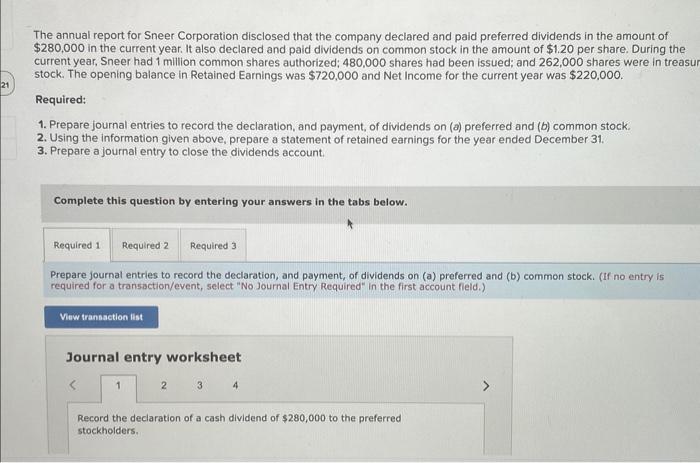

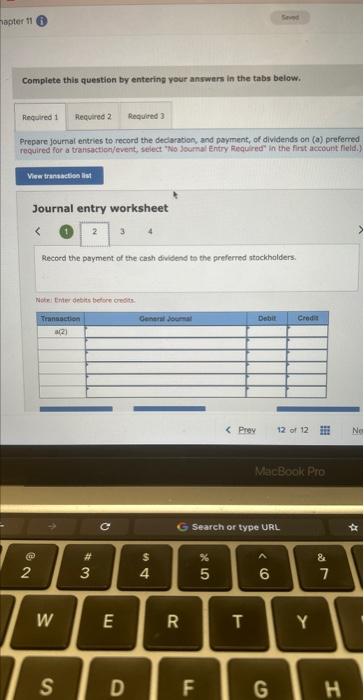

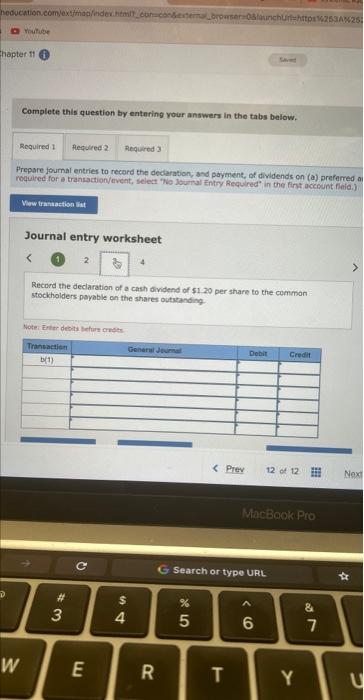

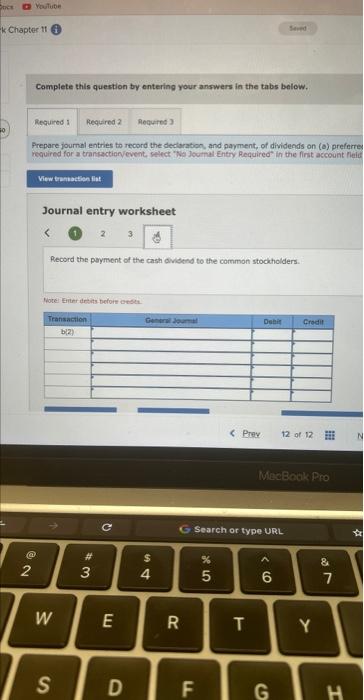

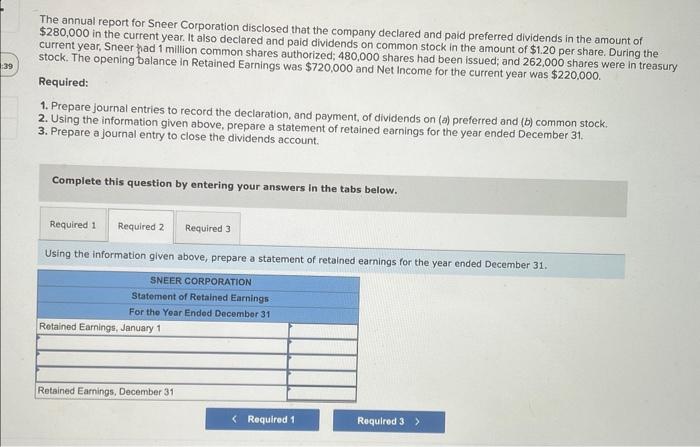

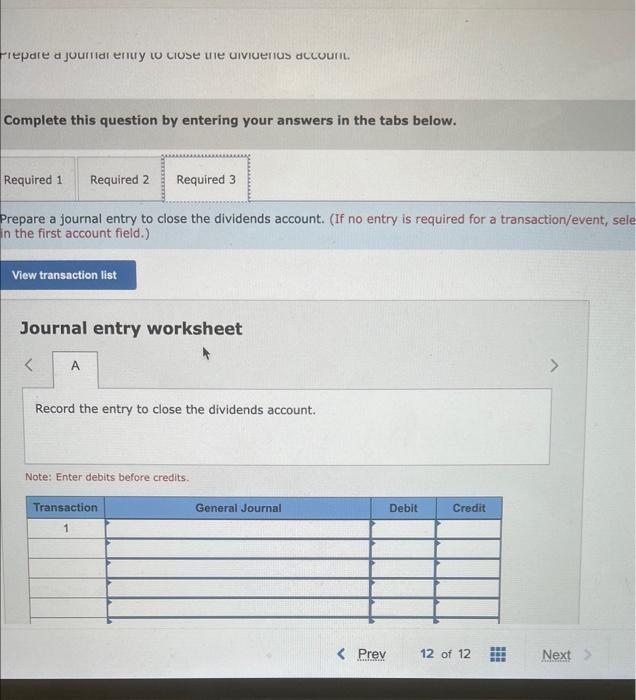

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $280,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.20 per share. During the current year, Sneer had 1 million common shares authorized; 480,000 shares had been issued; and 262,000 shares were in treasu stock. The opening balance in Retained Earnings was $720,000 and Net Income for the current year was $220,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the declaration of a cash dividend of $280,000 to the preferred stockholders. Complete this question by entering your answers in the tabs below. Prepsre joumal entries to record the deciarabon, and poyment, of dividends on (a) preferred required for a trentsattionfevent, seledt "No Joumal Entry fiequired" in the fint accoubt field.) Journal entry worksheet Record the payment of the cash dividend to the preferred stockhalders. Wobei Ente debits betore orebits. Complete this question by entering your answers in the tabs below. Frepare foumal entries to record the dectaration; and payment, of dividends on (a) preferred a roquired for a transactionvevent, select "Wo joutral Fntry Requlred" in the fint account flaid.) Journal entry worksheet 2 4 Record the declaration of a cash dividend of 51.20 per share to the common stockholders psyable on the shares oututanding Noter Enter debots Wefurt crestr Complete this question by entering your answers in the tabs below. Frepare jourmal entries to record the declarabon, and payment, of dividends on (a) preferrey required for a transactionyevent, select "Wa Joomal Entry Required" in the first account fleid Journal entry worksheet (1.) 2+3 Record the payment of the cash oividend to the common stockholders. Wote: Erfter dreits before Desta. The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $280,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.20 per share. During the current year, Sneer had 1 million common shares authorized; 480,000 shares had been issued; and 262,000 shares were in treasury stock. The opening balance in Retained Earnings was $720,000 and Net income for the current year was $220,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31 . 3. Prepare a journal entry to close the dividends account. Complete this question by entering your answers in the tabs below. Using the information given above, prepare a statement of retained earnings for the year ended December 31 . Tepate a juuridi eriry to ciuse uie uiviuerius accuari. Complete this question by entering your answers in the tabs below. Prepare a journal entry to close the dividends account. (If no entry is required for a transaction/event, se in the first account field.) Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits