Question: Instructions 10% Deduction for Each Day Late Create a current state map for the mailroom operation for categories 1-3 (page 6). Start your value stream

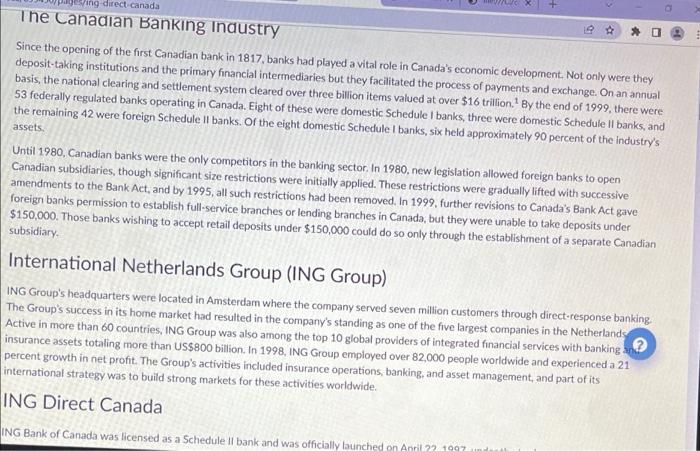

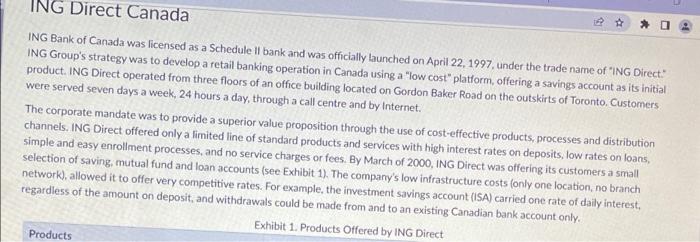

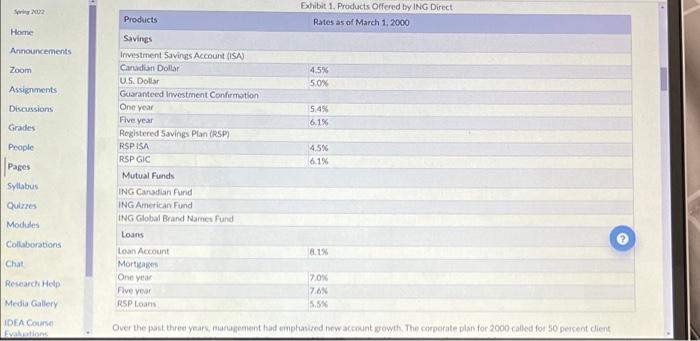

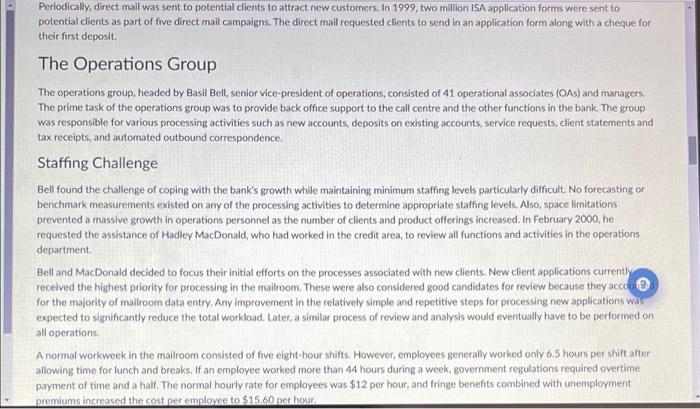

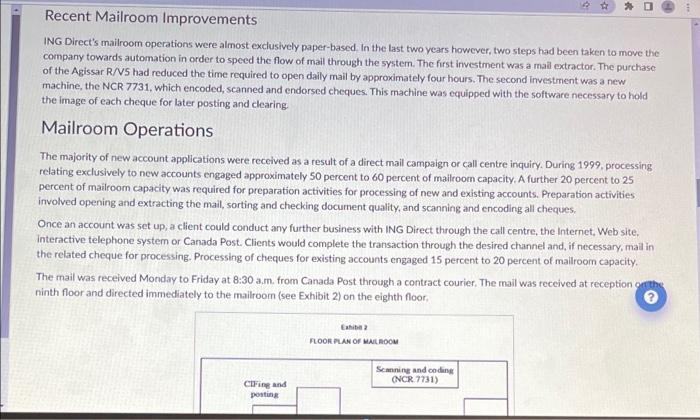

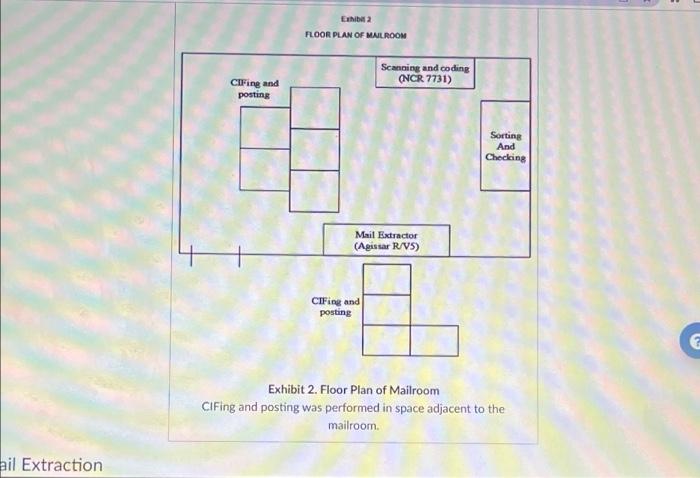

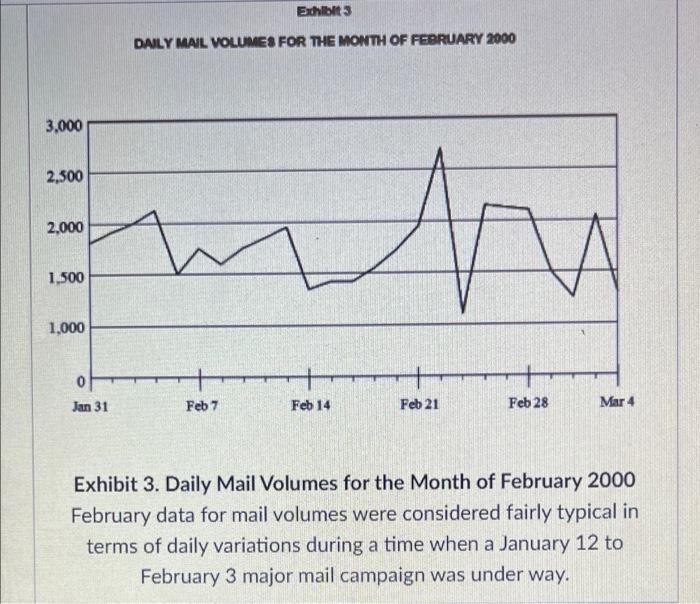

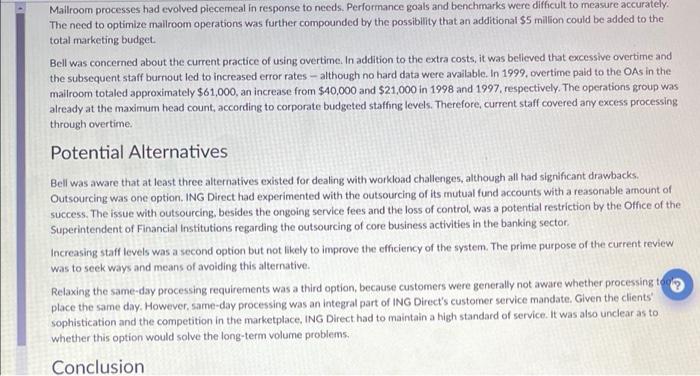

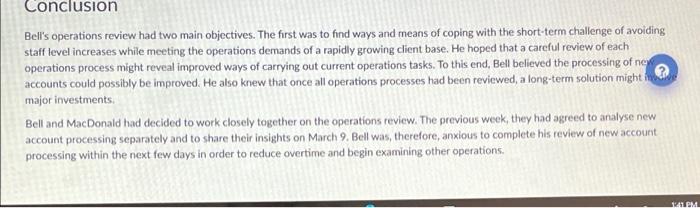

Instructions 10% Deduction for Each Day Late Create a current state map for the mailroom operation for categories 1-3 (page 6). Start your value stream map with delivery of the mail to ING. . Additional information: Assume 1000 pieces of mail for your inventory calculations Receiving and transporting the mail to the mailrooms take 5 min each Creating the calculator tapes takes 5 minutes, in 20% of the cases the totals of the two tapes are different Manual verification takes 1 minute, totals are rarely wrong. Use a weighted average for the processing time of CIFing You do not have to calculate total lead time and processing time since some of the processes are performed at the same time, but you need to show the timeline. Show how you calculated your times Identify at least 2 improvement opportunities . . Image you would present your value stream map to your boss. Pencil is ok, sloppy is not !!! Spell-check your work If you make assumptions, write them down (or better ask me questions) . . On March 6, 2000, Basil Bell, senior vice-president of operations at ING Direct in Toronto, Canada, was reviewing the processing of new accounts. He believed that back office processing capacity had reached its limit and had, therefore, recently requested the transfer of Had MacDonald from the credit area to head up the department and address staffing level concerns in back-office operations. Major space, budget and headcount constraints made it impossible to increase staffing levels to cope with the bank's rapidly growing client base. In Bell opinion, it was critical that ING Direct develop and implement long-term solutions for coping with the immediate challenges of growth. Moreover, Bell recognized that within the next two years a more technologically, sophisticated solution would have to be found. Bell and MacDonald had selected the processing of new accounts as the first set of operations to review and had documented the procedures currently in use. The processing of new accounts by the mailroom staff represented a significant part of the tasks performed by back office personnel, and was required to be completed on a same-day basis. The Canadian Banking Industry Since the opening of the first Canadian bank in 1817, banks had played a vital role in Canada's economic development. Not only were they deposit-taking institutions and the primary financial intermediaries but they facilitated the process of payments and exchange. On an annua basis, the national clearing and settlement system cleared over three billion items valued at over $16 trillion. By the end of 1999, there wer 53 federally regulated banks operating in Canada. Eight of these were domestic Schedule I banks, three were domestic Schedule Il banks, an the remaining 42 were foreign Schedule Il banks. Of the eight domestic Schedule I banks, six held approximately 90 percent of the industry's assets Until 1980, Canadian banks were the only competitors in the banking sector. In 1980, new legislation allowed foreign banks to open Canadian subsidiaries, though significant size restrictions were initially applied. These restrictions were gradually lifted with successive amendments to the Bank Act, and by 1995, all such restrictions had been removed. In 1999, further revisions to Canada's Bank Act gave foreign banks permission to establish full-service branches or lending branches in Canada, but they were unable to take deposits under $150,000. Those banks wishing to accept retail deposits under $150,000 could do so only through the establishment of a separate Canadian subsidiary ing direct canada The Canadian Banking Industry Since the opening of the first Canadian bank in 1817, banks had played a vital role in Canada's economic development. Not only were they deposit-taking institutions and the primary financial intermediaries but they facilitated the process of payments and exchange. On an annual basis, the national clearing and settlement system cleared over three billion items valued at over $16 trillion. By the end of 1999, there were 53 federally regulated banks operating in Canada. Eight of these were domestic Schedule I banks, three were domestic Schedule Il banks, and the remaining 42 were foreign Schedule Il banks. Of the eight domestic Schedule I banks, six held approximately 90 percent of the industry's assets Until 1980, Canadian banks were the only competitors in the banking sector. In 1980, new legislation allowed foreign banks to open Canadian subsidiaries, though significant size restrictions were initially applied. These restrictions were gradually lifted with successive amendments to the Bank Act, and by 1995, all such restrictions had been removed. In 1999, further revisions to Canada's Bank Act gave foreign banks permission to establish full-service branches or lending branches in Canada, but they were unable to take deposits under $150,000. Those banks wishing to accept retail deposits under $150,000 could do so only through the establishment of a separate Canadian subsidiary. International Netherlands Group (ING Group) ING Group's headquarters were located in Amsterdam where the company served seven million customers through direct response banking The Group's success in its home market had resulted in the company's standing as one of the five largest companies in the Netherlands Active in more than 60 countries, ING Group was also among the top 10 global providers of integrated financial services with banking anu insurance assets totaling more than US$800 billion. In 1998, ING Group employed over 82,000 people worldwide and experienced a 21 percent growth in net profit. The Group's activities included insurance operations, banking, and asset management, and part of its international strategy was to build strong markets for these activities worldwide. ING Direct Canada ING Bank of Canada was licensed as a Schedule Il bank and was officially launched on Antil 77 1917 ING Direct Canada ING Bank of Canada was licensed as a Schedule Il bank and was officially launched on April 22, 1997, under the trade name of "ING Direct: ING Group's strategy was to develop a retail banking operation in Canada using a "low cost platform, offering a savings account as its initial product. ING Direct operated from three floors of an office building located on Gordon Baker Road on the outskirts of Toronto. Customers were served seven days a week, 24 hours a day, through a call centre and by Internet. The corporate mandate was to provide a superior value proposition through the use of cost-effective products, processes and distribution channels. ING Direct offered only a limited line of standard