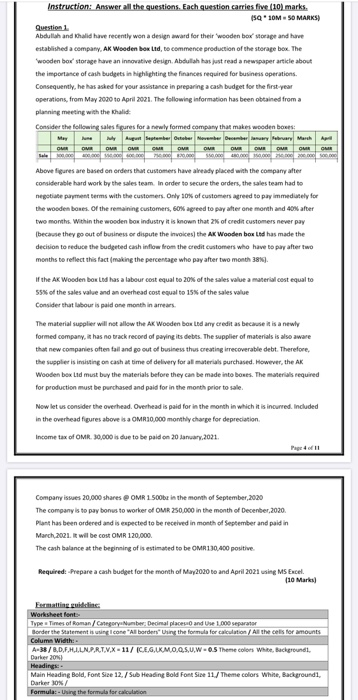

Instruction: Answer all the questions. Each question carries five (10) marks. 15Q10M50 MARKS) Question 1 Abdullah and Khalid have recently won a design award for their wooden box storage and have established a company, AK Wooden box Ltd, to commence production of the storage box. The 'wooden box storage have an innovative design. Abdullah has just read a newspaper article about the importance of cash budgets in highlighting the finances required for business operations Consequently, he has asked for your assistance in preparing a cash budget for the first year operations, from May 2020 to April 2021. The following information has been obtained from a planning meeting with the thalid Consider the following sales figures for a newly formed company that makes wooden boxes: June ugent September October November December wary February March OM Gun OM OM OMRON OR A Above figures are based on orders that customers have already placed with the company after considerable hard work by the sales team. In order to secure the orders, the sales team had to negotiate payment terms with the customers. Only 10% of customers agreed to pay immediately for the wooden boxes. Of the remaining customers, 60% agreed to pay after one month and 40% after two months. Within the wooden box industry it is known that 2 of credit customers never pay because they go out of business or dispute the invoices) the Ak Wooden box Lid has made the decision to reduce the budgeted cash inflow from the credit customers who have to pay after two months to reflect this fact (making the percentage who pay after two month 38%). If the Ak Wooden box Ltd has a labour cost equal to 20% of the sales value a material cost equal to 55% of the sales value and an overhead cost equal to 15% of the sales value Consider that labour is paid one month in arrears. The material supplier will not allow the AK Wooden box Ltd any credit as because it is a newly formed company, it has no track record of paying its debts. The supplier of materials is also aware that new companies often tail and go out of business thus creating irrecoverable debt. Therefore, the supplier is insisting on cash at time of delivery for all materials purchased. However, the AK Wooden box Lid must buy the materials before they can be made into boxes. The materials required for production must be purchased and paid for in the month prior to sale. Now let us consider the overhead. Overhead is paid for in the month in which it is incurred. Included in the overhead figures above is a OMR10,000 monthly charge for depreciation Income tax of OMR. 30.000 is due to be paid on 20 January,2021, Page 11 Company issues 20,000 shares OMR 1.500be in the month of September 2020 The company is to pay bonus to worker of OMR 250,000 in the month of Decenber,2020 Plant has been ordered and is expected to be received in month of September and paid in March 2021. I wil be COM OMR 120,000 The cash balance at the beginning of is estimated to be OMR 130,400 positive Required: -Prepare a cash budget for the month of May 2020 to and April 2021 using MS Excel (10 Marks Fernatting guilding Worksheet font Type Times of Roman CategoryNumber: Decimal places and Use 1.000 separator Border the Statement is using Icone "Al borders" Using the formula for calculation All the cells for amounts Columns Width: A-38/B.D.F.HI.LNP.RTV.X-11/ ICEGUKMOQS.U.W-05 Theme Colors White Background, Darker 2001 Headings: Main Heading Bold, Font Size 12./Sub Heading Bold Font Size 11/Theme colors White Background, Darker OX/ Formula- Using the formula for calculation