Answered step by step

Verified Expert Solution

Question

1 Approved Answer

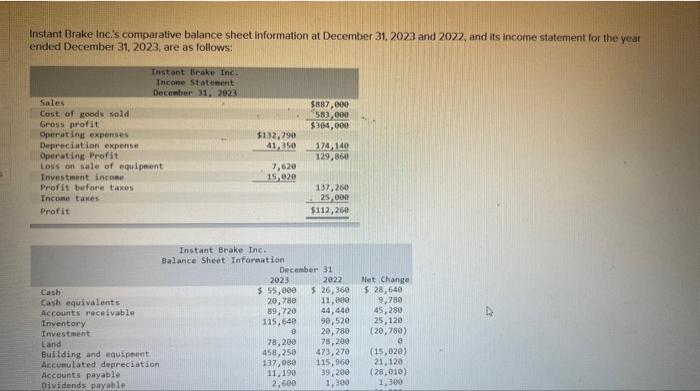

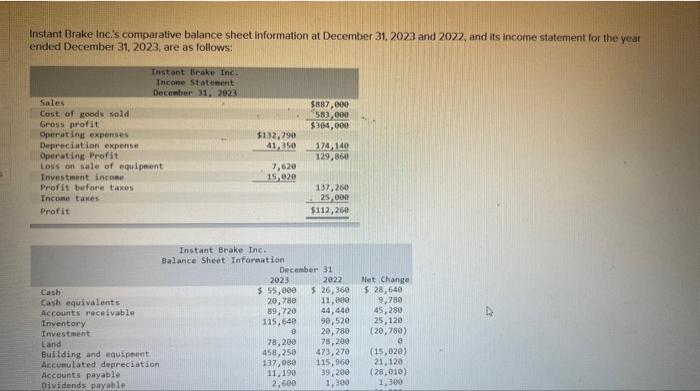

Instant Brake incis comparative balance sheet information at December 31,2023 and 2022 , and its income statement for the yeat ended December 31,2023 , are

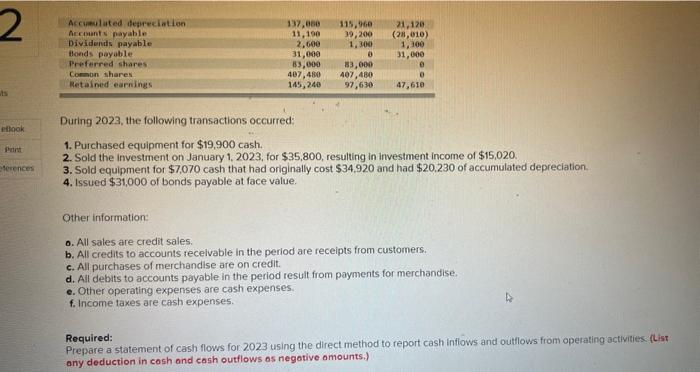

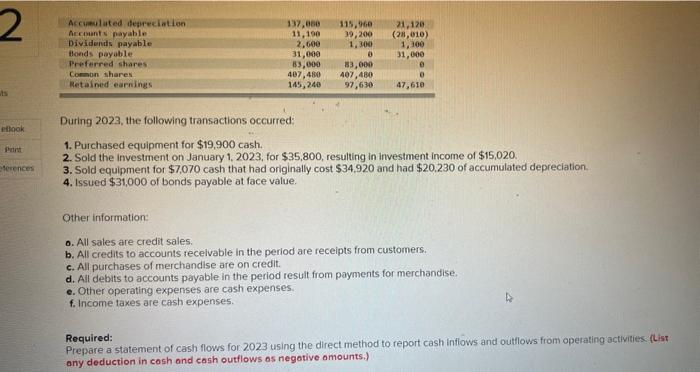

Instant Brake incis comparative balance sheet information at December 31,2023 and 2022 , and its income statement for the yeat ended December 31,2023 , are as follows: During 2023, the following transactions occurred: 1. Purchased equipment for $19,900 cash. 2. Sold the investment on January 1,2023, for $35,800, resulting in investment income of $15,020. 3. Sold equipment for $7,070 cash that had originally cost $34,920 and had $20,230 of accumulated depreciation. 4. Issued $31,000 of bonds payable at face value. Other information: o. All sales are credit sales. b. All credits to accounts recelvable in the period are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to accounts payable in the period result from payments for merchandise. e. Other operating expenses are cash expenses. f. Income taxes are cash expenses. Required: Prepare a statement of cash flows for 2023 using the direct method to report cash infliows and outflows from operating activities. fList any deduction in cosh and cosh outflows os negative omounts.) INSTANT BRAKE INC. Statement of Cash Flows For Year Ended December 31, 2023 10 points eBook Print References \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ INSTANT BRAKE INC: } \\ \hline Statement of Cash Flows \\ \hline Cash flws from operating activities: & & \\ \hline & & \\ \hline & & \\ \hline Cash flows from investing activities: & \\ \hline & \\ \hline & \\ \hline \end{tabular}

Instant Brake incis comparative balance sheet information at December 31,2023 and 2022 , and its income statement for the yeat ended December 31,2023 , are as follows: During 2023, the following transactions occurred: 1. Purchased equipment for $19,900 cash. 2. Sold the investment on January 1,2023, for $35,800, resulting in investment income of $15,020. 3. Sold equipment for $7,070 cash that had originally cost $34,920 and had $20,230 of accumulated depreciation. 4. Issued $31,000 of bonds payable at face value. Other information: o. All sales are credit sales. b. All credits to accounts recelvable in the period are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to accounts payable in the period result from payments for merchandise. e. Other operating expenses are cash expenses. f. Income taxes are cash expenses. Required: Prepare a statement of cash flows for 2023 using the direct method to report cash infliows and outflows from operating activities. fList any deduction in cosh and cosh outflows os negative omounts.) INSTANT BRAKE INC. Statement of Cash Flows For Year Ended December 31, 2023 10 points eBook Print References \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ INSTANT BRAKE INC: } \\ \hline Statement of Cash Flows \\ \hline Cash flws from operating activities: & & \\ \hline & & \\ \hline & & \\ \hline Cash flows from investing activities: & \\ \hline & \\ \hline & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started