products and services with high interest rates on deposits, low rates on loans, simple and easy enrollment processes, and no service charges or fees. By March of 2000, ING Direct was offering its customers a small selection of saving, mutual fund and loan accounts (see Exhibit 1). The company's low infrastructure costs (only one location, no branch network), allowed it to offer very competitive rates. For example, the investment savings account (ISA) carried one rate of daily interest, regardless of the amount on deposit, and withdrawals could be made from and to an existing Canadian bank account only. Exhibit 1. Products Offered by ING Direct Products 2022 Exhibit 1. Products Offered by ING Direct Rates as of March 1, 2000 Products Home Announcements Zoom 4.5% 5.0% Assignments Discussions 5.4% 6.1% Grades People 4.5% 6.1% Pages Savings Investment Savings Account (ISA) Canadian Dollar U.S. Dollar Guaranteed Investment Confirmation One year Five year Registered Savings Plan (RSP) RSPISA RSP GIC Mutual Funds ING Canadian Fund ING American Fund ING Global Brand Names Fund Loans Loan Account Mortgages One ye Five year RSP Loan Syllabus Quizzes Modules Collaborations 8.18 Chat Research Help 70% 7.6% 5.5% Media Gallery IDEA Course Rating Over the past three years, management had emphasized new account wowth. The corporate plan for 2000 called for 50 percent client Over the past three years, management had emphasized new account growth. The corporate plan for 2000 called for 50 percent client growth from about 220,000 accounts in December 1999, with a further 30 percent growth in each of the next two years. As part of its efforts to maintain low infrastructure costs, management also stressed tight budgetary controls, with strict restrictions on staffing levels. In March 2000, staff numbers at ING Direct totaled 242 people. Of these, 94 were full-time call centre employees with the title Direct Associate (DA). To provide peak-time support, 75 percent of ING Direct's remaining employees, including mailroom employees, were trained to answer phones in the call centre at peak times. Opening an ING Direct Account To open an account with ING Direct, customers had to provide their address, postal code, social insurance number (SIN) and a cheque from their chequing account with any major Canadian bank. There were four ways in which a client could open an account with ING Direct 1. Telephone the 24-hour call centre and request an application (otherwise known as a fulfillment package). Approximately 60 percent of these requests resulted in account openings. 2. Fill in an online application, or download the application from the Internet and mail it to ING Direct. 3. Enroll in person at one of the ING cafes in Toronto or Vancouver 4. Fill out an application sent through the mail as part of the company's direct mail campaign. If a customer telephoned the 24-hour call centre, DAs responded with either a standard or express fulfillment package. For a standard fulfillment package, a DA would answer the call and take down the customer's name, address, postal code and telephone number. Twice an electronic file of customer requests was generated and sent to a letter house subcontracted by ING Direct to mail out standard fulfillment packages to prospective clients. Each client was requested to complete an enclosed application form and return it with an initial deposit Alternatively, about 20 percent of all new clients called the 24-hour hotline to open an account immediately using an express fulfillment package. In order to be sent this package, these clients also supplied the DA with their date of birth and SIN, in addition to the information noted earlier. The DA would immediately assign a client number, which created a customer information file (CIF), and instruct the customer to mail their initial deposit cheque to ING Direct. The account would be opened when the cheque was received, and interest would begin accruinsat that time, legal regulations also required adianto send in an application form.non recent by ING Direct the client could 1:37 PM a Periodically, direct mail was sent to potential clients to attract new customers. In 1999, two million ISA application forms were sent to potential clients as part of five direct mail campaigns. The direct mail requested clients to send in an application form along with a cheque for their first deposit The Operations Group The operations group, headed by Basil Bell, senior vice-president of operations, consisted of 41 operational associates (OAS) and managers The prime task of the operations group was to provide back office support to the call centre and the other functions in the bank. The group was responsible for various processing activities such as new accounts, deposits on existing accounts, service requests, client statements and tax receipts, and automated outbound correspondence. Staffing Challenge Bell found the challenge of coping with the bank's growth while maintaining minimum staffing levels particularly difficult. No forecasting or benchmark measurements existed on any of the processing activities to determine appropriate staffing levels. Also, space limitations prevented a massive growth in operations personnel as the number of clients and product offerings increased. In February 2000, he requested the assistance of Hadley MacDonald, who had worked in the credit area, to review all functions and activities in the operations department Bell and Mac Donald decided to focus their initial efforts on the processes associated with new clients. New client applications currently received the highest priority for processing in the mailroom. These were also considered good candidates for review because they acco for the majority of mailroom data entry. Any improvement in the relatively simple and repetitive steps for processing new applications was expected to significantly reduce the total workload. Later, a similar process of review and analysis would eventuailly have to be performed on all operations A normal workweek in the mallroom consisted of five eight-hour shifts. However, employees generally worked only 6.5 hours per shift after allowing time for lunch and breaks. If an employee worked more than 14 hours during a week, government regulations required overtime payment of time and a half. The normal hourly rate for employees was $12 per hour and fringe benefits combined with unemployment premiums increased the cost per employee to $15.60 per hour Recent Mailroom Improvements ING Direct's mallroom operations were almost exclusively paper-based. In the last two years however, two steps had been taken to move the company towards automation in order to speed the flow of mail through the system. The first investment was a mail extractor. The purchase of the Agissar R/V5 had reduced the time required to open daily mail by approximately four hours. The second investment was a new machine, the NCR 7731, which encoded, scanned and endorsed cheques. This machine was equipped with the software necessary to hold the image of each cheque for later posting and clearing Mailroom Operations The majority of new account applications were received as a