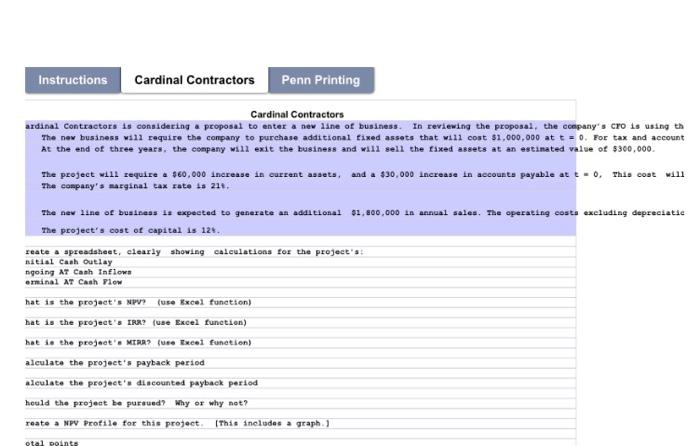

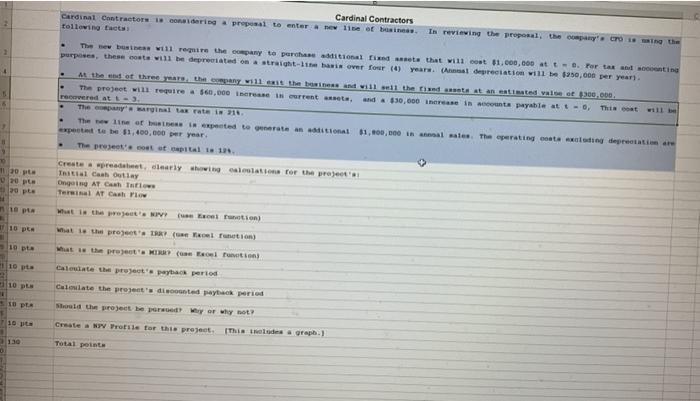

Instructions Cardinal Contractors Penn Printing Cardinal Contractors ardinal Contractors is considering a proposal to enter a new line of business. In reviewing the proposal, the company's cro is using th The new business will require the company to purchase additional fixed assets that will cost $1,000,000 at t = 0. For tax and account At the end of three years, the company will exit the business and will sell the fixed assets at an estimated value of $300,000 The project will require $60,000 increase in current assets, and $30,000 increase in account: payable at t. 0. This cost will The company's marginal tax rate is 211. The new line of business is expected to generate an additional $1,800,000 in annual sales. The operating costs excluding depreciatie The project's cost of capital is 12. reate a spreadsheet, clearly showing calculations for the projects nitial Cash outlay ngoing AT Cash Inflows erminal At Cash Flow hat is the project's NPV? (use Excel function) hat is the project's IRA? (use Excel function) hat is the project' MEHR? (use Excel function) alculate the project's payback period alculate the project's discounted payback period hould the project be pursued? Why or why not? reate a NPV profile for this project [This includes a graph) otal Poin Cardinal Contractors Cardinal Contractors condering a proposal to enter a new line of business In reviewing the proposal, the company CTO in the tollowing facts The new be will require the company to purchase additional fidate that will cost $1,000,000 t-. Por tax and conting purposes, these cote wul be deprecated on a straight this ver foer (4) years. As depreciation will be $350,00 per year. M the end of three years the capany will at the base and will the detest an estimated walce ot 100.000 The project will require a $60,000 is errent set and $30,000 Teren in accounts payable at: -0. This coat will ered at -3 The company warginal tax rate is 10 The new line of the expected to get an tional $1,600,000 Balle The sperating to sing depreciation are expected to be $1,400,000 per year The projet et optate Create a predmet, clearly showing allation for the projecten Testial Cash Outlay Ongoing AT Ch Thi Terial AT Cash Flow 130 pte 20 pe 0 pe What is the pot. Von 10 pts the projet' TR? (Nel fron) 30 pm What is the project Monti Calestate the project pack period 10 10 pts Calolate the project's dad pay period Sold the project be pod way or why not? 10 pts Create NXV Profile for this project 130 Total point