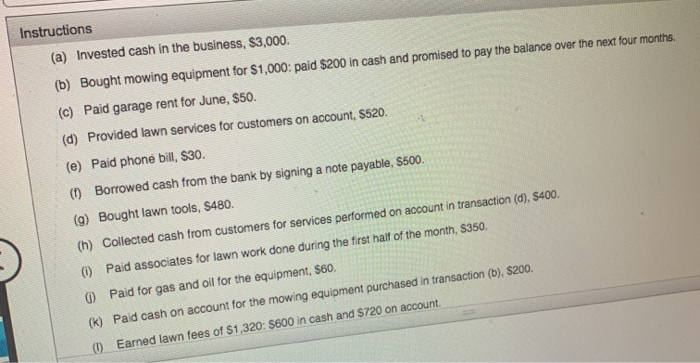

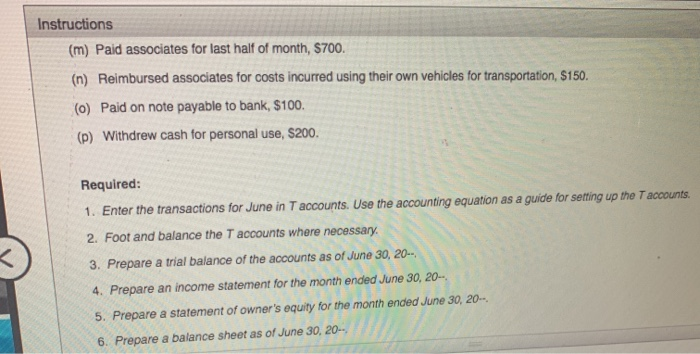

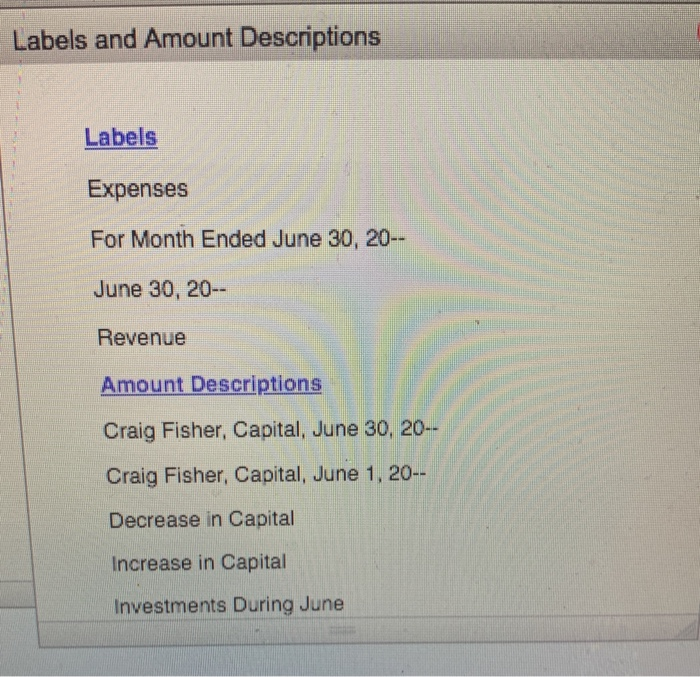

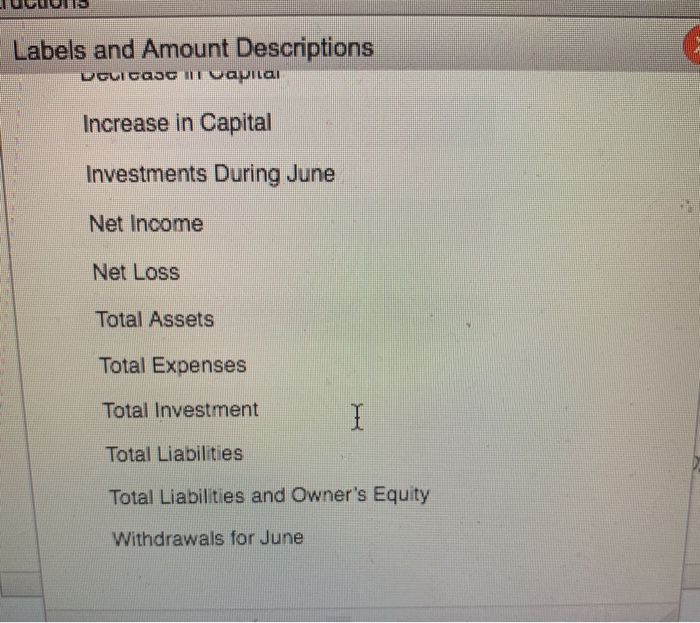

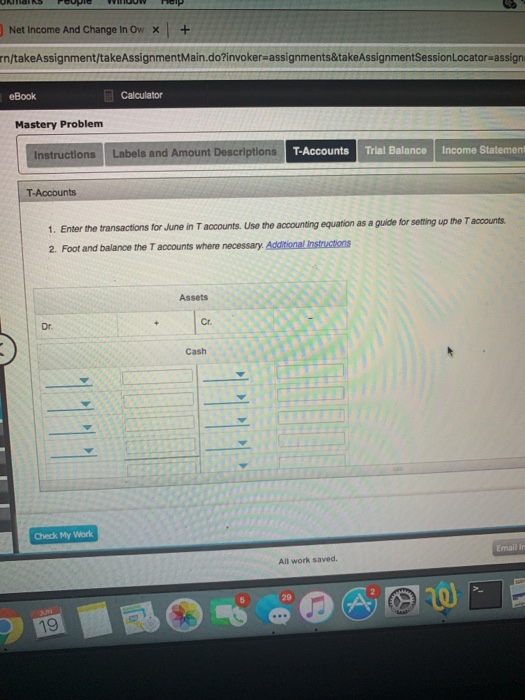

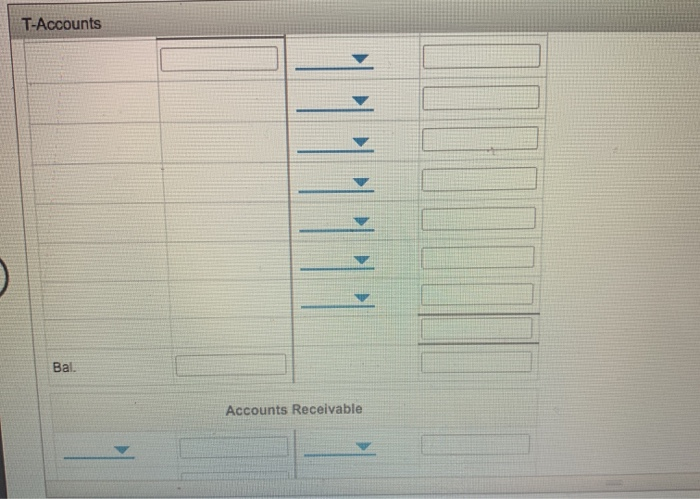

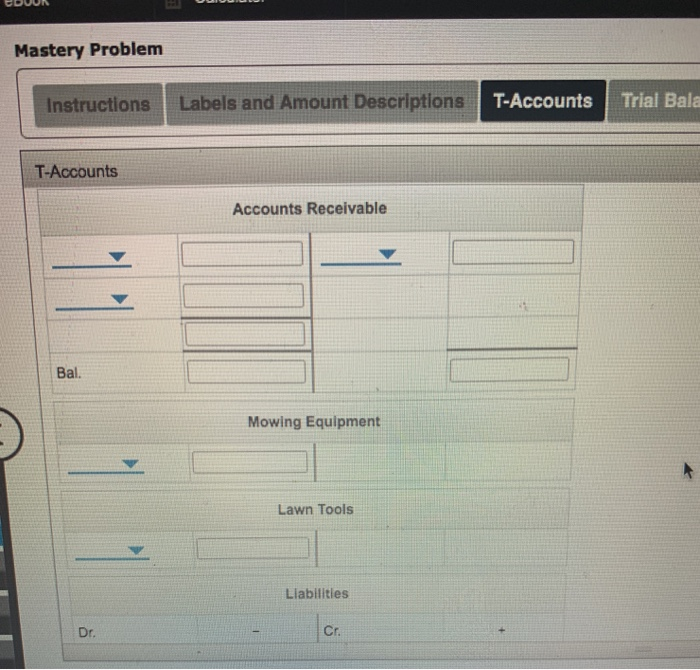

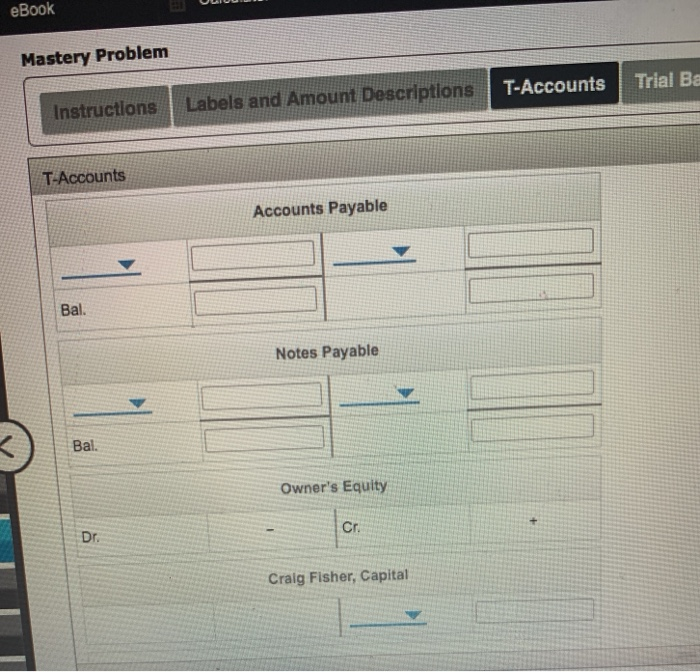

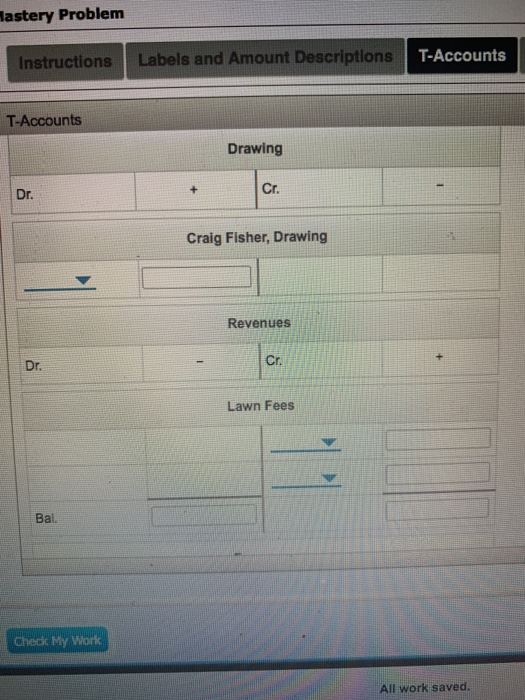

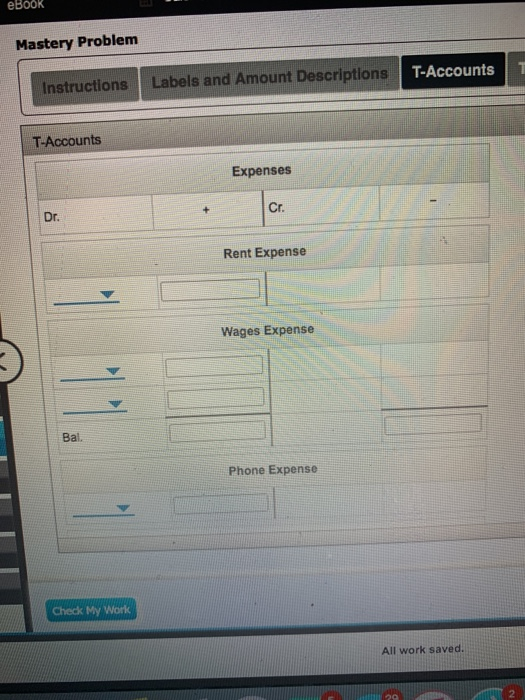

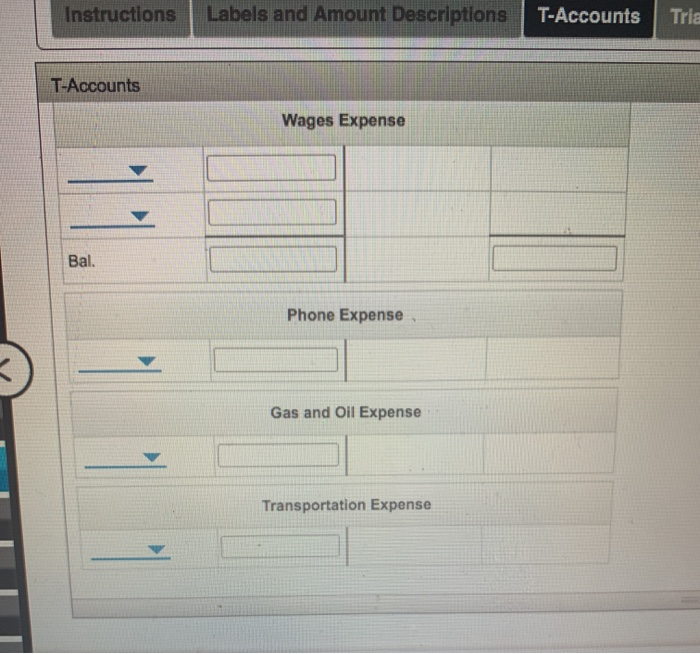

Instructions (a) Invested cash in the business, $3,000. Bought mowing equipment for $1,000: paid $200 in cash and promised to pay the balance over the next four months. (b) Paid garage rent for June, $50 (c) Provided lawn services for customers on account, $520. (d) (e) Paid phone bill, $30. Borrowed cash from the bank by signing a note payable, $500. () (g) Bought lawn tools, $480. (h) Collected cash from customers for services performed on account in transaction (d), $400. (0) Paid