result of a direct mail campaign or call centre inquiry. During 1999, processing relating exclusively to new accounts engaged approximately 50 percent to 60 percent of mallroom capacity. A further 20 percent to 25 percent of mailroom capacity was required for preparation activities for processing of new and existing accounts. Preparation activities involved opening and extracting the mail, sorting and checking document quality, and scanning and encoding all cheques, Once an account was set up a client could conduct any further business with ING Direct through the call centre, the Internet, Web site. Interactive telephone system or Canada Post. Clients would complete the transaction through the desired channel and, if necessary, mallin the related cheque for processing. Processing of cheques for existing accounts engaged 15 percent to 20 percent of mailroom capacity The mail was received Monday to Friday at 8:30 am. from Canada Post through a contract courier. The mail was received at reception the ninth floor and directed immediately to the mailroom (see Exhibit 2) on the eighth floor, Exhibi FLOOR PLAN OF MAIL ROOM Scanning and coding NCR 7731) Ciring and posting Exhiba FLOOR PLAN OF MAIL ROOM Scanning and coding (NCR 7731) CIFing and posting Sorting And Checking Mail Extractor (Agissar R/VS) CIF ing and posting Exhibit 2. Floor Plan of Mailroom CIFing and posting was performed in space adjacent to the mailroom bil Extraction Mail Extraction Once the mall was received in the mallroom, an operations associate (OA) fed the mail into the extractor and pre-sorted the mail into the following six categories. 1. Applications and cheques from standard fulfillment and direct mail clients, 2. Cheques from express enrollment clients. 3. Cheques from existing clients. 4. Free-standing inserts from other promotional efforts, 5. Marketing surveys, and 6. Loans The same OA also performed a preliminary verification on all cheques and applications to ensure that there was no missing or obviously incorrect information. The first category, standard fulfillment and direct mail clients represented about 70 percent of new clients, did not already have a customer information file (CIF); therefore, their applications would take longer to process. The second category was customers who had a CIF which was created following a call to the 24-hour call center or through the Internet. About one-third of the new applications with a CIF were Internet-generated. The last three categories were set aside to be handled by different groups. This process of mail extraction and preliminary verification took approximately 50 minutes per 1,000 pieces of mail Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.e., first three categories) were passed to OAs for further sorting and quality checking. Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to account type. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. a During this additional sorting, applications underwent quality checking. OAs checked for the client's SIN, telephone number, date of birth and deposit amount. They further checked the body and figure of all cheques and the information relating specifically to the various account types (es. customers opening a GIC account had to include the term of investment). The mailroom supervisor also completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to batching. All applications and cheques not received in good order (IGO) - es. no signature on application, cheques stale-dated or travellers' cheque instead of personalized cheque - were set aside. All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked. Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7.5 minutes to process one batch of 50 checks, Software that cost about $100,000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques, Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day (posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE held the cheque image and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for Cifing and posting CIFing of New Applications Cifing was the process of either creating or updating the CIF;this process required the manual entry of all client data into the contact management system, called EDGE. If the client already had a CIF, then the OA would go to the look-up screen and enter the client's first and atamendidate the baldadibaca contro 39. Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.e, first three categories) were passed to OAs for further sorting and quality checking Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to account type. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. During this additional sorting applications underwent quality checking. OAs checked for the client's SIN, telephone number, date of birth and deposit amount. They further checked the body and figure of all cheques and the information relating specifically to the various account types (c.8. customers opening a GIC account had to include the term of investment). The mailroom supervisor also completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to batching. All applications and cheques not received in good order (IGO) - e.g. no signature on application cheques stale-dated, or travellers cheque instead of personalized cheque - were set aside All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7,5 minutes to process one batch of 50 checks Software that cost about $100.000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques Running batch totals were taken from the scanning machine and compared in the rester tolerandering entine and charbine the totalchalanced the channes were taken to the stamnine hin for deposit Manual verification of totals was also performed on the cheques. Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit. The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day (posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE, that held the cheque image, and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for ClFing and posting. CIFing of New Applications Cifing was the process of either creating or updating the Cif this process required the manual entry of all client data into the contact management system, called EDGE. If the dient already had a CIF, then the OA would go to the look-up screen and enter the client's first and last name and update the primary account holder's data. If the account was a joint account, the OA would enter the secondary account holder's first and last name to ensure that no duplicates had already been entered in the system. New or updated client relevant data was also entered. Once the data entry was complete, the "setup" code was indicated to instruct all DA's that the client's account was active and ready for personal identification (PIN and password) If the client did not have a CIF, then one had to be created prior to data entry, First, the OA would input the client's first and last name to verify that no duplicates had already been entered into the system. Joint account information was also entered, if applicable. Once the data had been entered the OA would switch to the Profile system (a generic banking system used worldwide) to