Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Supposed you are an investor who falls in the 35% tax bracket (federal and state taxes combined). You have a lower risk appetite and

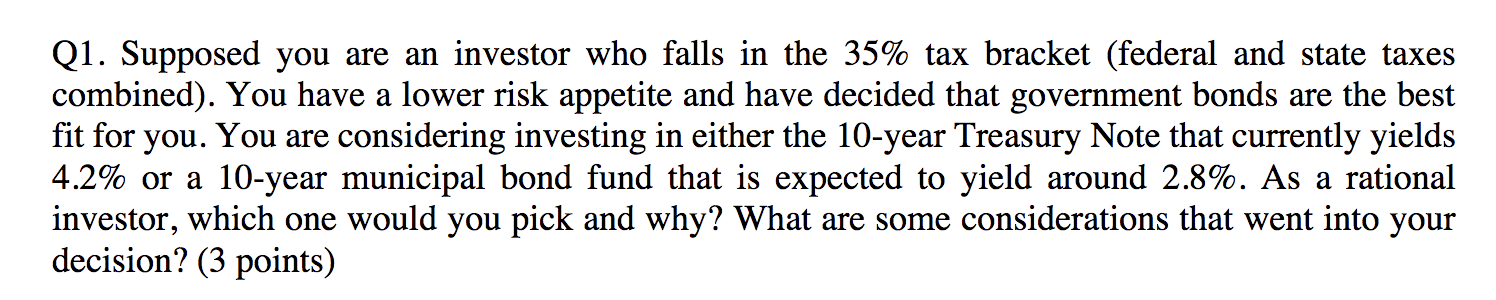

Q1. Supposed you are an investor who falls in the 35% tax bracket (federal and state taxes combined). You have a lower risk appetite and have decided that government bonds are the best fit for you. You are considering investing in either the 10-year Treasury Note that currently yields 4.2% or a 10 -year municipal bond fund that is expected to yield around 2.8%. As a rational investor, which one would you pick and why? What are some considerations that went into your decision? (3 points)

Q1. Supposed you are an investor who falls in the 35% tax bracket (federal and state taxes combined). You have a lower risk appetite and have decided that government bonds are the best fit for you. You are considering investing in either the 10-year Treasury Note that currently yields 4.2% or a 10 -year municipal bond fund that is expected to yield around 2.8%. As a rational investor, which one would you pick and why? What are some considerations that went into your decision? (3 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started