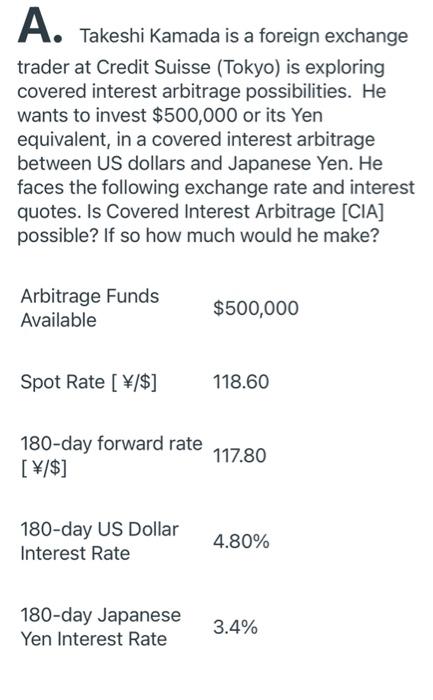

Instructions 1. Answer both part A and B. They have equal weight. 2. The assignment is due on April 4, 2021 at 11.59 PM 3. If you want partial credit, even if your answer is wrong, show all work. 4. In calculations round off to the nearest four decimal places. Interest Rate Arbitrage - Covered and Uncovered A. Takeshi Kamada is a foreign exchange a trader at Credit Suisse (Tokyo) is exploring covered interest arbitrage possibilities. He wants to invest $500,000 or its Yen equivalent, in a covered interest arbitrage between US dollars and Japanese Yen. He faces the following exchange rate and interest quotes. Is Covered Interest Arbitrage [CIA] possible? If so how much would he make? A. Takeshi Kamada is a foreign exchange trader at Credit Suisse (Tokyo) is exploring covered interest arbitrage possibilities. He wants to invest $500,000 or its Yen equivalent, in a covered interest arbitrage between US dollars and Japanese Yen. He faces the following exchange rate and interest quotes. Is Covered Interest Arbitrage [CIA] possible? If so how much would he make? Arbitrage Funds Available $500,000 Spot Rate [/$] 118.60 180-day forward rate [ /$] 117.80 180-day US Dollar Interest Rate 4.80% 180-day Japanese Yen Interest Rate 3.4% 180-day forward rate [\/$] 117.80 180-day US Dollar Interest Rate 4.80% 180-day Japanese Yen Interest Rate 3.4% B. Takeshi Kamada observes that the /$ spot rate has been holding steady, and that both dollar and Yen interest rates have remained relatively fixed over the past week. Takeshi wonders whether he should try an Uncovered Interest Arbitrage (UIA) and thereby save the cost of the forward cover. His research associates and computer models are predicting the spot rate to remain close to 118/$1 for the coming 180 days. What is the profit potential for UIA given the above data? Instructions 1. Answer both part A and B. They have equal weight. 2. The assignment is due on April 4, 2021 at 11.59 PM 3. If you want partial credit, even if your answer is wrong, show all work. 4. In calculations round off to the nearest four decimal places. Interest Rate Arbitrage - Covered and Uncovered A. Takeshi Kamada is a foreign exchange a trader at Credit Suisse (Tokyo) is exploring covered interest arbitrage possibilities. He wants to invest $500,000 or its Yen equivalent, in a covered interest arbitrage between US dollars and Japanese Yen. He faces the following exchange rate and interest quotes. Is Covered Interest Arbitrage [CIA] possible? If so how much would he make? A. Takeshi Kamada is a foreign exchange trader at Credit Suisse (Tokyo) is exploring covered interest arbitrage possibilities. He wants to invest $500,000 or its Yen equivalent, in a covered interest arbitrage between US dollars and Japanese Yen. He faces the following exchange rate and interest quotes. Is Covered Interest Arbitrage [CIA] possible? If so how much would he make? Arbitrage Funds Available $500,000 Spot Rate [/$] 118.60 180-day forward rate [ /$] 117.80 180-day US Dollar Interest Rate 4.80% 180-day Japanese Yen Interest Rate 3.4% 180-day forward rate [\/$] 117.80 180-day US Dollar Interest Rate 4.80% 180-day Japanese Yen Interest Rate 3.4% B. Takeshi Kamada observes that the /$ spot rate has been holding steady, and that both dollar and Yen interest rates have remained relatively fixed over the past week. Takeshi wonders whether he should try an Uncovered Interest Arbitrage (UIA) and thereby save the cost of the forward cover. His research associates and computer models are predicting the spot rate to remain close to 118/$1 for the coming 180 days. What is the profit potential for UIA given the above data