create the new account. The OA would then enter the client's new CIF, the product type, the currency code, Canadian or U.S. dollars, the relationship code (single, joint the branch code. Once completed, the OA would transfer the application to another OA for posting of the cheque. Process times for ClFing varied, depending on whether or not the creation of a CIF was required and further on the type of account requested by the client. For single accounts requiring the creation of a CIF (about 30 percent of all new accounts), processing took 1.75 person-hours per batch of 50 applications. For joint accounts requiring the creation of a CIF, about 40 percent of all new accounts, processing times equaled 2.5 person-hours per batch of So. Single accounts that already had a CIF (about 10 percent of all new accounts), took 1.40 person hours per batch of 50. Joint accounts with a CIF (about 20 percent of all new accounts) took 1.75 person-hours per batch of 50, 140 PM a Posting of Cheques After completion of all ClFing, the OA's would use the INQUIRE system to post the cheques. The posting of cheques required three primary steps: (1) open the CIF on the contact management system, (2) set up deposit details - term, amount, interest management and maturity and (3) post transactions to client's accounts. To post a cheque, the OA had to access the appropriate screen and then enter the cheque amount and the account number of the client. For new clients, external bank information held in the INQUIRE system was also linked to the account holder. This step for new clients took approximately 1.25 person-hours per batch of 50, double the time it took to process deposits for existing clients. Posting for existing clients was much simpler, as the client's external bank information was already linked. Thus, deposits for existing clients took half the time. Staffing Levels and Batch Sizes In total, nine OA's were involved in the mailroom operations process at various times during the day. One OA was responsible for opening the mail, up to five OA's were responsible for sorting and checking, and an additional OA was responsible for the scanning Once these tasks were complete, these seven OA's would join the other two in the Cifing and posting part of the process. Hadley MacDonald had tried to estimate the mailroom capacity for preparation and processing of new and existing accounts. He knew that delays were not currently tracked, although there was a factor built into average process times to account for delays at each step. As a result, total available staff hours were an approximation based on the following calculations Nine Oas worked 6.5 hours, for a total of 58.5 hours per day. However, only five of these associates worked in the preparation, inclothes extracting, sorting and checking, and scanning and encoding. The remaining four Oas worked in another area of the operations group until some applications were ready for ClFing and posting. Mail was received at 8:30 am, and Cifing and posting were scheduled to begin at 10:30 am. As a result, eight hours were subtracted from 58.5 hours, giving an approximate total of 50.5 hours available for preparation and processing of new and existing accounts Hadley MacDonald learned that the batch size for the various mallroom processes had been set by a previous mallroom supervisor and had not been changed since 1997 Problems with the Current Mailroom Operations In the last year, the number of new accounts and the number of deposits associated with existing accounts had increased dramatically. During 1999, 110,000 new accounts had been created and there had been 185,000 deposits associated with existing accounts. By the end of 1999, ING Direct's client base had grown to more than 220,000 accounts. Similar growth was expected for 2000, with a projection for 320,000 accounts by yearend. ING Direct's commitment to same-day processing of both new accounts and deposits to existing accounts was becoming increasingly difficult, given the volume of new accounts. Moreover, there were deposits and maintenance associated with these accounts once they became active, Another operations challenge was the variability in daily processing volunc. Typical daily mail volume ranged from 500 to 1,500 pieces, with about 35 percent of receipts being for new accounts. As a result, heavier volume days required the use of some overtime to maintain same day processing. However, if the marketing department was conducting a direct mail campaign, mail receipts could spike to over 2,000 pieces of mail per day (see Exhibit 3). These campaigns entailed the sending a total of 400,000 pieces of mail over a 16-day period (ie 25,000 pieces per day). The total promotion and advertising budget ran well over $10 million annually. DALY MAL VOLUMES FOR THE MONTE OF FEBRUARY 2009 3.000 2.300 2.000 An 1500 140 PM Exhibit 3 DAILY MAIL VOLUMES FOR THE MONTH OF FEBRUARY 2000 3,000 2,500 2,000 V A 1,500 1,000 0 Jan 31 Feb 7 Feb 14 Feb 21 Feb 28 Mar 4 Exhibit 3. Daily Mail Volumes for the Month of February 2000 February data for mail volumes were considered fairly typical in terms of daily variations during a time when a January 12 to February 3 major mail campaign was under way. Mallroom processes had evolved plecemeal in response to needs. Performance goals and benchmarks were difficult to measure accurately. The need to optimize mallroom operations was further compounded by the possibility that an additional $5 million could be added to the total marketing budget. Bell was concerned about the current practice of using overtime. In addition to the extra costs, it was believed that excessive overtime and the subsequent staff burnout led to increased error rates - although no hard data were available. In 1999, overtime paid to the OAs in the mallroom totaled approximately $61,000, an increase from $40,000 and $21,000 in 1998 and 1997, respectively. The operations group was already at the maximum head count, according to corporate budgeted staffing levels. Therefore, current staff covered any excess processing through overtime. Potential Alternatives Bell was aware that at least three alternatives existed for dealing with workload challenges, although all had significant drawbacks. Outsourcing was one option. ING Direct had experimented with the outsourcing of its mutual fund accounts with a reasonable amount of success. The issue with outsourcing, besides the ongoing service fees and the loss of control, was a potential restriction by the Office of the Superintendent of Financial Institutions regarding the outsourcing of core business activities in the banking sector Increasing staff levels was a second option but not likely to improve the efficiency of the system. The prime purpose of the current review was to seek ways and means of avoiding this alternative. Relaxing the same-day processing requirements was a third option, because customers were generally not aware whether processing to place the same day. However, same-day processing was an integral part of ING Direct's customer service mandate. Given the clients sophistication and the competition in the marketplace, ING Direct had to maintain