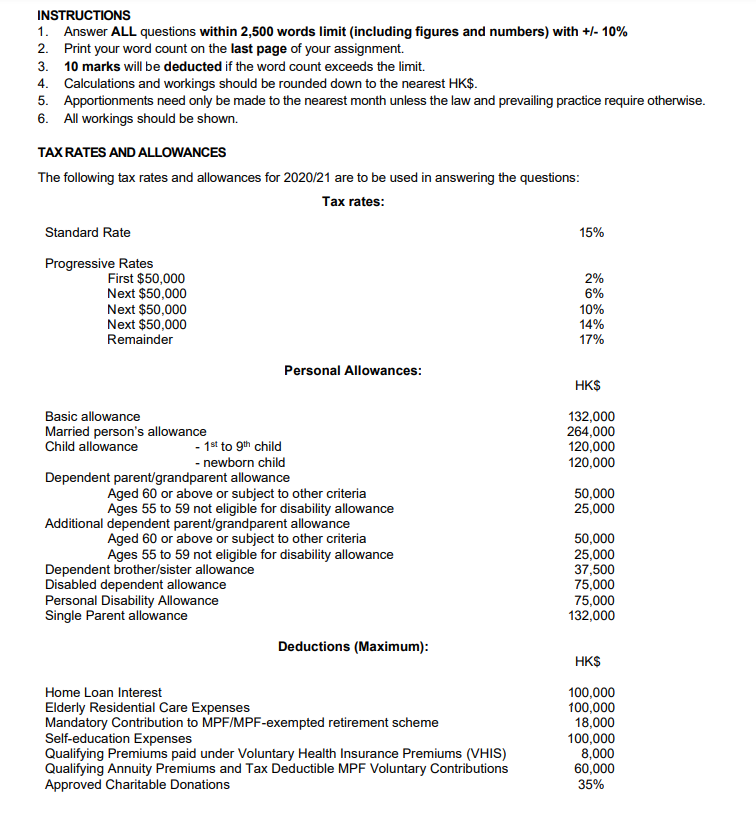

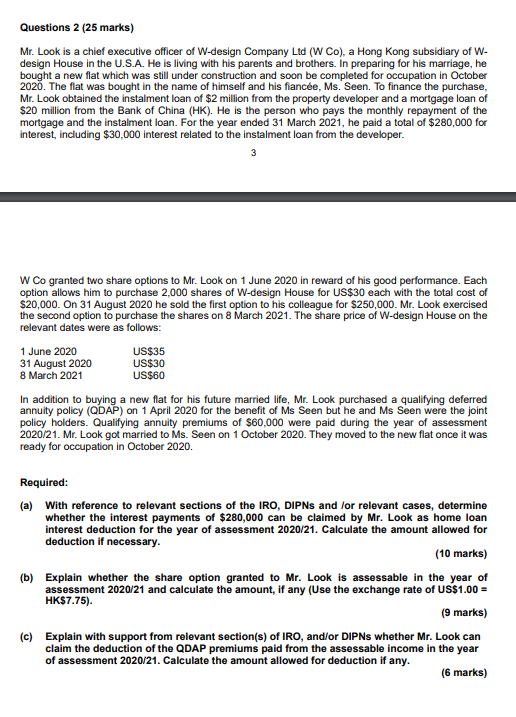

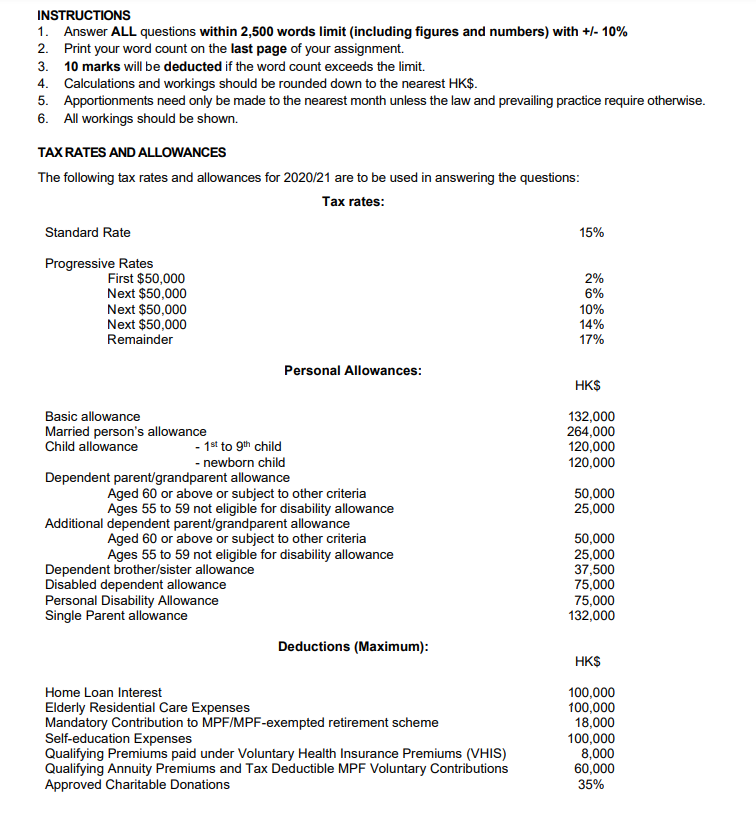

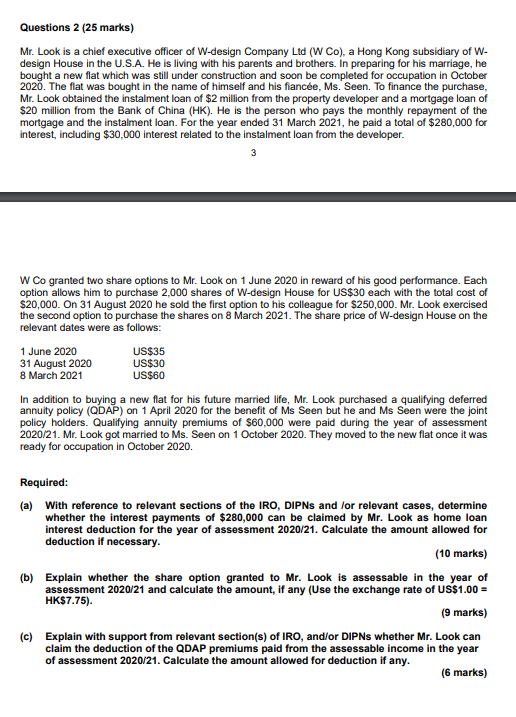

INSTRUCTIONS 1. Answer ALL questions within 2,500 words limit (including figures and numbers) with +/- 10% 2. Print your word count on the last page of your assignment 3. 10 marks will be deducted if the word count exceeds the limit. 4. Calculations and workings should be rounded down to the nearest HK$. 5. Apportionments need only be made to the nearest month unless the law and prevailing practice require otherwise. 6. All workings should be shown. TAX RATES AND ALLOWANCES The following tax rates and allowances for 2020/21 are to be used in answering the questions: Tax rates: Standard Rate 15% Progressive Rates First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder 2% 6% 10% 14% 17% Personal Allowances: HK$ 132,000 264,000 120,000 120,000 50,000 25,000 Basic allowance Married person's allowance Child allowance - 1st to gth child - newborn child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependent allowance Personal Disability Allowance Single Parent allowance Deductions (Maximum): 50,000 25,000 37,500 75,000 75,000 132,000 HK$ Home Loan Interest Elderly Residential Care Expenses Mandatory Contribution to MPF/MPF-exempted retirement scheme Self-education Expenses Qualifying Premiums paid under Voluntary Health Insurance Premiums (VHIS) Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contributions Approved Charitable Donations 100,000 100,000 18,000 100,000 8,000 60,000 35% Questions 2 (25 marks) Mr. Look is a chief executive officer of W-design Company Ltd (W Co), a Hong Kong subsidiary of W- design House in the U.S.A. He is living with his parents and brothers. In preparing for his marriage, he bought a new flat which was still under construction and soon be completed for occupation in October 2020. The flat was bought in the name of himself and his fiance, Ms. Seen. To finance the purchase, Mr. Look obtained the instalment