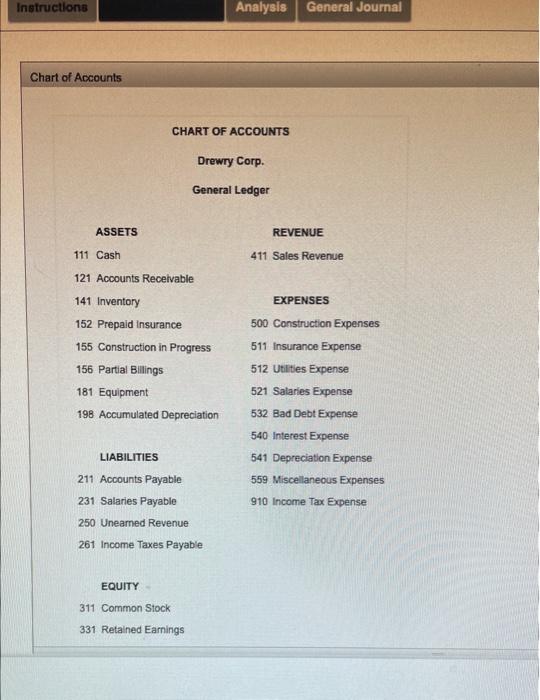

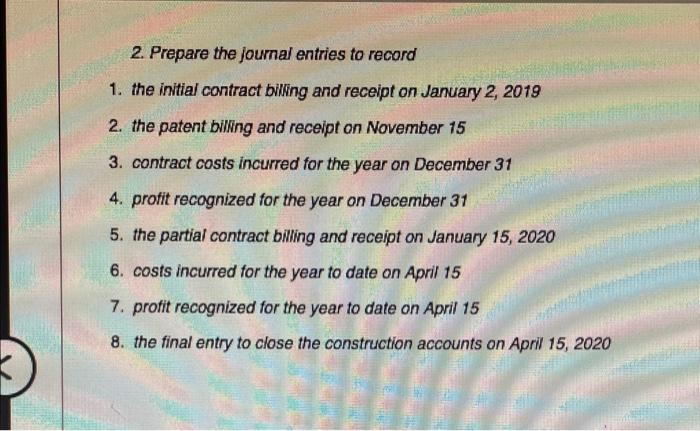

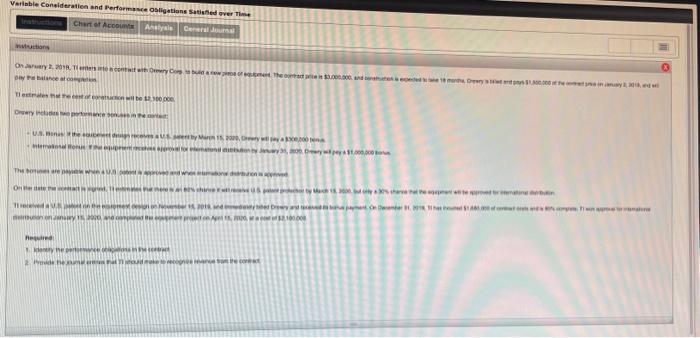

Instructions Analysis General Journal Chart of Accounts CHART OF ACCOUNTS Drewry Corp. General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Recelvable 141 Inventory EXPENSES 152 Prepaid insurance 500 Construction Expenses 155 Construction in Progress 511 Insurance Expense 156 Partial Billings 512 Utilities Expense 181 Equipment 521 Salaries Expense 198 Accumulated Depreciation 532 Bad Debt Expense 540 Interest Expense LIABILITIES 541 Depreciation Expense 211 Accounts Payable 559 Miscellaneous Expenses 231 Salaries Payable 910 Income Tax Expense 250 Uneamed Revenue 261 income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings 2. Prepare the journal entries to record 1. the initial contract billing and receipt on January 2,2019 2. the patent billing and receipt on November 15 3. contract costs incurred for the year on December 31 4. profit recognized for the year on December 31 5. the partial contract billing and receipt on January 15, 2020 6. costs incurred for the year to date on April 15 7. profit recognized for the year to date on April 15 8. the final entry to close the construction accounts on April 15, 2020 par fin bulance at oampenten Aetuires: Instructions Analysis General Journal Chart of Accounts CHART OF ACCOUNTS Drewry Corp. General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Recelvable 141 Inventory EXPENSES 152 Prepaid insurance 500 Construction Expenses 155 Construction in Progress 511 Insurance Expense 156 Partial Billings 512 Utilities Expense 181 Equipment 521 Salaries Expense 198 Accumulated Depreciation 532 Bad Debt Expense 540 Interest Expense LIABILITIES 541 Depreciation Expense 211 Accounts Payable 559 Miscellaneous Expenses 231 Salaries Payable 910 Income Tax Expense 250 Uneamed Revenue 261 income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings 2. Prepare the journal entries to record 1. the initial contract billing and receipt on January 2,2019 2. the patent billing and receipt on November 15 3. contract costs incurred for the year on December 31 4. profit recognized for the year on December 31 5. the partial contract billing and receipt on January 15, 2020 6. costs incurred for the year to date on April 15 7. profit recognized for the year to date on April 15 8. the final entry to close the construction accounts on April 15, 2020 par fin bulance at oampenten Aetuires