a high standard of service. It was also unclear as to whether this option would solve the long-term volume problems, Conclusion a Conclusion Bell's operations review had two main objectives. The first was to find ways and means of coping with the short-term challenge of avoiding staff level increases while meeting the operations demands of a rapidly growing client base. He hoped that a careful review of each operations process might reveal improved ways of carrying out current operations tasks. To this end, Bell believed the processing of new accounts could possibly be improved. He also knew that once all operations processes had been reviewed a long-term solution might in die major investments Bell and MacDonald had decided to work closely together on the operations review. The previous week, they had agreed to analyse new account processing separately and to share their insights on March 9. Bell was, therefore, anxious to complete his review of new account processing within the next few days in order to reduce overtime and begin examining other operations. OM Instructions 10% Deduction for Each Day Late Create a current state map for the mailroom operation for categories 1-3 (page 6). Start your value stream map with delivery of the mail to ING. . Additional information: Assume 1000 pieces of mail for your inventory calculations Receiving and transporting the mail to the mailrooms take 5 min each Creating the calculator tapes takes 5 minutes, in 20% of the cases the totals of the two tapes are different Manual verification takes 1 minute, totals are rarely wrong. Use a weighted average for the processing time of CIFing You do not have to calculate total lead time and processing time since some of the processes are performed at the same time, but you need to show the timeline. Show how you calculated your times Identify at least 2 improvement opportunities . . Image you would present your value stream map to your boss. Pencil is ok, sloppy is not !!! Spell-check your work If you make assumptions, write them down (or better ask me questions) . . On March 6, 2000, Basil Bell, senior vice-president of operations at ING Direct in Toronto, Canada, was reviewing the processing of new accounts. He believed that back office processing capacity had reached its limit and had, therefore, recently requested the transfer of Had MacDonald from the credit area to head up the department and address staffing level concerns in back-office operations. Major space, budget and headcount constraints made it impossible to increase staffing levels to cope with the bank's rapidly growing client base. In Bell opinion, it was critical that ING Direct develop and implement long-term solutions for coping with the immediate challenges of growth. Moreover, Bell recognized that within the next two years a more technologically, sophisticated solution would have to be found. Bell and MacDonald had selected the processing of new accounts as the first set of operations to review and had documented the procedures currently in use. The processing of new accounts by the mailroom staff represented a significant part of the tasks performed by back office personnel, and was required to be completed on a same-day basis. The Canadian Banking Industry Since the opening of the first Canadian bank in 1817, banks had played a vital role in Canada's economic development. Not only were they deposit-taking institutions and the primary financial intermediaries but they facilitated the process of payments and exchange. On an annua basis, the national clearing and settlement system cleared over three billion items valued at over $16 trillion. By the end of 1999, there wer 53 federally regulated banks operating in Canada. Eight of these were domestic Schedule I banks, three were domestic Schedule Il banks, an the remaining 42 were foreign Schedule Il banks. Of the eight domestic Schedule I banks, six held approximately 90 percent of the industry's assets Until 1980, Canadian banks were the only competitors in the banking sector. In 1980, new legislation allowed foreign banks to open Canadian subsidiaries, though significant size restrictions were initially applied. These restrictions were gradually lifted with successive amendments to the Bank Act, and by 1995, all such restrictions had been removed. In 1999, further revisions to Canada's Bank Act gave foreign banks permission to establish full-service branches or lending branches in Canada, but they were unable to take deposits under $150,000. Those banks wishing to accept retail deposits under $150,000 could do so only through the establishment of a separate Canadian subsidiary ing direct canada The Canadian Banking Industry Since the opening of the first Canadian bank in 1817, banks had played a vital role in Canada's economic development. Not only were they deposit-taking institutions and the primary financial intermediaries but they facilitated the process of payments and exchange. On an annual basis, the national clearing and settlement system cleared over three billion items valued at over $16 trillion. By the end of 1999, there were 53 federally regulated banks operating in Canada. Eight of these were domestic Schedule I banks, three were domestic Schedule Il banks, and the remaining 42 were foreign Schedule Il banks. Of the eight domestic Schedule I banks, six held approximately 90 percent of the industry's assets Until 1980, Canadian banks were the only competitors in the banking sector. In 1980, new legislation allowed foreign banks to open Canadian subsidiaries, though significant size restrictions were initially applied. These restrictions were gradually lifted with successive amendments to the Bank Act, and by 1995, all such restrictions had been removed. In 1999, further revisions to Canada's Bank Act gave foreign banks permission to establish full-service branches or lending branches in Canada, but they were unable to take deposits under $150,000. Those banks wishing to accept retail deposits under $150,000 could do so only through the establishment of a separate Canadian subsidiary. International Netherlands Group (ING Group) ING Group's headquarters were located in Amsterdam where the company served seven million customers through direct response banking The Group's success in its home market had resulted in the company's standing as one of the five largest companies in the Netherlands Active in more than 60 countries, ING Group was also among the top 10 global providers of integrated financial services with banking anu insurance assets totaling more than US$800 billion. In 1998, ING Group employed over 82,000 people worldwide and experienced a 21 percent growth in net profit. The Group's activities included insurance operations, banking, and asset management, and part of its international strategy was to build strong markets for these activities worldwide. ING Direct Canada ING Bank of Canada was licensed as a Schedule Il bank and was officially launched on Antil 77 1917 ING Direct Canada ING Bank of Canada was licensed as a Schedule Il bank and was officially launched on April 22, 1997, under the trade name of "ING Direct: ING Group's strategy was