Question

Installment Loans: You are buying a house and desire to compare financing options. Since you are familiar with Excel spreadsheets, it is the perfect tool

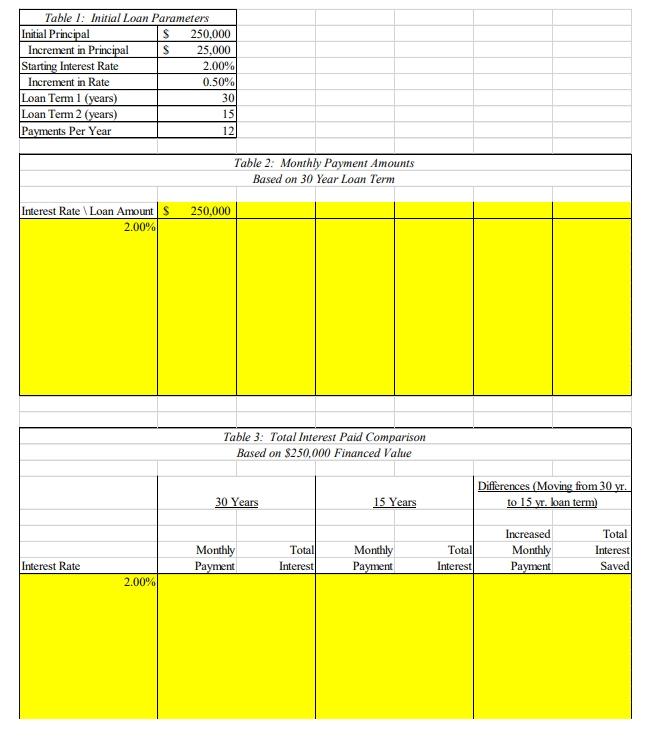

Installment Loans: You are buying a house and desire to compare financing options. Since you are familiar with Excel spreadsheets, it is the perfect tool to investigate how the rate of interest charged and the amount financed affect your periodic mortgage payment. You will also investigate how the length of the loan affects your monthly mortgage payment as well as the total interest paid to the lender during the life of the loan. The initial retirement assumptions shown in Table 1 include:

Annual rates of interest ranging from 2.00 to 7.00%, with a 0.50% constant increment.

Loan amounts ranging from $250,000 to $375,000, with a $25,000 constant increment. Table 2 will illustrate how the periodic payment changes with interest rates and the amount of money financed, while Table 3 will track the differences in monthly payment and total interest saved when comparing the 30 year and 15-year loan terms

All cells highlighted in yellow must contain a cell reference, mathematical equation, or function

Table 1: Initial Loan Parameters Initial Principal S 250,000 Increment in Principal $ 25,000 Starting Interest Rate 2.00% Increment in Rate 0.50% Loan Term 1 (years) 30 Loan Term 2 (years) 15 Payments Per Year 12 Table 2. Monthly Payment Amounts Based on 30 Year Loan Term 250,000 Interest Rate Loan Amounts 2.00% Table 3. Total Interest Paid Comparison Based on $250,000 Financed Value Differences (Moving from 30 yr. to 15 vr. loan term 30 Years 15 Years Monthly Payment Totall Interest Monthly Payment Total Interest Increased Monthly Payment Total Interest Saved Interest Rate 2.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started