loan of $2 million from the property developer and a mortgage loan of $20 million from the Bank of China (HK). He is the person who pays the monthly repayment of the mortgage and the instalment loan. For the year ended 31 March 2021, he paid a total of $280,000 for interest, including $30,000 interest related to the instalment loan from the developer. W Co granted two share options to Mr. Look on 1 June 2020 in reward of his good performance. Each option allows him to purchase 2,000 shares of W-design House for US$30 each with the total cost of $20,000. On 31 August 2020 he sold the first option to his colleague for $250,000. Mr. Look exercised the second option to purchase the shares on 8 March 2021. The share price of W-design House on the relevant dates were as follows: 1 June 2020 US$35 31 August 2020 US$30 8 March 2021 US$60 In addition to buying a new flat for his future married life, Mr. Look purchased a qualifying deferred annuity policy (QDAP) on 1 April 2020 for the benefit of Ms Seen but he and Ms Seen were the joint policy holders. Qualifying annuity premiums of $60,000 were paid during the year of assessment 2020/21. Mr. Look got married to Ms. Seen on 1 October 2020. They moved to the new flat once it was ready for occupation in October 2020. Required: (a) With reference to relevant sections of the IRO, DIPNs and/or relevant cases, determine whether the interest payments of $280,000 can be claimed by Mr. Look as home loan interest deduction for the year of assessment 2020/21. Calculate the amount allowed for deduction if necessary. (10 marks) (b) Explain whether the share option granted to Mr. Look is assessable in the year of assessment 2020/21 and calculate the amount, if any (Use the exchange rate of US$1.00 = HK$7.75). (9 marks) (c) Explain with support from relevant section(s) of IRO, and/or DIPNs whether Mr. Look can claim the deduction of the QDAP premiums paid from the assessable income in the year of assessment 2020/21. Calculate the amount allowed for deduction if any. (6 marks)