to develop a retail banking operation in Canada using a "low cost platform, offering a savings account as its initial product. ING Direct operated from three floors of an office building located on Gordon Baker Road on the outskirts of Toronto. Customers were served seven days a week, 24 hours a day, through a call centre and by Internet. The corporate mandate was to provide a superior value proposition through the use of cost-effective products, processes and distribution channels. ING Direct offered only a limited line of standard products and services with high interest rates on deposits, low rates on loans, simple and easy enrollment processes, and no service charges or fees. By March of 2000, ING Direct was offering its customers a small selection of saving, mutual fund and loan accounts (see Exhibit 1). The company's low infrastructure costs (only one location, no branch network), allowed it to offer very competitive rates. For example, the investment savings account (ISA) carried one rate of daily interest, regardless of the amount on deposit, and withdrawals could be made from and to an existing Canadian bank account only. Exhibit 1. Products Offered by ING Direct Products 2022 Exhibit 1. Products Offered by ING Direct Rates as of March 1, 2000 Products Home Announcements Zoom 4.5% 5.0% Assignments Discussions 5.4% 6.1% Grades People 4.5% 6.1% Pages Savings Investment Savings Account (ISA) Canadian Dollar U.S. Dollar Guaranteed Investment Confirmation One year Five year Registered Savings Plan (RSP) RSPISA RSP GIC Mutual Funds ING Canadian Fund ING American Fund ING Global Brand Names Fund Loans Loan Account Mortgages One ye Five year RSP Loan Syllabus Quizzes Modules Collaborations 8.18 Chat Research Help 70% 7.6% 5.5% Media Gallery IDEA Course Rating Over the past three years, management had emphasized new account wowth. The corporate plan for 2000 called for 50 percent client Over the past three years, management had emphasized new account growth. The corporate plan for 2000 called for 50 percent client growth from about 220,000 accounts in December 1999, with a further 30 percent growth in each of the next two years. As part of its efforts to maintain low infrastructure costs, management also stressed tight budgetary controls, with strict restrictions on staffing levels. In March 2000, staff numbers at ING Direct totaled 242 people. Of these, 94 were full-time call centre employees with the title Direct Associate (DA). To provide peak-time support, 75 percent of ING Direct's remaining employees, including mailroom employees, were trained to answer phones in the call centre at peak times. Opening an ING Direct Account To open an account with ING Direct, customers had to provide their address, postal code, social insurance number (SIN) and a cheque from their chequing account with any major Canadian bank. There were four ways in which a client could open an account with ING Direct 1. Telephone the 24-hour call centre and request an application (otherwise known as a fulfillment package). Approximately 60 percent of these requests resulted in account openings. 2. Fill in an online application, or download the application from the Internet and mail it to ING Direct. 3. Enroll in person at one of the ING cafes in Toronto or Vancouver 4. Fill out an application sent through the mail as part of the company's direct mail campaign. If a customer telephoned the 24-hour call centre, DAs responded with either a standard or express fulfillment package. For a standard fulfillment package, a DA would answer the call and take down the customer's name, address, postal code and telephone number. Twice an electronic file of customer requests was generated and sent to a letter house subcontracted by ING Direct to mail out standard fulfillment packages to prospective clients. Each client was requested to complete an enclosed application form and return it with an initial deposit Alternatively, about 20 percent of all new clients called the 24-hour hotline to open an account immediately using an express fulfillment package. In order to be sent this package, these clients also supplied the DA with their date of birth and SIN, in addition to the information noted earlier. The DA would immediately assign a client number, which created a customer information file (CIF), and instruct the customer to mail their initial deposit cheque to ING Direct. The account would be opened when the cheque was received, and interest would begin accruinsat that time, legal regulations also required adianto send in an application form.non recent by ING Direct the client could 1:37 PM a Periodically, direct mail was sent to potential clients to attract new customers. In 1999, two million ISA application forms were sent to potential clients as part of five direct mail campaigns. The direct mail requested clients to send in an application form along with a cheque for their first deposit The Operations Group The operations group, headed by Basil Bell, senior vice-president of operations, consisted of 41 operational associates (OAS) and managers The prime task of the operations group was to provide back office support to the call centre and the other functions in the bank. The group was responsible for various processing activities such as new accounts, deposits on existing accounts, service requests, client statements and tax receipts, and automated outbound correspondence. Staffing Challenge Bell found the challenge of coping with the bank's growth while maintaining minimum staffing levels particularly difficult. No forecasting or benchmark measurements existed on any of the processing activities to determine appropriate staffing levels. Also, space limitations prevented a massive growth in operations personnel as the number of clients and product offerings increased. In February 2000, he requested the assistance of Hadley MacDonald, who had worked in the credit area, to review all functions and activities in the operations department Bell and Mac Donald decided to focus their initial efforts on the processes associated with new clients. New client applications currently received the highest priority for processing in the mailroom. These were also considered good candidates for review because they acco for the majority of mailroom data entry. Any improvement in the relatively simple and repetitive steps for processing new applications was expected to significantly reduce the total workload. Later, a similar process of review and analysis would eventuailly have to be performed on all operations A normal workweek in the mallroom consisted of five eight-hour shifts. However, employees generally worked only 6.5 hours per shift after allowing time for lunch and breaks. If an employee worked more than 14 hours during a week, government regulations required overtime payment of time and a half. The normal hourly rate for employees was $12 per hour and fringe benefits combined with unemployment premiums increased the cost per employee to $15.60 per hour Recent Mailroom Improvements ING Direct's mallroom operations were almost exclusively paper-based. In the last two years however, two steps had been taken to move