associates for lawn work done during the first half of the month, $350. Paid for gas and oil for the equipment, $60. ) Paid cash on account for the mowing equipment purchased in transaction (b), $200. (k) Earned lawn fees of $1,320: $600 in cash and $720 on account. (I) Instructions (m) Paid associates for last half of month, $700. Reimbursed associates for costs incurred using their own vehicles for transportation, $150. (n) (o) Paid on note payable to bank, $100 (p) Withdrew cash for personal use, $200 Required: guide for setting up the T accounts. 1. Enter the transactions for June in T accounts. Use the accounting equation as a 2. Foot and balance the T accounts where necessary 3. Prepare a trial balance of the accounts as of June 30, 20 4. Prepare an income statement for the month ended June 30, 20- 5. Prepare a statement of owner's equity for the month ended June 30, 20 6. Prepare a balance sheet as of June 30, 20- Labels and Amount Descriptions Labels Expenses For Month Ended June 30, 20- June 30, 20-- Revenue Amount Descriptions Craig Fisher, Capital, June 30, 20- Craig Fisher, Capital, June 1, 20- Decrease in Capital Increase in Capital Investments During June Labels and Amount Descriptions DGCICasC TOaDILa Increase in Capital Investments During June Net Income Net Loss Total Assets Total Expenses Total Investment I Total Liabilities Total Liabilities and Owner's Equity Withdrawals for June OKITIal KS Flaip Net Income And Change In Ow + x n/takeAssignment/ta keAssignmentMain.do?invoker=assignments&takeAssignmentSession Locator=assign Calculator eBook Mastery Problem T-Accounts Income Statement Trial Balance Labels and Amount Descriptions Instructions T-Accounts 1. Enter the transactions for June in T accounts. Use the accounting equation as a guide for setting up the T accounts 2. Foot and balance the T accounts where necessary. Additional Instructions Assets Cr. Dr. Cash Check My Work Email Ir All work saved. 2 Aj 29 19 T-Accounts Bal. Accounts Receivable Mastery Problem Trial Bala T-Accounts Labels and Amount Descriptions Instructions T-Accounts Accounts Receivable Bal. Mowing Equipment Lawn Tools Liabilities Cr. Dr. eBook Mastery Problem Trial Ba T-Accounts Labels and Amount Descriptions Instructions T-Accounts Accounts Payable Bal. Notes Payable Bal. Owner's Equity Cr. + Dr. Craig Fisher, Capital astery Problem T-Accounts Labels and Amount Descriptions Instructions T-Accounts Drawing Cr. + Dr. Craig Fisher, Drawing Revenues Cr. Dr. Lawn Fees Bal. Chedk My Work All work saved. eBook Mastery Problem Labels and Amount Descriptions T-Accounts Instructions T-Accounts Expenses Cr. Dr. Rent Expense Wages Expense Bal. Phone Expense Check My Work All work saved. Labels and Amount Descriptions Instructions T-Accounts Tria T-Accounts Wages Expense Bal. Phone Expense Gas and Oil Expense Transportation Expense