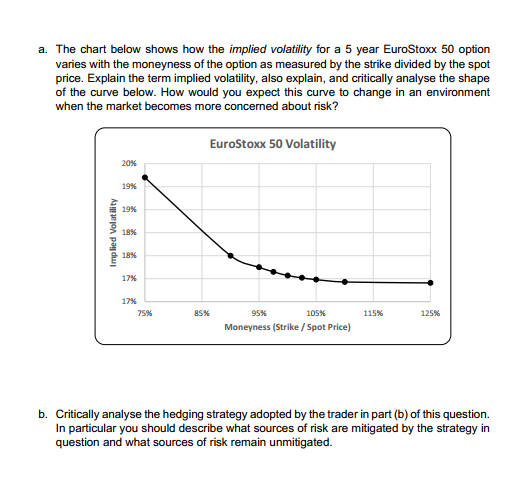

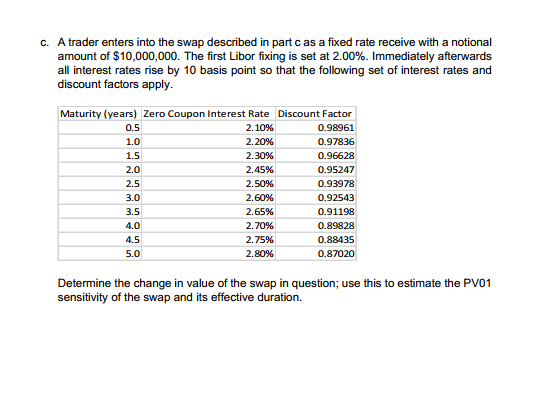

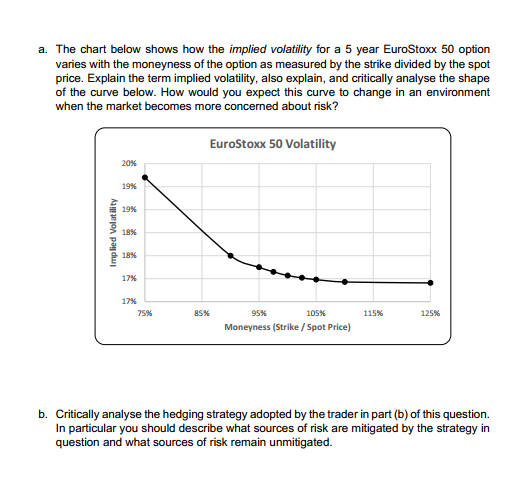

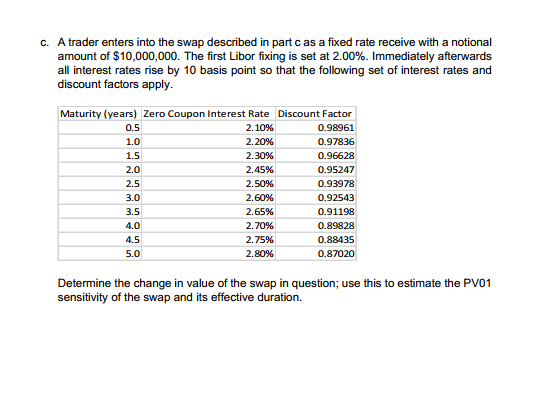

a. The chart below shows how the implied volatility for a 5 year EuroStoxx 50 option varies with the moneyness of the option as measured by the strike divided by the spot price. Explain the term implied volatility, also explain, and critically analyse the shape of the curve below. How would you expect this curve to change in an environment when the market becomes more concerned about risk? EuroStoxx 50 Volatility Implied Volatility 75% 95% 115% 125% 95% 105% Moneyness (Strike / Spot Price) b. Critically analyse the hedging strategy adopted by the trader in part (b) of this question. In particular you should describe what sources of risk are mitigated by the strategy in question and what sources of risk remain unmitigated. c. A trader enters into the swap described in part cas a fixed rate receive with a notional amount of $10,000,000. The first Libor fixing is set at 2.00%. Immediately afterwards all interest rates rise by 10 basis point so that the following set of interest rates and discount factors apply. 0.5 1.0 Maturity (years) Zero Coupon Interest Rate Discount Factor 2.10% 0.98961 2.20% 0.97836 1.5 2.30% 0.96628 2.0 2.45% 0.95247 2.5 2.50% 0.93978 2.60% 0.92543 3.5 2.65% 0.91198 4.0 2.70% 0.89828 2.75% 0.88435 5.0 2.80% 0.87020 3.0 4.5 Determine the change in value of the swap in question; use this to estimate the PV01 sensitivity of the swap and its effective duration. a. The chart below shows how the implied volatility for a 5 year EuroStoxx 50 option varies with the moneyness of the option as measured by the strike divided by the spot price. Explain the term implied volatility, also explain, and critically analyse the shape of the curve below. How would you expect this curve to change in an environment when the market becomes more concerned about risk? EuroStoxx 50 Volatility Implied Volatility 75% 95% 115% 125% 95% 105% Moneyness (Strike / Spot Price) b. Critically analyse the hedging strategy adopted by the trader in part (b) of this question. In particular you should describe what sources of risk are mitigated by the strategy in question and what sources of risk remain unmitigated. c. A trader enters into the swap described in part cas a fixed rate receive with a notional amount of $10,000,000. The first Libor fixing is set at 2.00%. Immediately afterwards all interest rates rise by 10 basis point so that the following set of interest rates and discount factors apply. 0.5 1.0 Maturity (years) Zero Coupon Interest Rate Discount Factor 2.10% 0.98961 2.20% 0.97836 1.5 2.30% 0.96628 2.0 2.45% 0.95247 2.5 2.50% 0.93978 2.60% 0.92543 3.5 2.65% 0.91198 4.0 2.70% 0.89828 2.75% 0.88435 5.0 2.80% 0.87020 3.0 4.5 Determine the change in value of the swap in question; use this to estimate the PV01 sensitivity of the swap and its effective duration