the company towards automation in order to speed the flow of mail through the system. The first investment was a mail extractor. The purchase of the Agissar R/V5 had reduced the time required to open daily mail by approximately four hours. The second investment was a new machine, the NCR 7731, which encoded, scanned and endorsed cheques. This machine was equipped with the software necessary to hold the image of each cheque for later posting and clearing Mailroom Operations The majority of new account applications were received as a result of a direct mail campaign or call centre inquiry. During 1999, processing relating exclusively to new accounts engaged approximately 50 percent to 60 percent of mallroom capacity. A further 20 percent to 25 percent of mailroom capacity was required for preparation activities for processing of new and existing accounts. Preparation activities involved opening and extracting the mail, sorting and checking document quality, and scanning and encoding all cheques, Once an account was set up a client could conduct any further business with ING Direct through the call centre, the Internet, Web site. Interactive telephone system or Canada Post. Clients would complete the transaction through the desired channel and, if necessary, mallin the related cheque for processing. Processing of cheques for existing accounts engaged 15 percent to 20 percent of mailroom capacity The mail was received Monday to Friday at 8:30 am. from Canada Post through a contract courier. The mail was received at reception the ninth floor and directed immediately to the mailroom (see Exhibit 2) on the eighth floor, Exhibi FLOOR PLAN OF MAIL ROOM Scanning and coding NCR 7731) Ciring and posting Exhiba FLOOR PLAN OF MAIL ROOM Scanning and coding (NCR 7731) CIFing and posting Sorting And Checking Mail Extractor (Agissar R/VS) CIF ing and posting Exhibit 2. Floor Plan of Mailroom CIFing and posting was performed in space adjacent to the mailroom bil Extraction Mail Extraction Once the mall was received in the mallroom, an operations associate (OA) fed the mail into the extractor and pre-sorted the mail into the following six categories. 1. Applications and cheques from standard fulfillment and direct mail clients, 2. Cheques from express enrollment clients. 3. Cheques from existing clients. 4. Free-standing inserts from other promotional efforts, 5. Marketing surveys, and 6. Loans The same OA also performed a preliminary verification on all cheques and applications to ensure that there was no missing or obviously incorrect information. The first category, standard fulfillment and direct mail clients represented about 70 percent of new clients, did not already have a customer information file (CIF); therefore, their applications would take longer to process. The second category was customers who had a CIF which was created following a call to the 24-hour call center or through the Internet. About one-third of the new applications with a CIF were Internet-generated. The last three categories were set aside to be handled by different groups. This process of mail extraction and preliminary verification took approximately 50 minutes per 1,000 pieces of mail Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.e., first three categories) were passed to OAs for further sorting and quality checking. Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to account type. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. a During this additional sorting, applications underwent quality checking. OAs checked for the client's SIN, telephone number, date of birth and deposit amount. They further checked the body and figure of all cheques and the information relating specifically to the various account types (es. customers opening a GIC account had to include the term of investment). The mailroom supervisor also completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to batching. All applications and cheques not received in good order (IGO) - es. no signature on application, cheques stale-dated or travellers' cheque instead of personalized cheque - were set aside. All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked. Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7.5 minutes to process one batch of 50 checks, Software that cost about $100,000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques, Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day (posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE held the cheque image and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for Cifing and posting CIFing of New Applications Cifing was the process of either creating or updating the CIF;this process required the manual entry of all client data into the contact management system, called EDGE. If the client already had a CIF, then the OA would go to the look-up screen and enter the client's first and atamendidate the baldadibaca contro 39. Sorting and Checking Shortly after the extraction process was started, the applications and cheques (.e, first three categories) were passed to OAs for further sorting and quality checking Up to five OAs performed these tasks simultaneously. As many as two OAs dealt with the applications and cheques for fulfillment of new clients, while up to three others processed cheques for existing clients. All cheques were sorted according to account type. New client applications within the first two categories were further sorted according to whether or not they were single or joint accounts. Joint accounts took longer to process, as the OA would have to enter information for the secondary or joint account holder who might or might not have a CIF. Applications were grouped into batches of 50, and two calculator tapes of each batch were made to verify totals. During this additional sorting applications underwent quality checking. OAs checked for the client's SIN, telephone number, date of birth and deposit amount. They further checked the body and figure of all cheques and the information relating specifically to the various account types (c.8. customers opening a GIC account had to include the term of investment). The mailroom supervisor also completed signature verification by matching the signature on the cheque with the signature on the application. The entire process of sorting and checking took six person-hours per 1,000 mail pieces. Exceptions were separated during the Q&A process, prior to batching. All applications and cheques not received in good order (IGO) - e.g. no signature on application cheques stale-dated, or travellers cheque instead of personalized cheque - were set aside All not in good order (NIGO) items had to be returned to the client by mail. The number of exceptions was not tracked Scanning and Encoding of Cheques Cheques were next sent to an OA at the NCR 7731 image transport machine for imaging and encoding. The OA sent the cheque through the scanner but had to enter the deposit amount of each cheque manually in order to encode it. The capacity of the NCR 7731 machine was 30 cheques per minute, although it took the OA about 7,5 minutes to process one batch of 50 checks Software that cost about $100.000 was