produced 47,200 designer cowboy boots and sold 51,350 conbey boots Operaing data for June are surrmanzed as folows: Required: 1. Using the absoypbon coskng concept, prepare encomie statenenfs for (a) May and (b) June. 2. Using the variake costing concept, prepare income stafements for (a) May and (b) June." Ia Explaw the reason for One diflerences an operading meome in (1) and (2) for May. Explan the reason for the diferences m operabing income an (1) and (2) for dune 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) Jure. 3a. Explain the reason for the differences in operating income in (1) and (2) for May. 3b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain. - Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon () wil automatically appear if it is required Enter amounts as positive numbers uniess the amount is a caiculation that resulfs in a negative amount For example: Net loss should be negative. Labels and Amount Descriptions Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Inventory, June 1 Inventory, June 1 Inventory, May 31 Operating loss Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses example Net hass should be negatve. example Ant lass should be negalve Vanablo Cosling tncome Stalement May Net lase mhould be negutive Met toss should be negubve coaing incorne sfatement. Th Explari Bie feasen tor the dNlerences in operaling income in (1) and (2) for tune. For dune, Operating income repaited under cosing is kss than that reported under costing due to part of expensed on the manufactiaing costs trem May that ine costing income stwement. Hig Sky Creatoon Compiry was under me variable cosing concept. The dfference in cperatrg inceme repoted under the absertan caseng concept is due to alocating to the insiructions 1924,30000 1. Meritactariog conts 1) Diect matriak 4 Oieet labor 3) Variale mtindactiring tas - Fixed mandatirioy ied 7. Selitive and adtinisustive eperoes: 1 Vaiable. 530810.00 (4) fiaed 25675005645500 Required: 1. Using the absorpten cosbng concepd, prepave income statements for (a) May and (b) June * 2 Using the varibbe costing concesk, prepare income stalements for (a) May and (b) June * 3a. Exptah the reason far the diferences an operatng incowie in (1) and (2) tar May 36. Explaer the reason for the diflerences in operating ancome in (1) and (2) for thine. Required: 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare incorne stadements for (a) May and (b) .tune." 3a. Explain the reason for the differences in operafing income in (1) and (2) for May. 36. Explain the reason for the diferences in operating income in (1) and (2) for June 4. Based an your answers fo (1) and (2). did Big Sky Creations Company operate more profitably in May or in Jume? Explain * Be sure to complefe the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colan (J wal automaticaly appear if i is required Enter amounts as positive numbers uniess the amnount is a cakculation that resuifs in a negative amount. For example Net loss should be negative. Labels and Amount Descriptions Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Labels and Amount Descriptions rixeumalluiactuning custs Fixed selling and administrative expenses Gross profit Operating income Inventory, June 1 Inventory, May 31 Operating loss Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses 23. Explan the reason for me direrences moperating income in (n) and (2) Hor Meay For May Operarng income reported ander coskng excecits that reported under costing decto part of manifacturing costs that me epersed in the casteng meome statenert, but not on the cossing ricome staterinent 26. Explaer the reasos tor the diterences in operating nicome n (1) and (2) for . Arie. For June: Operating ncame reporied under_ coscng is less than that reported under costing due to pat of expensed on the costry incorne statemert, but not on tive cesteig inconive staicment. 4 Based on your answers to (1) and (2), da Big Shy Greatons Company operate more problably a May or wi due? Eintan. Hig Shy Creatans Corrpany was . under the varible cesterg concept. The deference in cseratrg ins ame reported usbe the icsoption caseng cancept it dus to alacaling to the During the fost mereh of operations ended May 31, Big siy Creabons Company produced 55,500 designer conbey boots, of which 51,350 were sold Operateng dita for the monti an During dune, Big Sky Creations produced 47,200 designer cowboy boots and sold 51,350 conbey boots Operaing data for June are surrmanzed as folows: Required: 1. Using the absoypbon coskng concept, prepare encomie statenenfs for (a) May and (b) June. 2. Using the variake costing concept, prepare income stafements for (a) May and (b) June." Ia Explaw the reason for One diflerences an operading meome in (1) and (2) for May. Explan the reason for the diferences m operabing income an (1) and (2) for dune 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) Jure. 3a. Explain the reason for the differences in operating income in (1) and (2) for May. 3b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain. - Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon () wil automatically appear if it is required Enter amounts as positive numbers uniess the amount is a caiculation that resulfs in a negative amount For example: Net loss should be negative. Labels and Amount Descriptions Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Inventory, June 1 Inventory, June 1 Inventory, May 31 Operating loss Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses example Net hass should be negatve. example Ant lass should be negalve Vanablo Cosling tncome Stalement May Net lase mhould be negutive Met toss should be negubve coaing incorne sfatement. Th Explari Bie feasen tor the dNlerences in operaling income in (1) and (2) for tune. For dune, Operating income repaited under cosing is kss than that reported under costing due to part of expensed on the manufactiaing costs trem May that ine costing income stwement. Hig Sky Creatoon Compiry was under me variable cosing concept. The dfference in cperatrg inceme repoted under the absertan caseng concept is due to alocating to the