available to fully automate the scanning and encoding step by the NCR 7731 using intelligent character recognition Manual verification of totals was also performed on the cheques Running batch totals were taken from the scanning machine and compared in the rester tolerandering entine and charbine the totalchalanced the channes were taken to the stamnine hin for deposit Manual verification of totals was also performed on the cheques. Running batch totals were taken from the scanning machine and compared against the calculator totals run during sorting and checking. If the totals balanced, the cheques were taken to the stamping bin for deposit. The cheques were sent to the bank for deposit, even though posting usually occurred much later in the day (posting occurred when a particular cheque was credited to that particular client's account). The NCR 7731 machine hosted a software program called INQUIRE, that held the cheque image, and therefore allowed it to be posted later the same day. The OA simply had to sequence the batch number to retain the information for posting purposes. Batches of applications were logged and placed in a tray for ClFing and posting. CIFing of New Applications Cifing was the process of either creating or updating the Cif this process required the manual entry of all client data into the contact management system, called EDGE. If the dient already had a CIF, then the OA would go to the look-up screen and enter the client's first and last name and update the primary account holder's data. If the account was a joint account, the OA would enter the secondary account holder's first and last name to ensure that no duplicates had already been entered in the system. New or updated client relevant data was also entered. Once the data entry was complete, the "setup" code was indicated to instruct all DA's that the client's account was active and ready for personal identification (PIN and password) If the client did not have a CIF, then one had to be created prior to data entry, First, the OA would input the client's first and last name to verify that no duplicates had already been entered into the system. Joint account information was also entered, if applicable. Once the data had been entered the OA would switch to the Profile system (a generic banking system used worldwide) to create the new account. The OA would then enter the client's new CIF, the product type, the currency code, Canadian or U.S. dollars, the relationship code (single, joint the branch code. Once completed, the OA would transfer the application to another OA for posting of the cheque. Process times for ClFing varied, depending on whether or not the creation of a CIF was required and further on the type of account requested by the client. For single accounts requiring the creation of a CIF (about 30 percent of all new accounts), processing took 1.75 person-hours per batch of 50 applications. For joint accounts requiring the creation of a CIF, about 40 percent of all new accounts, processing times equaled 2.5 person-hours per batch of So. Single accounts that already had a CIF (about 10 percent of all new accounts), took 1.40 person hours per batch of 50. Joint accounts with a CIF (about 20 percent of all new accounts) took 1.75 person-hours per batch of 50, 140 PM a Posting of Cheques After completion of all ClFing, the OA's would use the INQUIRE system to post the cheques. The posting of cheques required three primary steps: (1) open the CIF on the contact management system, (2) set up deposit details - term, amount, interest management and maturity and (3) post transactions to client's accounts. To post a cheque, the OA had to access the appropriate screen and then enter the cheque amount and the account number of the client. For new clients, external bank information held in the INQUIRE system was also linked to the account holder. This step for new clients took approximately 1.25 person-hours per batch of 50, double the time it took to process deposits for existing clients. Posting for existing clients was much simpler, as the client's external bank information was already linked. Thus, deposits for existing clients took half the time. Staffing Levels and Batch Sizes In total, nine OA's were involved in the mailroom operations process at various times during the day. One OA was responsible for opening the mail, up to five OA's were responsible for sorting and checking, and an additional OA was responsible for the scanning Once these tasks were complete, these seven OA's would join the other two in the Cifing and posting part of the process. Hadley MacDonald had tried to estimate the mailroom capacity for preparation and processing of new and existing accounts. He knew that delays were not currently tracked, although there was a factor built into average process times to account for delays at each step. As a result, total available staff hours were an approximation based on the following calculations Nine Oas worked 6.5 hours, for a total of 58.5 hours per day. However, only five of these associates worked in the preparation, inclothes extracting, sorting and checking, and scanning and encoding. The remaining four Oas worked in another area of the operations group until some applications were ready for ClFing and posting. Mail was received at 8:30 am, and Cifing and posting were scheduled to begin at 10:30 am. As a result, eight hours were subtracted from 58.5 hours, giving an approximate total of 50.5 hours available for preparation and processing of new and existing accounts Hadley MacDonald learned that the batch size for the various mallroom processes had been set by a previous mallroom supervisor and had not been changed since 1997 Problems with the Current Mailroom Operations In the last year, the number of new accounts and the number of deposits associated with existing accounts had increased dramatically. During 1999, 110,000 new accounts had been created and there had been 185,000 deposits associated with existing accounts. By the end of 1999, ING Direct's client base had grown to more than 220,000 accounts. Similar growth was expected for 2000, with a projection for 320,000 accounts by yearend. ING Direct's commitment to same-day processing of both new accounts and deposits to existing accounts was becoming increasingly difficult, given the volume of new accounts. Moreover, there were deposits and maintenance associated with these accounts once they became active, Another operations challenge was the variability in daily processing volunc. Typical daily mail volume ranged from 500 to 1,500 pieces, with about 35 percent of receipts being for new accounts. As a result, heavier volume days required the use of some overtime to maintain same day processing. However, if the marketing department was conducting a direct mail campaign, mail receipts could spike to over 2,000 pieces of mail per day (see Exhibit 3). These campaigns entailed the sending a total of 400,000 pieces of mail over a 16-day period (ie 25,000 pieces per day). The total promotion and advertising budget ran well over $10 million annually. DALY MAL VOLUMES FOR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts